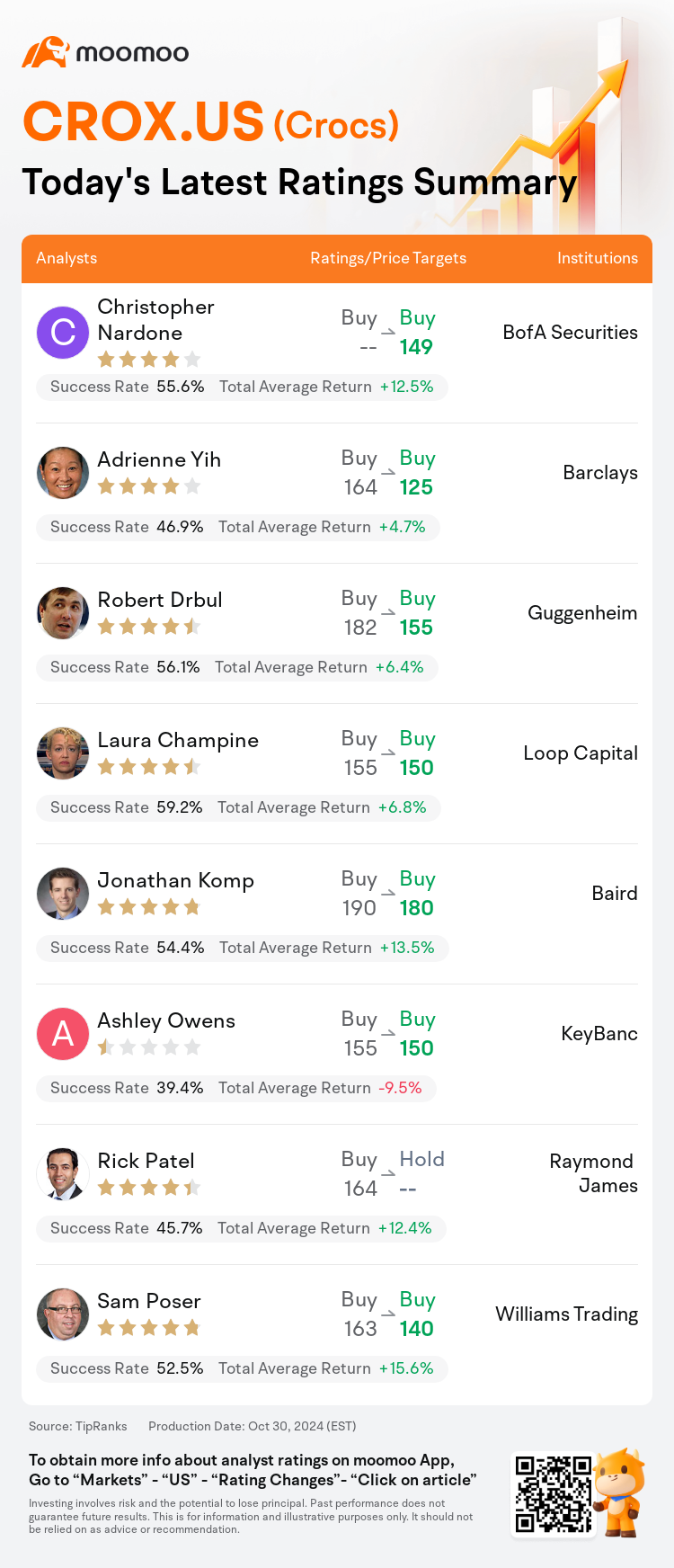

On Oct 30, major Wall Street analysts update their ratings for $Crocs (CROX.US)$, with price targets ranging from $125 to $180.

BofA Securities analyst Christopher Nardone maintains with a buy rating, and sets the target price at $149.

Barclays analyst Adrienne Yih maintains with a buy rating, and adjusts the target price from $164 to $125.

Guggenheim analyst Robert Drbul maintains with a buy rating, and adjusts the target price from $182 to $155.

Guggenheim analyst Robert Drbul maintains with a buy rating, and adjusts the target price from $182 to $155.

Loop Capital analyst Laura Champine maintains with a buy rating, and adjusts the target price from $155 to $150.

