On Oct 30, major Wall Street analysts update their ratings for $Stryker Corp (SYK.US)$, with price targets ranging from $370 to $420.

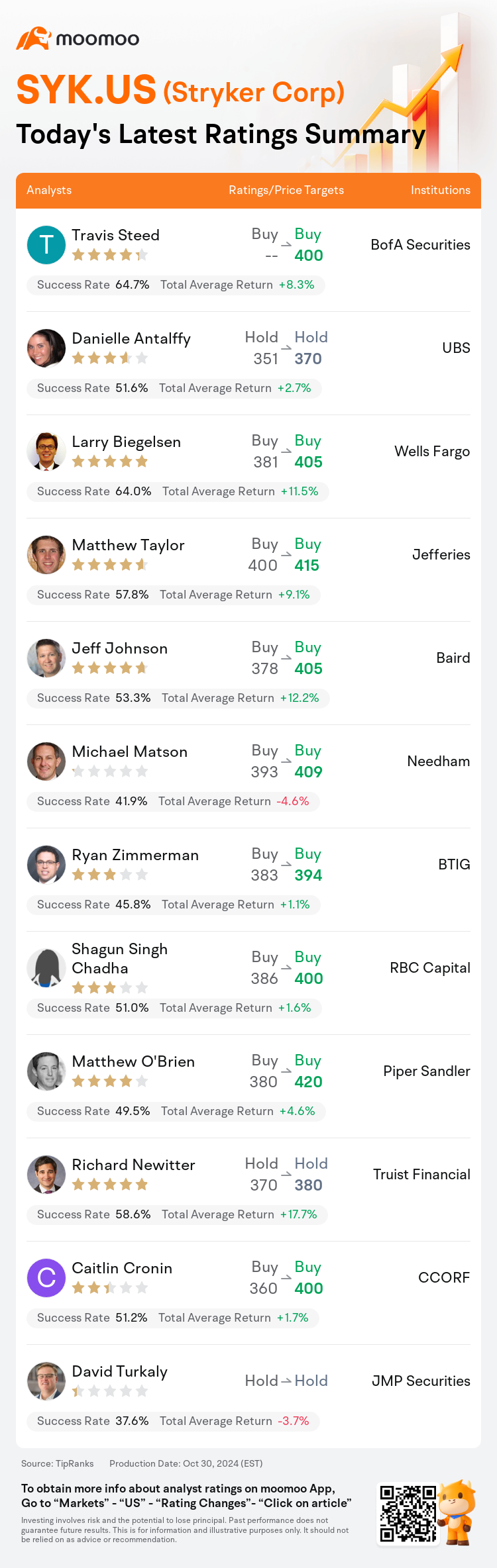

BofA Securities analyst Travis Steed maintains with a buy rating, and sets the target price at $400.

UBS analyst Danielle Antalffy maintains with a hold rating, and adjusts the target price from $351 to $370.

Wells Fargo analyst Larry Biegelsen maintains with a buy rating, and adjusts the target price from $381 to $405.

Wells Fargo analyst Larry Biegelsen maintains with a buy rating, and adjusts the target price from $381 to $405.

Jefferies analyst Matthew Taylor maintains with a buy rating, and adjusts the target price from $400 to $415.

Baird analyst Jeff Johnson maintains with a buy rating, and adjusts the target price from $378 to $405.

Furthermore, according to the comprehensive report, the opinions of $Stryker Corp (SYK.US)$'s main analysts recently are as follows:

Stryker's recent financial results exceeded expectations, with the prospect of growth by 2025 being attributed to the launch of new products and the anticipated contributions from mergers and acquisitions, which include about seven deals in the pipeline. Additionally, the continued expansion of the Mako platform, particularly with two new indications, is expected to bolster growth. The analyst's position remains neutral pending stronger confidence in sales and earnings per share outperformance relative to consensus estimates.

Stryker reported robust and diverse results for Q3, with revenue surpassing expectations. Although the implied organic growth rate is somewhat below the company's historical trend for a seasonally strong quarter, Stryker anticipates maintaining healthy procedural dynamics, favorable pricing, and product growth drivers to uphold its premium growth trajectory.

The recent quarter showcased another strong performance, with global organic growth returning to double-digit figures. This marks a significant milestone as orthopedic pricing has seen a positive turn for the first time in ten years, and earnings per share have been expanding at or above the mid-teen rate.

Stryker's third-quarter results presented a positive surprise in sales, particularly led by its MedSurg division. The projection for the fourth quarter is deemed to be on the cautious side, while the company's strong business momentum is expected to carry on through 2025.

