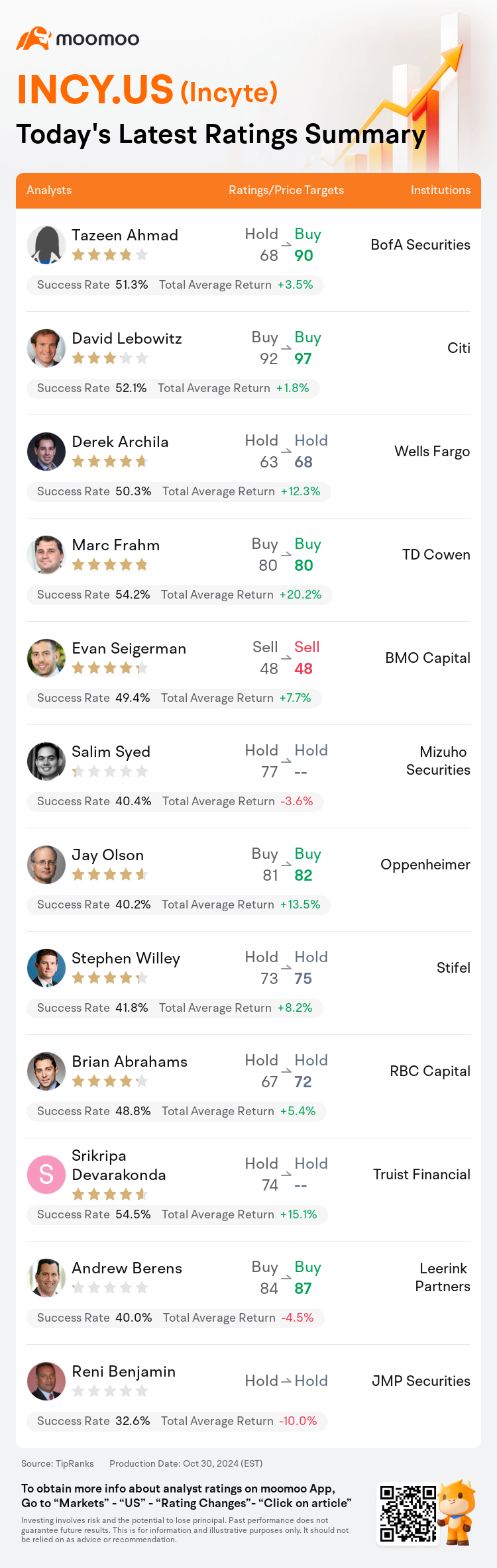

On Oct 30, major Wall Street analysts update their ratings for $Incyte (INCY.US)$, with price targets ranging from $48 to $97.

BofA Securities analyst Tazeen Ahmad upgrades to a buy rating, and adjusts the target price from $68 to $90.

Citi analyst David Lebowitz maintains with a buy rating, and adjusts the target price from $92 to $97.

Wells Fargo analyst Derek Archila maintains with a hold rating, and adjusts the target price from $63 to $68.

Wells Fargo analyst Derek Archila maintains with a hold rating, and adjusts the target price from $63 to $68.

TD Cowen analyst Marc Frahm maintains with a buy rating, and maintains the target price at $80.

BMO Capital analyst Evan Seigerman maintains with a sell rating, and maintains the target price at $48.

Furthermore, according to the comprehensive report, the opinions of $Incyte (INCY.US)$'s main analysts recently are as follows:

Incyte's Q3 results have been notable for surpassing revenue expectations, primarily driven by the sustained growth of its key products, Jakafi and Opzelura. The company's underlying narrative is strengthened by its steady commercial performance, reduced apprehensions regarding Jakafi's competition, and a robust pipeline with multiple potential opportunities.

Previous concerns regarding competitive pressure to Jakafi in myelofibrosis appear to be abating in light of the strong continued demand, suggesting a diminished risk profile. Additionally, the sustained growth of Opzelura, alongside the potential for expansion into pediatric atopic dermatitis, is viewed positively.

The company's recent top-line performance surpassed expectations, accompanied by an updated forecast for FY24 that remained relatively steady or showed potential improvement. This was despite the projection for Jakafi being balanced out by a diminished outlook for the Heme/Oncology segment. Nevertheless, there persists a level of uncertainty regarding the company's long-term prospects, primarily due to apprehensions about growth considering that the bulk of pipeline revenue is anticipated subsequent to the Jakafi patent expiration in 2028.

Incyte has been observed to deliver strong third-quarter results, surpassing expectations with the performance of Jakafi and Opzelura, and also outperforming in terms of profits. Demonstrating effective commercial strategies, the company has increased its forecast for fiscal year 2024, suggesting robust sales for Jakafi in the fourth quarter and a 6% growth for the entire fiscal year. The focus is anticipated to shift towards the company's pipeline projects, where several imminent events are expected, including updates on the LIMBER program and key data releases from clinical studies on MRGPRX2 in chronic spontaneous urticaria, along with Phase 3 results for povorcitinib in hidradenitis suppurativa, which will shed light on potential growth drivers beyond the patent expiration of Jakafi.

It is believed that the recent uplift in Incyte's share value may be partially due to a better-than-expected financial performance, yet it may also be attributed to the anticipation of numerous significant data disclosures expected in the first half of 2025. Shares are anticipated to perform positively leading up to these events, although the stock valuation is not considered particularly low.

