On Oct 30, major Wall Street analysts update their ratings for $First Solar (FSLR.US)$, with price targets ranging from $240 to $326.

Morgan Stanley analyst Andrew Percoco maintains with a buy rating, and adjusts the target price from $329 to $297.

J.P. Morgan analyst Mark Strouse maintains with a buy rating, and maintains the target price at $282.

BofA Securities analyst Dimple Gosai maintains with a buy rating, and adjusts the target price from $321 to $269.

BofA Securities analyst Dimple Gosai maintains with a buy rating, and adjusts the target price from $321 to $269.

Wells Fargo analyst Michael Blum maintains with a buy rating, and maintains the target price at $240.

TD Cowen analyst Jeff Osborne maintains with a buy rating, and maintains the target price at $325.

Furthermore, according to the comprehensive report, the opinions of $First Solar (FSLR.US)$'s main analysts recently are as follows:

While the volume guidance for First Solar was decreased, mainly due to three contract terminations and modules previously expected to be sold within the current year, these setbacks seem to be specific to the situation and not indicative of systemic problems. The recent challenges faced are considered to be circumstantial rather than indicative of any underlying issues.

First Solar has faced operational challenges and India market headwinds that contributed to less favorable Q3 results along with a downward adjustment in 2024 volume and revenue guidance. Project delays are seen as a continuing risk for Q4, with anticipated share volatility in the period surrounding the U.S. presidential election. Nonetheless, the current stock valuation is perceived to reflect a substantial discount with regard to risks of IRA repeal and potential earnings per share falling significantly short of consensus estimates.

First Solar's third-quarter performance was described as 'weak,' influenced by a reduced volume of megawatts sold and a warranty charge due to S7 start-up manufacturing challenges. It was observed that the report presented both positive aspects and challenges. The outlook on First Solar remains optimistic, with an intention to further evaluate the political landscape following the upcoming U.S. elections.

The adjustment in guidance from First Solar didn't catch many investors off guard, despite being significant. A number of unique factors led to the revised 2024 forecast, and it was unexpected that project deferrals weren't a major reason. It's noted that First Solar stands to benefit significantly from the Inflation Reduction Act, which is anticipated to enhance earnings potential and visibility as developers scramble to obtain domestic solar modules.

The firm recognizes that First Solar's third quarter performance fell short and that its 2024 outlook has been adjusted downward. However, it was noted that the results were more favorable than anticipated. Looking ahead to 2025, it is anticipated that the rate of bookings will accelerate and average selling prices will rise.

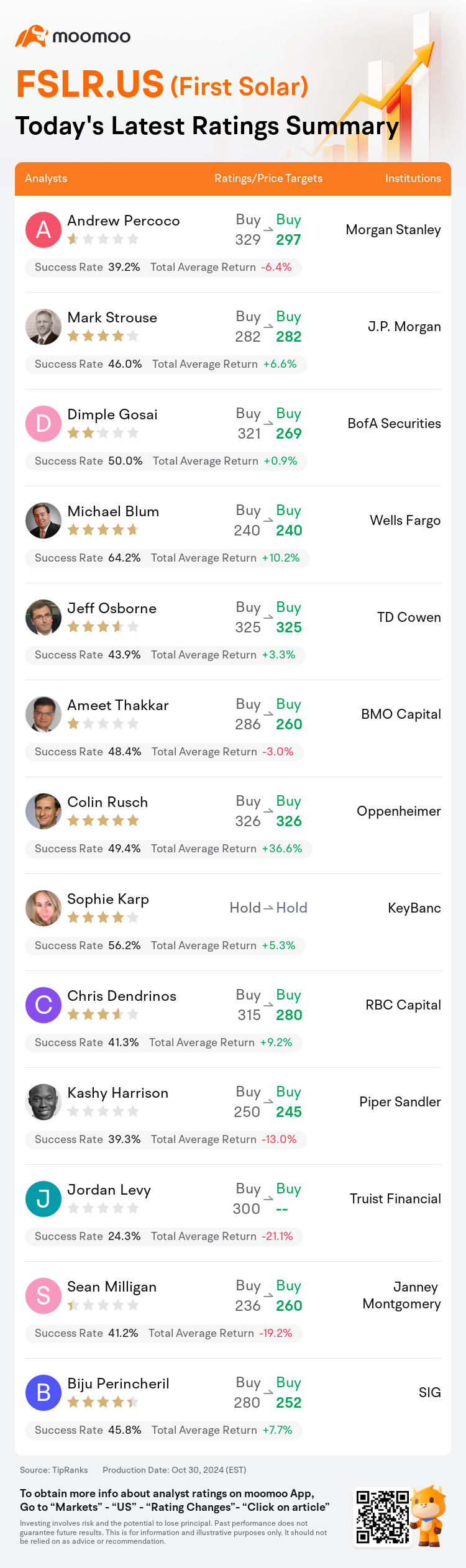

Here are the latest investment ratings and price targets for $First Solar (FSLR.US)$ from 13 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月30日,多家华尔街大行更新了$第一太阳能 (FSLR.US)$的评级,目标价介于240美元至326美元。

