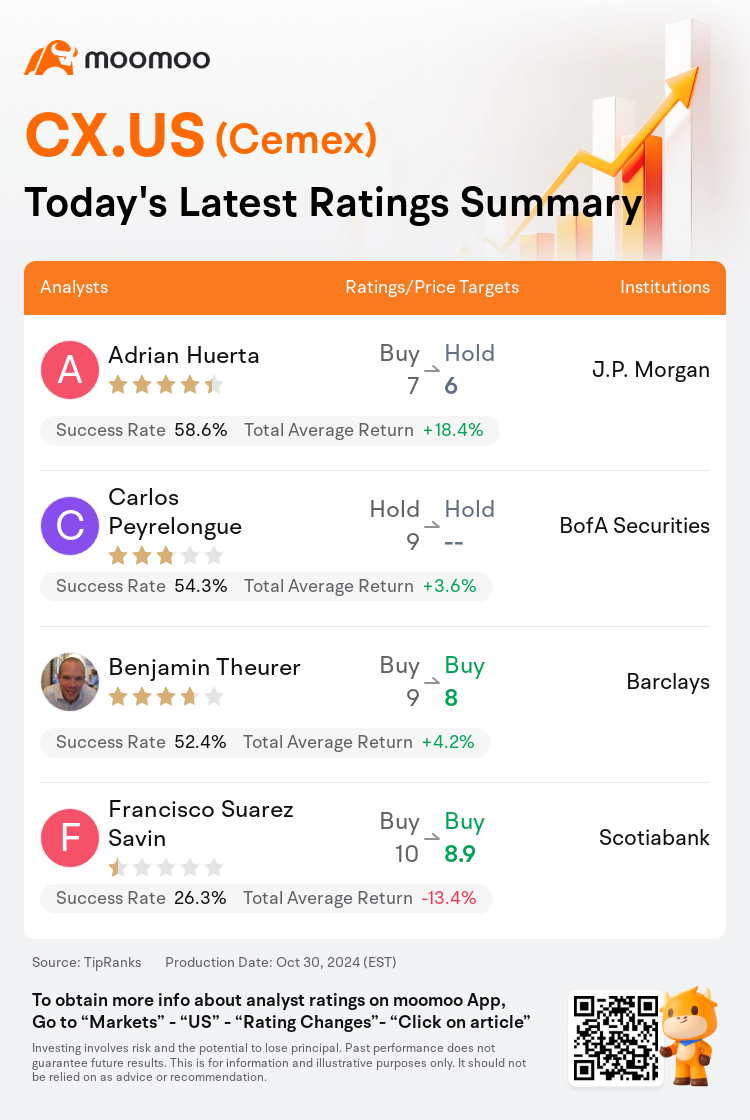

On Oct 30, major Wall Street analysts update their ratings for $Cemex (CX.US)$, with price targets ranging from $6 to $8.9.

J.P. Morgan analyst Adrian Huerta downgrades to a hold rating, and adjusts the target price from $7 to $6.

BofA Securities analyst Carlos Peyrelongue maintains with a hold rating.

Barclays analyst Benjamin Theurer maintains with a buy rating, and adjusts the target price from $9 to $8.

Barclays analyst Benjamin Theurer maintains with a buy rating, and adjusts the target price from $9 to $8.

Scotiabank analyst Francisco Suarez Savin maintains with a buy rating, and adjusts the target price from $10 to $8.9.

Furthermore, according to the comprehensive report, the opinions of $Cemex (CX.US)$'s main analysts recently are as follows:

The company's Q4 results exhibited a softer performance with operating EBITDA registering at $747M, which was notably lower than anticipated. Nonetheless, it is believed that the majority of the adverse factors are already reflected in the current share price.

The company's recent quarterly performance fell short of the already cautious projections. There appears to be a lack of substantial fundamental drivers for the company's growth until at least mid-February, except for a possible upswing in the Mexican market. Moreover, expectations for the fourth-quarter outcomes are also leaning towards the milder side, accompanied by limited clarity regarding the next year's financial results. Current free cash flow generation does not suffice to support an increasing dividend and buybacks at a reasonable level.

