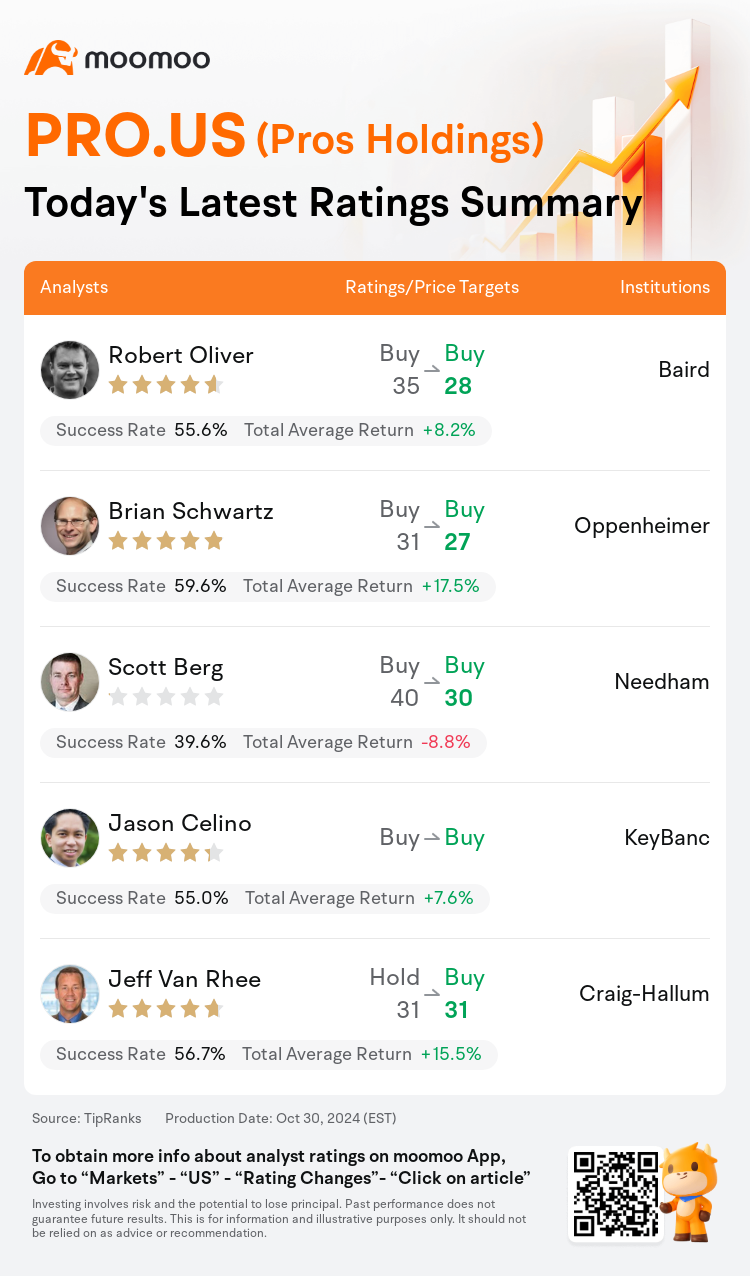

On Oct 30, major Wall Street analysts update their ratings for $Pros Holdings (PRO.US)$, with price targets ranging from $27 to $31.

Baird analyst Robert Oliver maintains with a buy rating, and adjusts the target price from $35 to $28.

Oppenheimer analyst Brian Schwartz maintains with a buy rating, and adjusts the target price from $31 to $27.

Needham analyst Scott Berg maintains with a buy rating, and adjusts the target price from $40 to $30.

Needham analyst Scott Berg maintains with a buy rating, and adjusts the target price from $40 to $30.

KeyBanc analyst Jason Celino maintains with a buy rating.

Craig-Hallum analyst Jeff Van Rhee upgrades to a buy rating, and maintains the target price at $31.

Furthermore, according to the comprehensive report, the opinions of $Pros Holdings (PRO.US)$'s main analysts recently are as follows:

Pros Holdings' recent report indicates that Q3 subscription and total revenue were marginally above the consensus, with a notably stronger EBITDA performance. Despite the unchanged outlook in travel, the B2B segment is witnessing widespread vigor. Additionally, the company has made an announcement regarding the planned retirement of their CEO, Andres Reiner, which is set to occur following the appointment of a successor.

The firm acknowledged Pros Holdings' solid quarterly performance despite prevailing fears and modest expectations. Although the travel market remains challenging, there has been notable strength in the B2B sector, partly fueled by advancements in AI. A significant increase in new logos, accounting for half of the bookings, marks a sequential improvement and bodes well for B2B prospects.