摩根士丹利分析师Andrew Percoco维持买入评级,并将目标价从329美元下调至297美元。

摩根大通分析师Mark Strouse维持买入评级,维持目标价282美元。

美银证券分析师Dimple Gosai维持买入评级,并将目标价从321美元下调至269美元。

美银证券分析师Dimple Gosai维持买入评级,并将目标价从321美元下调至269美元。

富国集团分析师Michael Blum维持买入评级,维持目标价240美元。

TD Cowen分析师Jeff Osborne维持买入评级,维持目标价325美元。

此外,综合报道,$第一太阳能 (FSLR.US)$近期主要分析师观点如下:

第一太阳能的成交量指导下调,主要是因为三份合同终止和预期今年内销售的组件,这些挫折似乎更多地与特定情况有关,而非系统性问题的指标。最近面临的挑战被认为是偶然的,而非任何潜在问题的指标。

第一太阳能面临运营挑战和印度市场逆风,导致Q3业绩不佳,2024年成交量和营业收入指引调降。项目延迟被视为Q4持续风险,预期在美国总统大选期间的股票波动。然而,目前的股票估值被认为反映了对IRA废除风险和潜在每股收入远低于共识预期的相当折扣。

第一太阳能第三季度业绩被描述为“疲弱”,受到销售的兆瓦数减少和因S7开始控件制造挑战而产生的保修费用的影响。有观察者指出,报告呈现了正面因素和挑战。对第一太阳能的展望仍然乐观,有意在即将到来的美国大选后进一步评估政治格局。

第一太阳能的指引调整并没有让许多投资者感到意外,尽管这是显著的。多个独特因素导致了修订的2024年预测,令人意外的是项目推迟并非主要原因。有人指出,第一太阳能有望从通胀减少法案中获益匪浅,预计将增强盈利潜力和可见度,因为开发商争相获得国内太阳能组件。

公司认识到第一太阳能第三季度业绩不理想,其2024年前景已经下调。然而,值得注意的是,结果比预期的更有利。展望到2025年,预计预订速度将加快,平均销售价格将上涨。

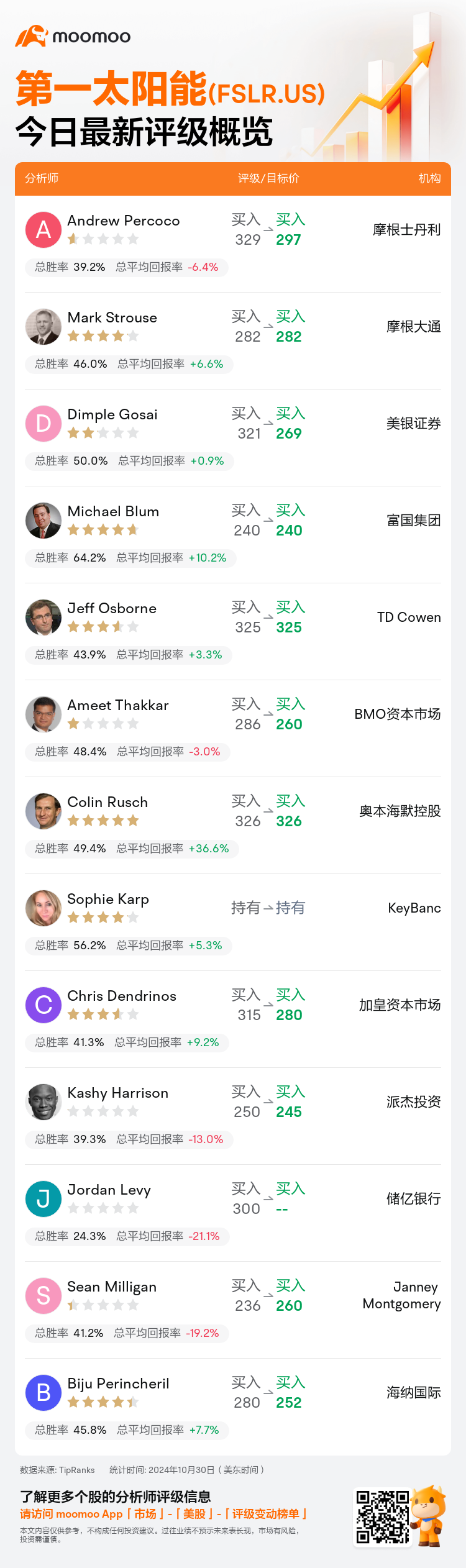

以下为今日13位分析师对$第一太阳能 (FSLR.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师Dimple Gosai维持买入评级,并将目标价从321美元下调至269美元。

美银证券分析师Dimple Gosai维持买入评级,并将目标价从321美元下调至269美元。

BofA Securities analyst Dimple Gosai maintains with a buy rating, and adjusts the target price from $321 to $269.

BofA Securities analyst Dimple Gosai maintains with a buy rating, and adjusts the target price from $321 to $269.