Baird analyst Jonathan Komp maintains with a buy rating, and adjusts the target price from $190 to $180.

Furthermore, according to the comprehensive report, the opinions of $Crocs (CROX.US)$'s main analysts recently are as follows:

Q3 results for Crocs exceeded expectations in terms of sales, operating margin, and earnings per share. However, despite outperforming, the favorable results didn't carry over to the fiscal 2024 EPS projections as guidance was refined for most metrics. It was observed that Q4 guidance was significantly lower than anticipated, which had an impact on the annual outlook due to challenging macroeconomic conditions and delays in realizing returns from HEYDUDE.

Expectations have been set for a more challenging expenditure climate in North America and China. Nonetheless, forecasts remain optimistic for Crocs' direct-to-consumer performance in North America during the fourth quarter, although there is an anticipation of a continued subdued performance for HEYDUDE. The earnings per share estimate for FY24 remains unchanged, while the projection for FY25 has been modestly adjusted to reflect the anticipated additional investments aimed at stabilizing HEYDUDE.

Following a third-quarter beat and an updated forecast for the full year, it's noted that the Crocs brand experienced a 7.4% year-over-year increase, though HEYDUDE fell short of expectations. For the full year, it's now anticipated that Crocs will see a revenue growth of around 3% year-over-year. The adjustment in HEYDUDE's fourth-quarter projection is attributed to the effects on digital channels from the reallocation of market focus towards brand rather than performance, along with lower wholesale sell-through.

The valuation of Crocs appears attractive following the stock's pullback after the company's Q3 results and guidance. Nevertheless, there is a lack of enthusiasm for the Q4 sales outlook across both segments. Concerns are amplified by the challenges encountered by the Hey Dude segment, particularly as it confronts easier comparisons from the past.

The firm observed that Crocs delivered a fairly strong performance in Q3, though it wasn't the usual standout beat. The company has increased the mid-point guidance for 2024E EPS. However, a more challenging expenditure landscape and an extended revival period for HEYDUDE are affecting overall confidence.

Here are the latest investment ratings and price targets for $Crocs (CROX.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

