Jiangsu Huasheng Tianlong Photoelectric Co.,Ltd.'s (SZSE:300029) Shares Climb 33% But Its Business Is Yet to Catch Up

Jiangsu Huasheng Tianlong Photoelectric Co.,Ltd.'s (SZSE:300029) Shares Climb 33% But Its Business Is Yet to Catch Up

Despite an already strong run, Jiangsu Huasheng Tianlong Photoelectric Co.,Ltd. (SZSE:300029) shares have been powering on, with a gain of 33% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 30% in the last twelve months.

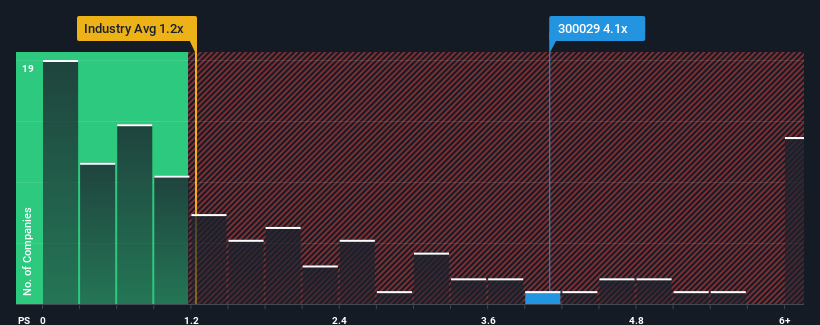

After such a large jump in price, when almost half of the companies in China's Construction industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Jiangsu Huasheng Tianlong PhotoelectricLtd as a stock not worth researching with its 4.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Jiangsu Huasheng Tianlong PhotoelectricLtd's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Jiangsu Huasheng Tianlong PhotoelectricLtd over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jiangsu Huasheng Tianlong PhotoelectricLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiangsu Huasheng Tianlong PhotoelectricLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiangsu Huasheng Tianlong PhotoelectricLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. Even so, admirably revenue has lifted 36% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is predicted to deliver 15% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Jiangsu Huasheng Tianlong PhotoelectricLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Jiangsu Huasheng Tianlong PhotoelectricLtd's P/S?

Shares in Jiangsu Huasheng Tianlong PhotoelectricLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Jiangsu Huasheng Tianlong PhotoelectricLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for Jiangsu Huasheng Tianlong PhotoelectricLtd (1 is concerning!) that you should be aware of.

If you're unsure about the strength of Jiangsu Huasheng Tianlong PhotoelectricLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.