Market Mover | Woolworths shares fall 6%, approaching the support level

Market Mover | Woolworths shares fall 6%, approaching the support level

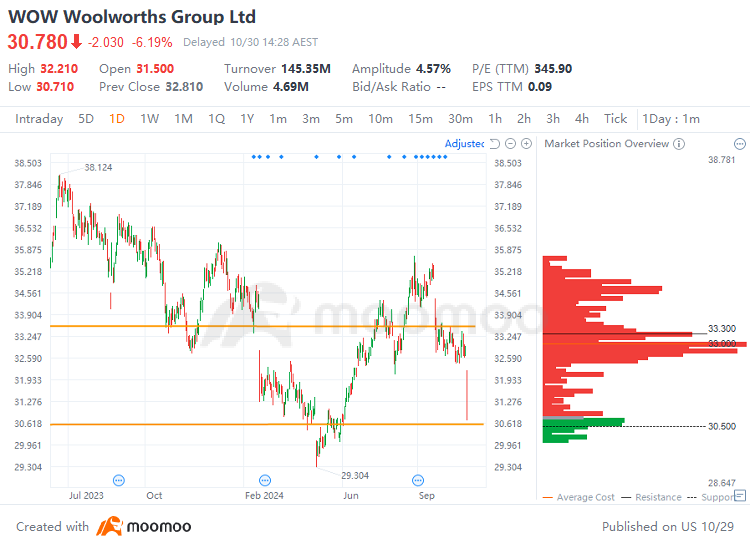

$Woolworths Group Ltd (WOW.AU)$ shares fell 6.19% on Wednesday, with trading volume expanding to A$145.35 million. Woolworths has fallen 4.61% over the past week, with a cumulative loss of 13.02% year-to-date.

$Woolworths Group Ltd (WOW.AU)$ 周三股价下跌6.19%,成交量扩大至A$14535万。沃尔沃在过去一周下跌了4.61%,年初累计损失13.02%。

Woolworths 's technical analysis chart:

沃尔沃的技术面分析图表:

Technical Analysis:

技术面分析:

Support: A$30.50

Resistance: A$33.30

Price range A$30.50 to A$33.30: The trading range indicates a heavy concentration of selling orders, with the stock price on an downward trend. There's a high concentration of trapped positions within the trading range, which implies strong resistance to any upward movement. The stock started to decline near A$33.30 due to selling pressure and repeatedly touched the A$30.50 level, where it seems to find some support. Going forward, it's crucial to watch whether the support at A$30.50 holds and if it can lead to a potential rebound.

支撑位:A$30.50

压力位:A$33.30

价格区间A$30.50至A$33.30:该交易区间显示有大量卖单集中,股价呈下降趋势。交易区间内有大量被套住的持仓,意味着对股价上涨有很强的阻力。股价开始在A$33.30附近下跌,受到卖压影响,并反复触及A$30.50水平,似乎找到了一些支撑。未来至关重要的是观察A$30.50的支撑是否能持住,以及是否能引发潜在的反弹。

Market News :

市场资讯:

Woolworths announced its Q1 sales results and trading update on October 30, 2024. In the first quarter of FY25, the company's sales rose by 4.5%, or 3.3% if excluding Petstock. The total group sales reached A$18 billion, a 4.5% increase from the previous year's A$17.22 billion.

Woolworths宣布其2024年10月30日的Q1销售业绩和交易更新。在FY25第一季度,公司销售额增长了4.5%,如果排除Petstock,则为3.3%。总集团销售额达到了180亿澳元,比去年的172.2亿澳元增加了4.5%。

Australian Food's total sales grew by 3.8%, driven by a strong focus on value, improved availability, popular Disney collectibles, and a robust 23.6% increase in eCommerce sales.

澳大利亚食品的总销售额增长了3.8%,得益于对价值的高度关注,改善了供应和受欢迎的迪士尼收藏品,以及电子商务销售的强劲增长23.6%。

Although the crucial Q2 trading period is still ahead, the company anticipates that the EBIT for Australian Food in the first half will be lower than previously expected. Woolworths currently estimates the H1 FY25 EBIT, which includes an additional A$40 million in supply chain costs, to be between A$1.48 billion and A$1.53 billion, compared to A$1.5951 billion in H1 FY24.

尽管至关重要的Q2交易期仍在前方,公司预计澳大利亚食品在上半年的EBIt将低于之前预期。Woolworths目前预计H1 FY25的EBIt,包括额外的4千万澳元的供应链成本,将在14.8亿澳元和15.3亿澳元之间,相比H1 FY24的15.951亿澳元。

Overall Analysis:

总体分析:

Fundamentally, focus on the company's performance and operational status. Technically, pay attention to whether the support levels hold and if the resistance levels can be effectively breached.

基本上,关注公司的业绩和运营状况。从技术上讲,要注意支撑位能否持稳,以及阻力位是否能被有效突破。

In this scenario, investors should adopt a cautious strategy, setting stop-loss points to manage risk and maintaining ongoing vigilance regarding company developments and market conditions.

在这种情况下,投资者应采取谨慎的策略,设置止损点来管理风险,并对公司发展和市场情况保持持续警惕。

Resistance: A$33.30

Resistance: A$33.30