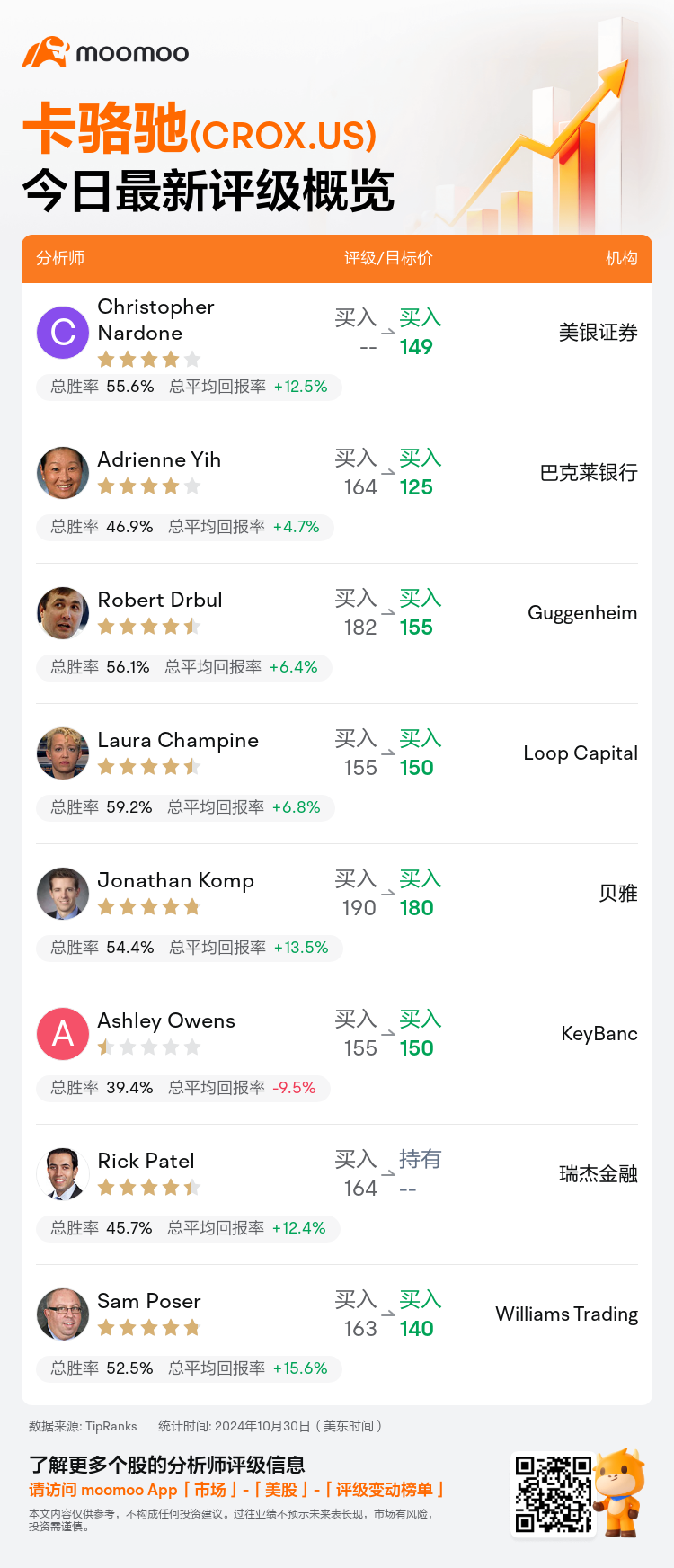

美东时间10月30日,多家华尔街大行更新了$卡骆驰 (CROX.US)$的评级,目标价介于125美元至180美元。

美银证券分析师Christopher Nardone维持买入评级,目标价149美元。

巴克莱银行分析师Adrienne Yih维持买入评级,并将目标价从164美元下调至125美元。

Guggenheim分析师Robert Drbul维持买入评级,并将目标价从182美元下调至155美元。

Guggenheim分析师Robert Drbul维持买入评级,并将目标价从182美元下调至155美元。

Loop Capital分析师Laura Champine维持买入评级,并将目标价从155美元下调至150美元。

贝雅分析师Jonathan Komp维持买入评级,并将目标价从190美元下调至180美元。

此外,综合报道,$卡骆驰 (CROX.US)$近期主要分析师观点如下:

Crocs第三季度的销售额、营业利润率和每股收益均超出预期。然而,尽管表现出色,良好的业绩并未延续到2024财年的每股收益预测,因为对大多数指标的指引进行了调整。观察到第四季度的指引显著低于预期,这对年度展望产生了影响,原因是宏观经济条件复杂和从HEYDUDE获取回报的延误。

已经为北美和中国设定了更具挑战性的支出环境预期。尽管如此,对Crocs在北美直销业绩在第四季度保持乐观,尽管预计HEYDUDE的表现仍将继续低迷。财年24的每股收益预估保持不变,而财年25的预估已经略微调整,以反映旨在稳定HEYDUDE的预期额外投资。

在第三季度表现出色和整年更新预测后,Crocs品牌实现了7.4%的年度增长,尽管HEYDUDE未达预期。据预计,Crocs整年营业收入将约增长3%。对HEYDUDE第四季度预测的调整归因于由于重新调整市场关注点向品牌而不是业绩,以及较低的批发卖出量,数字渠道受到影响。

Crocs的估值在公司第三季度业绩和指引后的股价回落后显得有吸引力。然而,两个业务板块的第四季度销售前景缺乏热情。对Hey Dude板块遇到的挑战倍感忧虑,尤其是面临着过去更为简单对比所带来的挑战。

公司观察到Crocs在第三季度表现相当强劲,但并非富有亮点。公司已上调2024财年每股收益的中间指引。然而,更具挑战性的支出环境和对HEYDUDE的延长复苏期正在影响整体信心。

以下为今日8位分析师对$卡骆驰 (CROX.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Guggenheim分析师Robert Drbul维持买入评级,并将目标价从182美元下调至155美元。

Guggenheim分析师Robert Drbul维持买入评级,并将目标价从182美元下调至155美元。

Guggenheim analyst Robert Drbul maintains with a buy rating, and adjusts the target price from $182 to $155.

Guggenheim analyst Robert Drbul maintains with a buy rating, and adjusts the target price from $182 to $155.