Here are the latest investment ratings and price targets for $Incyte (INCY.US)$ from 12 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

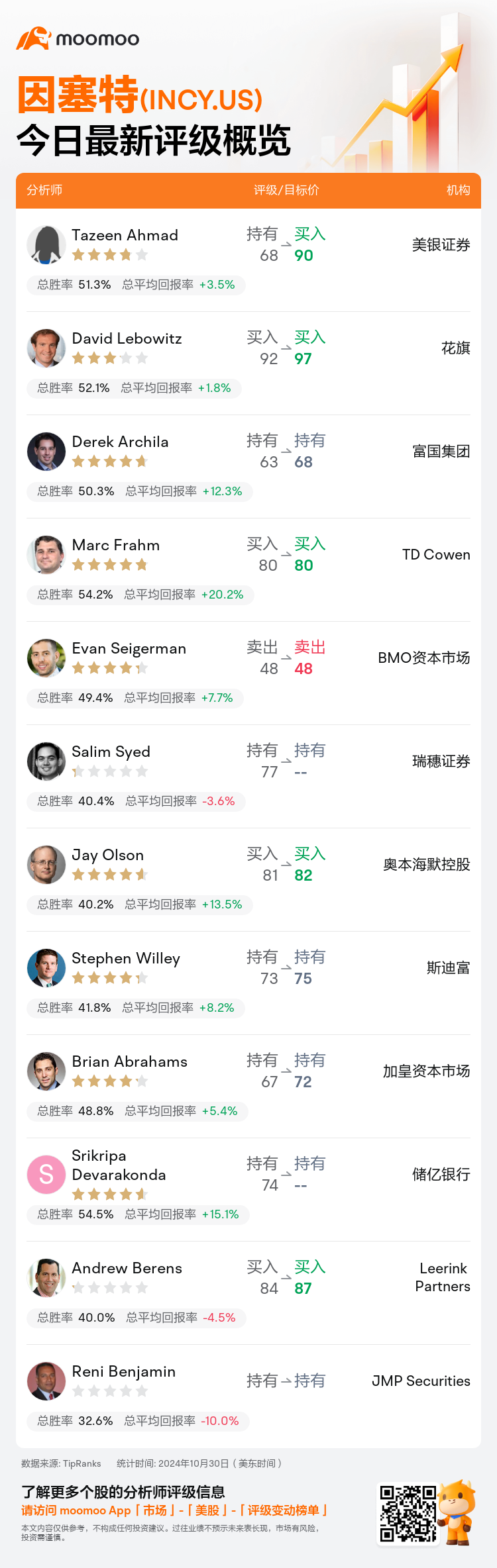

美东时间10月30日,多家华尔街大行更新了$因塞特 (INCY.US)$的评级,目标价介于48美元至97美元。

美银证券分析师Tazeen Ahmad上调至买入评级,并将目标价从68美元上调至90美元。

花旗分析师David Lebowitz维持买入评级,并将目标价从92美元上调至97美元。

富国集团分析师Derek Archila维持持有评级,并将目标价从63美元上调至68美元。

富国集团分析师Derek Archila维持持有评级,并将目标价从63美元上调至68美元。

TD Cowen分析师Marc Frahm维持买入评级,维持目标价80美元。

BMO资本市场分析师Evan Seigerman维持卖出评级,维持目标价48美元。

此外,综合报道,$因塞特 (INCY.US)$近期主要分析师观点如下:

因塞特的第三季度业绩在超越营业收入预期方面非常显著,主要受其关键产品Jakafi和Opzelura持续增长的推动。该公司的基本故事得到加强,稳健的商业表现、减少对Jakafi竞争的担忧,以及具有多个潜在机会的强大产品线起到了支撑作用。

考虑到对肺纤维化中Jakafi竞争压力的担忧似乎在持续强劲的需求下有所减轻,表明风险配置有所降低。此外,Opzelura持续增长,加上扩展到儿童特应性皮炎的潜力被视为正面因素。

该公司最近的营收表现超出预期,并伴随着对FY24的更新预测保持相对稳定或呈现潜在改善。尽管对Jakafi的预测被削弱,血液/肿瘤领域的前景也相应减少,但仍存在对公司长期前景的一定程度的不确定性,主要是由于对增长的担忧,考虑到产品线获得的大部分营收预计将在2028年Jakafi专利到期后出现。

因塞特被观察到在第三季度取得强劲业绩,通过Jakafi和Opzelura的表现超越预期,也在利润方面表现优异。展示了有效的商业策略,公司已经提高了对2024财年的预测,暗示第四季度Jakafi的强劲销售以及整个财年6%的增长。重点预计将转向公司的产品线项目,其中预计将发生几个即将到来的事件,包括LIMBER项目的更新以及MRGPRX2关于慢性自发性荨麻疹的临床研究数据发布,以及hideadinectis suppurativa中povorcitinib的三期结果,这将为Jakafi专利到期后的潜在增长驱动因素带来启示。

据信因塞特股票价值最近上升,可能部分原因是出乎意料的良好财务表现,但也可能归因于2025年上半年预期的大量重要数据披露。预计股票在这些事件之前将表现积极,尽管股票估值并不特别低。

以下为今日12位分析师对$因塞特 (INCY.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Derek Archila维持持有评级,并将目标价从63美元上调至68美元。

富国集团分析师Derek Archila维持持有评级,并将目标价从63美元上调至68美元。

Wells Fargo analyst Derek Archila maintains with a hold rating, and adjusts the target price from $63 to $68.

Wells Fargo analyst Derek Archila maintains with a hold rating, and adjusts the target price from $63 to $68.