On Oct 30, major Wall Street analysts update their ratings for $Qorvo (QRVO.US)$, with price targets ranging from $80 to $80.

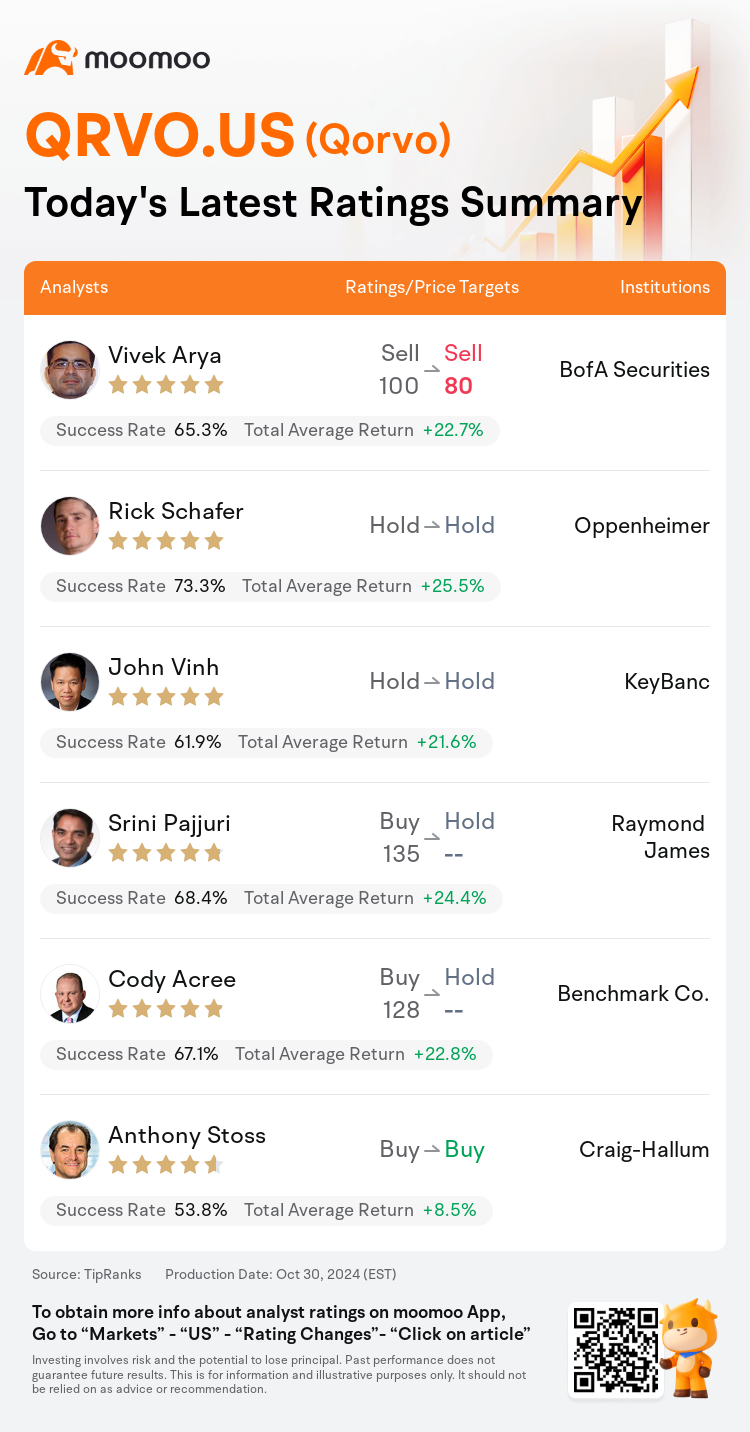

BofA Securities analyst Vivek Arya maintains with a sell rating, and adjusts the target price from $100 to $80.

Oppenheimer analyst Rick Schafer maintains with a hold rating.

KeyBanc analyst John Vinh maintains with a hold rating.

KeyBanc analyst John Vinh maintains with a hold rating.

Raymond James analyst Srini Pajjuri downgrades to a hold rating.

Benchmark Co. analyst Cody Acree downgrades to a hold rating.

Furthermore, according to the comprehensive report, the opinions of $Qorvo (QRVO.US)$'s main analysts recently are as follows:

The firm has reduced its pro-forma EPS forecasts for the calendar years 2025 and 2026 by 31% and 33% respectively, as Qorvo faces execution challenges within its core mobile-based ACG segment amidst a difficult end-market.

Qorvo's reduction in its Android business and Apple unit challenges have led to a significant decrease in projections, serving as a key indicator for the mobile industry.

A noted shift in the product mix towards Flagship/premium designs combined with a notable decline in the mid-tier Android market segments has prompted a revision to the expected earnings for FY25/26, with a projected decrease of 25% for each fiscal year.

The expectation for 'modest' content gains from a major tech company through 2026 has been projected, with an overall conservative approach to unit estimates. The sentiment towards mobile technology is believed to offer a compelling risk/reward scenario for Qorvo if it improves. It is anticipated that mobile unit estimates could rise as evidence of an artificial intelligence-driven smartphone product cycle strengthens, positioning Qorvo favorably.