Here are the latest investment ratings and price targets for $Stryker Corp (SYK.US)$ from 12 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

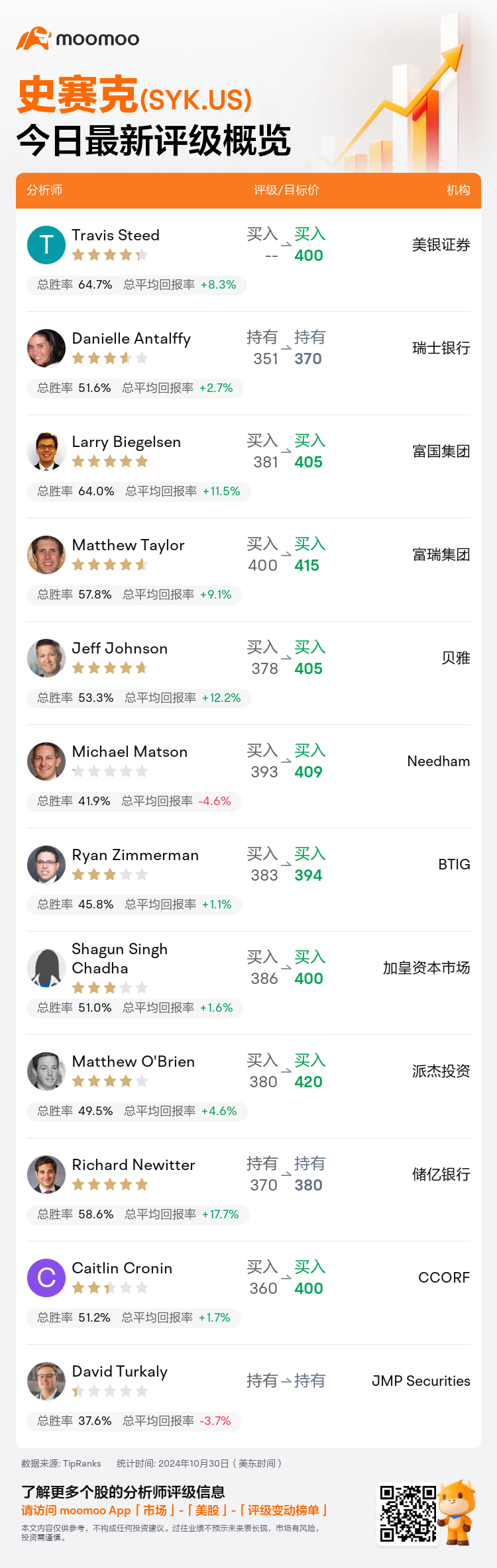

美东时间10月30日,多家华尔街大行更新了$史赛克 (SYK.US)$的评级,目标价介于370美元至420美元。

美银证券分析师Travis Steed维持买入评级,目标价400美元。

瑞士银行分析师Danielle Antalffy维持持有评级,并将目标价从351美元上调至370美元。

富国集团分析师Larry Biegelsen维持买入评级,并将目标价从381美元上调至405美元。

富国集团分析师Larry Biegelsen维持买入评级,并将目标价从381美元上调至405美元。

富瑞集团分析师Matthew Taylor维持买入评级,并将目标价从400美元上调至415美元。

贝雅分析师Jeff Johnson维持买入评级,并将目标价从378美元上调至405美元。

此外,综合报道,$史赛克 (SYK.US)$近期主要分析师观点如下:

斯特赖克最近的财务业绩超出预期,到2025年的增长前景归因于新产品的推出以及预期的并购贡献,其中包括大约七笔交易正在进行中。此外,Mako平台的持续扩张,特别是两个新适应症,预计将支撑增长。在信恳智能在销售额和每股收益表现方面超越共识估值前提下,分析师的立场仍保持中立。

斯特赖克报告了第三季度强劲且多元化的业绩,营业收入超出预期。尽管暗示的有机增长率略低于公司历史趋势的强季度表现,斯特赖克预计保持健康的程序动态、有利的定价以及产品增长驱动因素,以维持其优质增长轨迹。

最近的一个季度展示出另一次强劲表现,全球有机增长率恢复到两位数。这标志着骨科产品定价在十年来首次出现积极变化,每股收益一直保持在或高于中青年率。

斯特赖克第三季度的销售业绩出现积极意外,特别是由其MedSurg部门主导。对于第四季度的预期被认为是保守的,而公司强劲的业务势头预计将持续到2025年。

以下为今日12位分析师对$史赛克 (SYK.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Larry Biegelsen维持买入评级,并将目标价从381美元上调至405美元。

富国集团分析师Larry Biegelsen维持买入评级,并将目标价从381美元上调至405美元。

Wells Fargo analyst Larry Biegelsen maintains with a buy rating, and adjusts the target price from $381 to $405.

Wells Fargo analyst Larry Biegelsen maintains with a buy rating, and adjusts the target price from $381 to $405.