Here are the latest investment ratings and price targets for $Pros Holdings (PRO.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

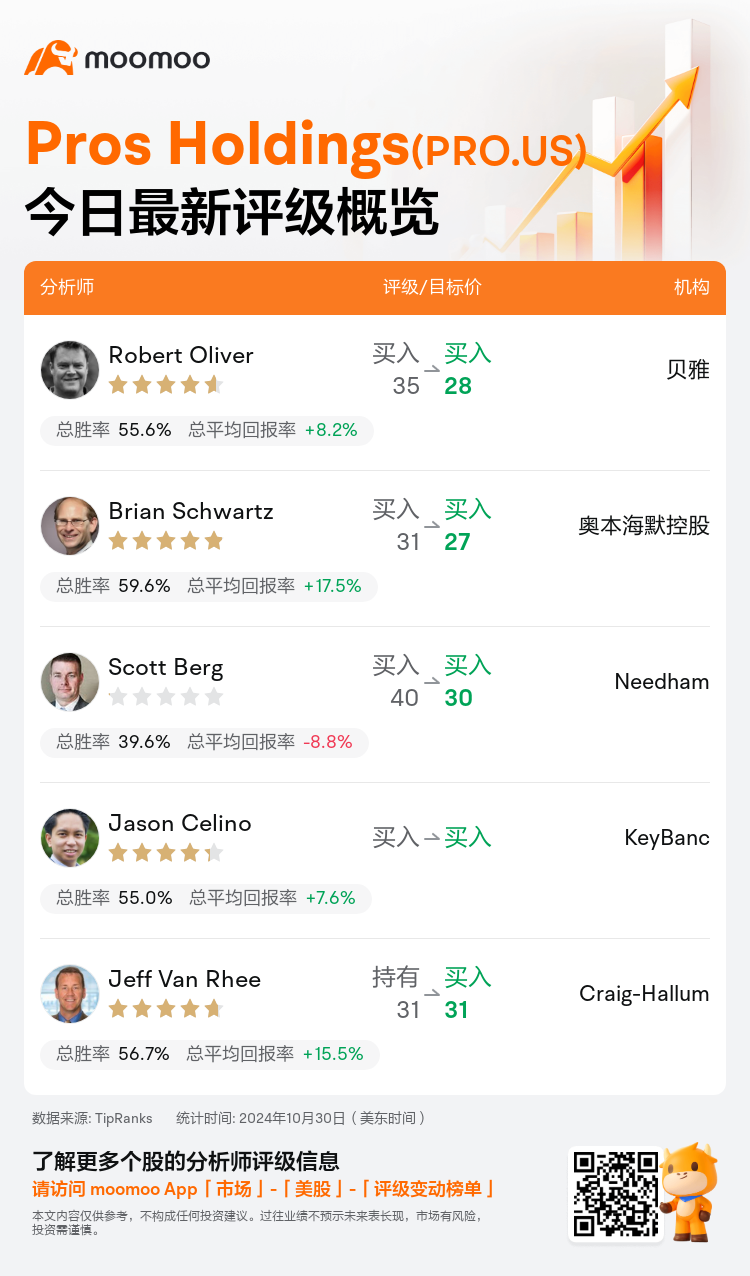

美东时间10月30日,多家华尔街大行更新了$Pros Holdings (PRO.US)$的评级,目标价介于27美元至31美元。

贝雅分析师Robert Oliver维持买入评级,并将目标价从35美元下调至28美元。

奥本海默控股分析师Brian Schwartz维持买入评级,并将目标价从31美元下调至27美元。

Needham分析师Scott Berg维持买入评级,并将目标价从40美元下调至30美元。

Needham分析师Scott Berg维持买入评级,并将目标价从40美元下调至30美元。

KeyBanc分析师Jason Celino维持买入评级。

Craig-Hallum分析师Jeff Van Rhee上调至买入评级,维持目标价31美元。

此外,综合报道,$Pros Holdings (PRO.US)$近期主要分析师观点如下:

pros holdings最近的报告显示,第三季订阅和总收入略高于共识,EBITDA表现明显更强。尽管旅行业前景不变,但20亿板块正经历着普遍的活力。此外,公司已宣布首席执行官安德烈斯·赖纳计划退休,将在任命继任者后进行。

尽管对旅行市场前景存在担忧和保守预期,公司表示赞赏pros holdings坚实的季度业绩。尽管旅行市场仍然具有挑战性,20亿板块的表现显著,并部分得益于人工智能的进步。新增标识的大幅增加,占订购的一半,标志着顺序改善,并对20亿前景有利。

以下为今日5位分析师对$Pros Holdings (PRO.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Needham分析师Scott Berg维持买入评级,并将目标价从40美元下调至30美元。

Needham分析师Scott Berg维持买入评级,并将目标价从40美元下调至30美元。

Needham analyst Scott Berg maintains with a buy rating, and adjusts the target price from $40 to $30.

Needham analyst Scott Berg maintains with a buy rating, and adjusts the target price from $40 to $30.