Here are the latest investment ratings and price targets for $Qorvo (QRVO.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月30日,多家华尔街大行更新了$Qorvo (QRVO.US)$的评级,目标价介于80美元至80美元。

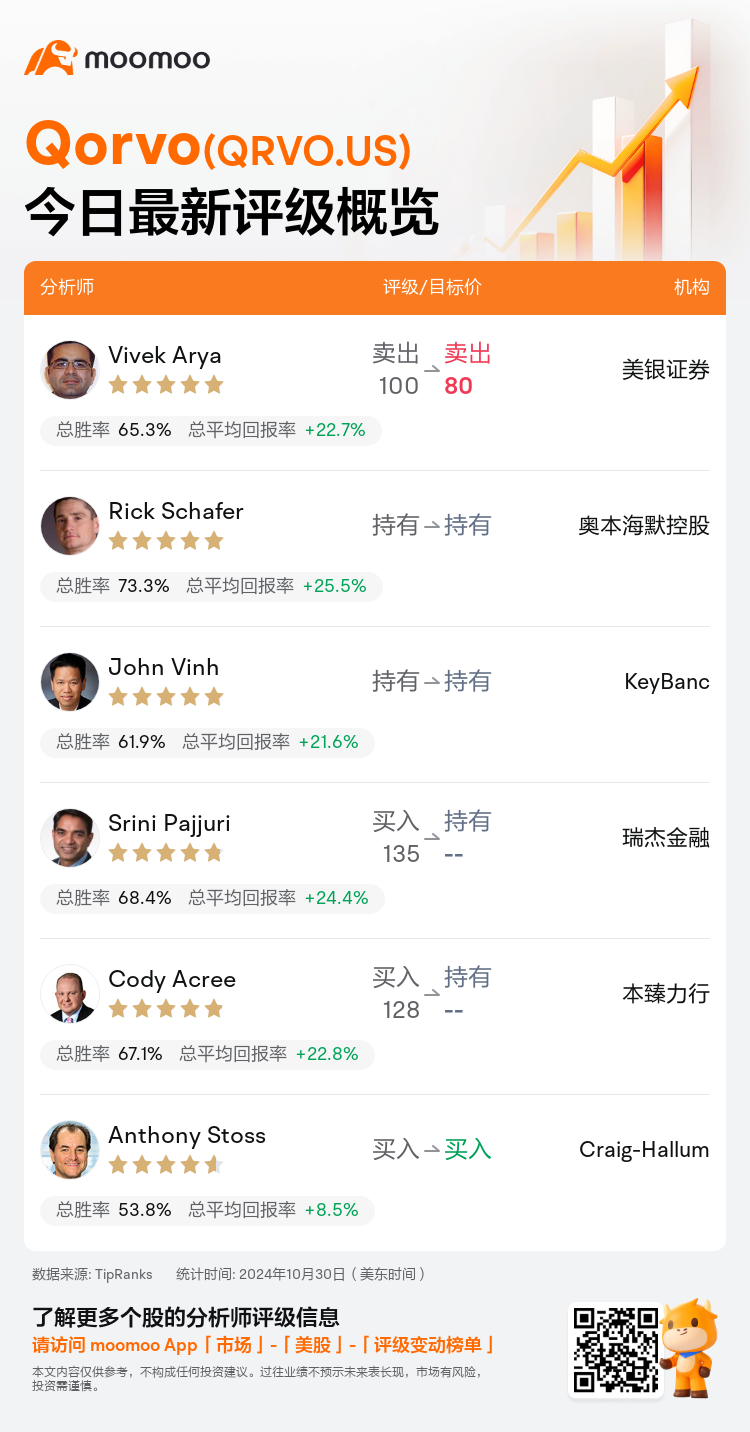

美银证券分析师Vivek Arya维持卖出评级,并将目标价从100美元下调至80美元。

奥本海默控股分析师Rick Schafer维持持有评级。

KeyBanc分析师John Vinh维持持有评级。

KeyBanc分析师John Vinh维持持有评级。

瑞杰金融分析师Srini Pajjuri下调至持有评级。

本臻力行分析师Cody Acree下调至持有评级。

此外,综合报道,$Qorvo (QRVO.US)$近期主要分析师观点如下:

该公司已经将其2025年和2026年日历年的调整后每股收益预测分别降低了31%和33%,因为qorvo在其核心移动ACG板块面临执行挑战,面临一个困难的终端市场。

Qorvo在其Android业务和苹果业务方面的减少挑战导致了预测的显著下降,成为移动行业的一个重要指标。

产品组合向旗舰/高端设计的显著转变,以及中档Android市场部分的明显下降,促使了对FY25/26预期收益的修订,每个财政年度预计下降25%。

对通过2026年获得来自一家大型科技公司的'适度'内容增益的预期已经得出结论,对销量估计采取了总体保守的方法。对移动科技的看法被认为为qorvo提供了一种引人注目的风险/回报方案,如果它提升的话。预计随着人工智能驱动的智能手机产品周期的加强,移动销量预估可能会上升,这将有利于qorvo的地位。

以下为今日6位分析师对$Qorvo (QRVO.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

KeyBanc分析师John Vinh维持持有评级。

KeyBanc分析师John Vinh维持持有评级。

KeyBanc analyst John Vinh maintains with a hold rating.

KeyBanc analyst John Vinh maintains with a hold rating.