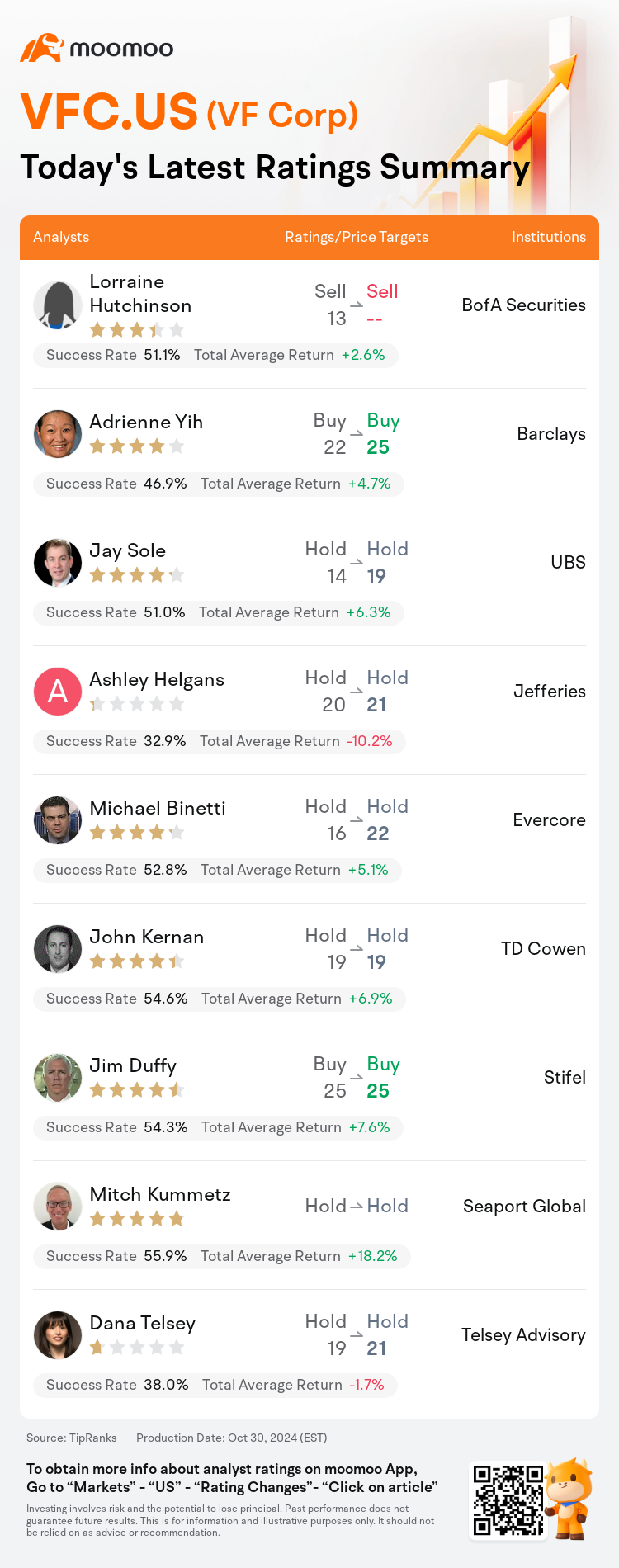

On Oct 30, major Wall Street analysts update their ratings for $VF Corp (VFC.US)$, with price targets ranging from $19 to $25.

BofA Securities analyst Lorraine Hutchinson maintains with a sell rating.

Barclays analyst Adrienne Yih maintains with a buy rating, and adjusts the target price from $22 to $25.

UBS analyst Jay Sole maintains with a hold rating, and adjusts the target price from $14 to $19.

UBS analyst Jay Sole maintains with a hold rating, and adjusts the target price from $14 to $19.

Jefferies analyst Ashley Helgans maintains with a hold rating, and adjusts the target price from $20 to $21.

Evercore analyst Michael Binetti maintains with a hold rating, and adjusts the target price from $16 to $22.

