There's Reason For Concern Over Guangdong Huicheng Vacuum Technology Co., Ltd.'s (SZSE:301392) Massive 27% Price Jump

There's Reason For Concern Over Guangdong Huicheng Vacuum Technology Co., Ltd.'s (SZSE:301392) Massive 27% Price Jump

Guangdong Huicheng Vacuum Technology Co., Ltd. (SZSE:301392) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

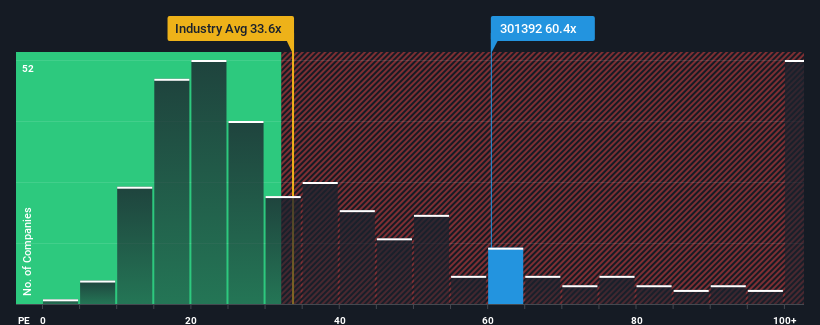

Since its price has surged higher, Guangdong Huicheng Vacuum Technology may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 60.4x, since almost half of all companies in China have P/E ratios under 34x and even P/E's lower than 20x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

The recent earnings growth at Guangdong Huicheng Vacuum Technology would have to be considered satisfactory if not spectacular. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Does Growth Match The High P/E?

In order to justify its P/E ratio, Guangdong Huicheng Vacuum Technology would need to produce outstanding growth well in excess of the market.

In order to justify its P/E ratio, Guangdong Huicheng Vacuum Technology would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 3.6% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 2.3% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 38% shows it's an unpleasant look.

With this information, we find it concerning that Guangdong Huicheng Vacuum Technology is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Shares in Guangdong Huicheng Vacuum Technology have built up some good momentum lately, which has really inflated its P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Guangdong Huicheng Vacuum Technology revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 3 warning signs for Guangdong Huicheng Vacuum Technology you should be aware of, and 2 of them are a bit concerning.

If you're unsure about the strength of Guangdong Huicheng Vacuum Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.