Here are the latest investment ratings and price targets for $Cemex (CX.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

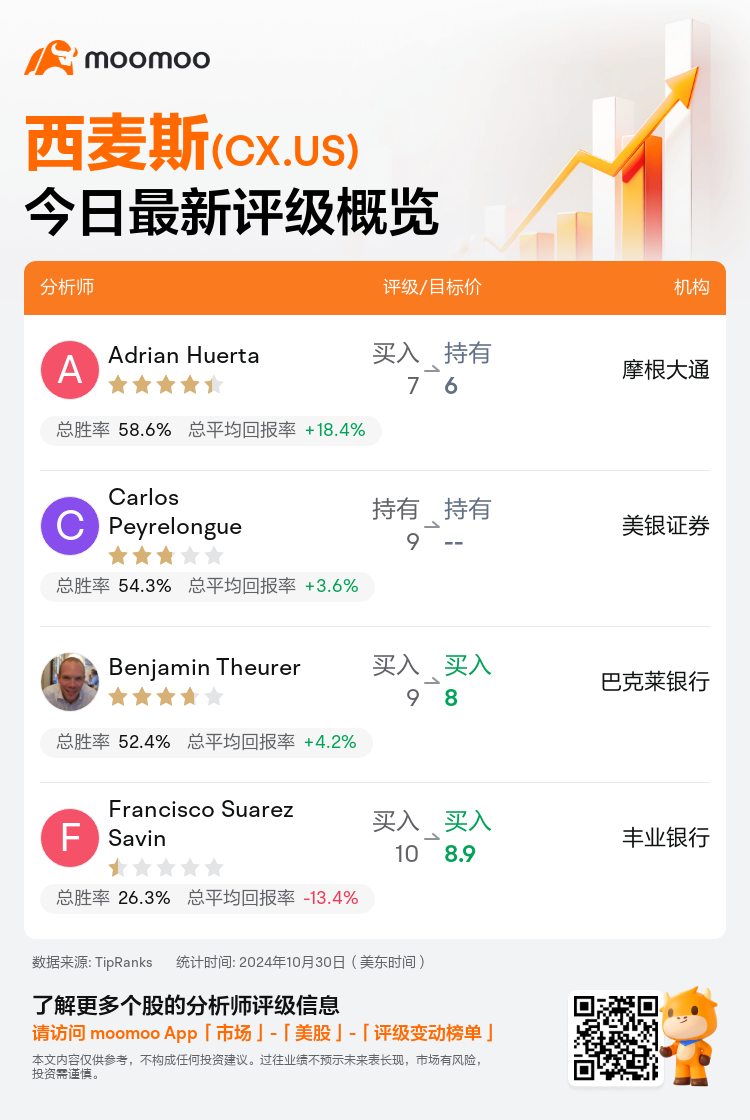

美东时间10月30日,多家华尔街大行更新了$西麦斯 (CX.US)$的评级,目标价介于6美元至8.9美元。

摩根大通分析师Adrian Huerta下调至持有评级,并将目标价从7美元下调至6美元。

美银证券分析师Carlos Peyrelongue维持持有评级。

巴克莱银行分析师Benjamin Theurer维持买入评级,并将目标价从9美元下调至8美元。

巴克莱银行分析师Benjamin Theurer维持买入评级,并将目标价从9美元下调至8美元。

丰业银行分析师Francisco Suarez Savin维持买入评级,并将目标价从10美元下调至8.9美元。

此外,综合报道,$西麦斯 (CX.US)$近期主要分析师观点如下:

以下为今日4位分析师对$西麦斯 (CX.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Benjamin Theurer维持买入评级,并将目标价从9美元下调至8美元。

巴克莱银行分析师Benjamin Theurer维持买入评级,并将目标价从9美元下调至8美元。

Barclays analyst Benjamin Theurer maintains with a buy rating, and adjusts the target price from $9 to $8.

Barclays analyst Benjamin Theurer maintains with a buy rating, and adjusts the target price from $9 to $8.