Furthermore, according to the comprehensive report, the opinions of $VF Corp (VFC.US)$'s main analysts recently are as follows:

There is a recognition of the gradual increase in sales growth for VF Corp., which is viewed positively. However, there are concerns regarding the level of investment required to sustain this growth. Given the company's high leverage, there is an added emphasis on the necessity for a swift business turnaround. The challenge in shifting to a growth trajectory is also noted. Despite the recognition of improved recent execution, expectations for future earnings have been moderated due to anticipated increases in selling, general, and administrative expenses.

VF Corp.'s recent earnings outperformed consensus forecasts, bolstered by enhanced sales, margin, and spending discipline. Notably, the sequential improvement observed at Vans countered prevailing expectations. Despite the modest absolute figures from Vans, investor anticipations had been braced for a notably poorer outcome. It's anticipated that the equity will experience a marked increase, given the previously negative investor sentiment.

VF Corp.'s fiscal Q2 results exceeded expectations, yet the projection for second-half earnings significantly trails the consensus by 70%, as noted by an analyst.

VF Corp.'s fiscal Q2 demonstrated advancement, surpassing expectations in revenue, margin, and earnings, alongside maintaining inventory control. It was noted that the company's operating profit didn't meet the consensus due to heightened investments aimed at fostering future growth.

VF Corp.'s shares experienced an uptick following the announcement of third-quarter earnings per share that surpassed expectations along with the reinstatement of quarterly forecasts. It is indicated that revenue projections for the third quarter point towards an improvement in trends as the second half of the year progresses.

Here are the latest investment ratings and price targets for $VF Corp (VFC.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月30日,多家华尔街大行更新了$威富集团 (VFC.US)$的评级,目标价介于19美元至25美元。

美银证券分析师Lorraine Hutchinson维持卖出评级。

巴克莱银行分析师Adrienne Yih维持买入评级,并将目标价从22美元上调至25美元。

瑞士银行分析师Jay Sole维持持有评级,并将目标价从14美元上调至19美元。

瑞士银行分析师Jay Sole维持持有评级,并将目标价从14美元上调至19美元。

富瑞集团分析师Ashley Helgans维持持有评级,并将目标价从20美元上调至21美元。

Evercore分析师Michael Binetti维持持有评级,并将目标价从16美元上调至22美元。

此外,综合报道,$威富集团 (VFC.US)$近期主要分析师观点如下:

威富集团的销售增长逐渐增加得到认可,这一点被认为是积极的。然而,对维持这种增长所需投资水平存在担忧。考虑到公司的高杠杆,对迅速实现业务扭转的必要性更为强调。同时也指出了转向增长轨迹的挑战。尽管认可了最近改善的执行情况,但由于预计销售、管理和行政费用的增加,对未来收益的预期已经有所调整。

威富集团最近的收益超过了一致预测,得益于增强的销售、利润率和支出管控。值得注意的是,在Vans观察到的按顺序的改善抵消了普遍预期。尽管Vans的绝对数据较为温和,但投资者的预期已经为一个明显不佳的结果做好了准备。预计股权将会大幅增长,鉴于此前的负面投资者情绪。

威富集团财政第二季度的业绩超出预期,然而下半年盈利预测明显低于一致预期,按照一位分析师的说法。

威富集团财政第二季度取得了进展,收入、利润率和收益方面的表现超出预期,同时保持库存控制。据悉,由于加大投资以促进未来增长,公司的营业利润未能达到共识水平。

威富集团的股票在宣布第三季度每股收益超过预期以及恢复季度预测后出现上涨。据显示,第三季度的营收预测指向随着年下半年的进展趋势改善。

以下为今日9位分析师对$威富集团 (VFC.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

瑞士银行分析师Jay Sole维持持有评级,并将目标价从14美元上调至19美元。

瑞士银行分析师Jay Sole维持持有评级,并将目标价从14美元上调至19美元。

UBS analyst Jay Sole maintains with a hold rating, and adjusts the target price from $14 to $19.

UBS analyst Jay Sole maintains with a hold rating, and adjusts the target price from $14 to $19.