Whitestone REIT Responds To MCB Indication Of Interest; Determined To Reject Indication Of Interest

Whitestone REIT Responds To MCB Indication Of Interest; Determined To Reject Indication Of Interest

Dear Mr. Bramble,

亲爱的Bramble先生,

The Whitestone Board of Trustees has reviewed your October 9, 2024, indication of interest. The Board's review considered the $15 per share indication of interest against numerous data points, including, but not limited to, sell side Net Asset Value, Net Asset Value utilizing peer capitalization rate indications, sell side estimates and price targets and a Discounted Cash Flow valuation utilizing the company's internal 5-year forecast. While your indication of interest is premised on public market valuation, the Board views NAV and DCF as critical to determining the intrinsic value of Whitestone REIT. Your valuation falls short on both marks. The Whitestone Board of Trustees has unanimously determined to reject your indication of interest and does not believe it reflects an appropriate valuation to enter into discussions toward a negotiated transaction.

Whitestone董事会已审查了您于2024年10月9日的兴趣表示。董事会的审查考虑了每股15美元的兴趣表示,并参考了众多数据点,包括但不限于卖方净资产价值、利用同行资本化率指标的资产净值、卖方估计和价格目标,以及利用公司内部5年预测的贴现现金流估值。尽管您的兴趣表示是基于公开市场估值,但董事会认为NAV和DCF对于确定Whitestone REIt的内在价值至关重要。您的估值在这两个方面都达不到要求。Whitestone董事会一致决定拒绝您的兴趣表示,并认为这不是进行谈判交易的适当估值。

The Whitestone Board also considered the following in rejecting your indication of interest:

Whitestone董事会在拒绝您的兴趣表示时还考虑了以下因素:

-

The Whitestone REIT Board of Trustees believes the indication of interest is opportunistically timed to take advantage of Whitestone's performance while the company is still gaining momentum under the new management team. Given the all cash indication of interest, Whitestone believes that a transaction at this valuation would deprive all other Whitestone shareholders of the opportunity to maximize the value of their investment while transferring additional value directly to MCB.

-

Whitestone REIT is well-positioned for growth. As our financial results disclosed today demonstrate, Whitestone is making great progress against its strategic objectives and gaining momentum while driving shareholder value. Key highlights include:

- Reiteration of 2024's Core FFO per share estimate of $0.98 to $1.04, targeting 11% growth in 2024 versus 2023 (at the midpoint)

- An increased Same Store NOI growth target of 3.75% – 4.75%, after delivering year-to-date Same Store NOI growth of 4.9%

- Q3 2024 Debt / EBITDAre ratio of 7.2x, a 0.6x improvement versus one year ago

- Accretive asset recycling with disposition cap rates over 100 basis points below acquisition cap rates while simultaneously positioning Whitestone for future growth

- Reiteration of 2024's Core FFO per share estimate of $0.98 to $1.04, targeting 11% growth in 2024 versus 2023 (at the midpoint)

-

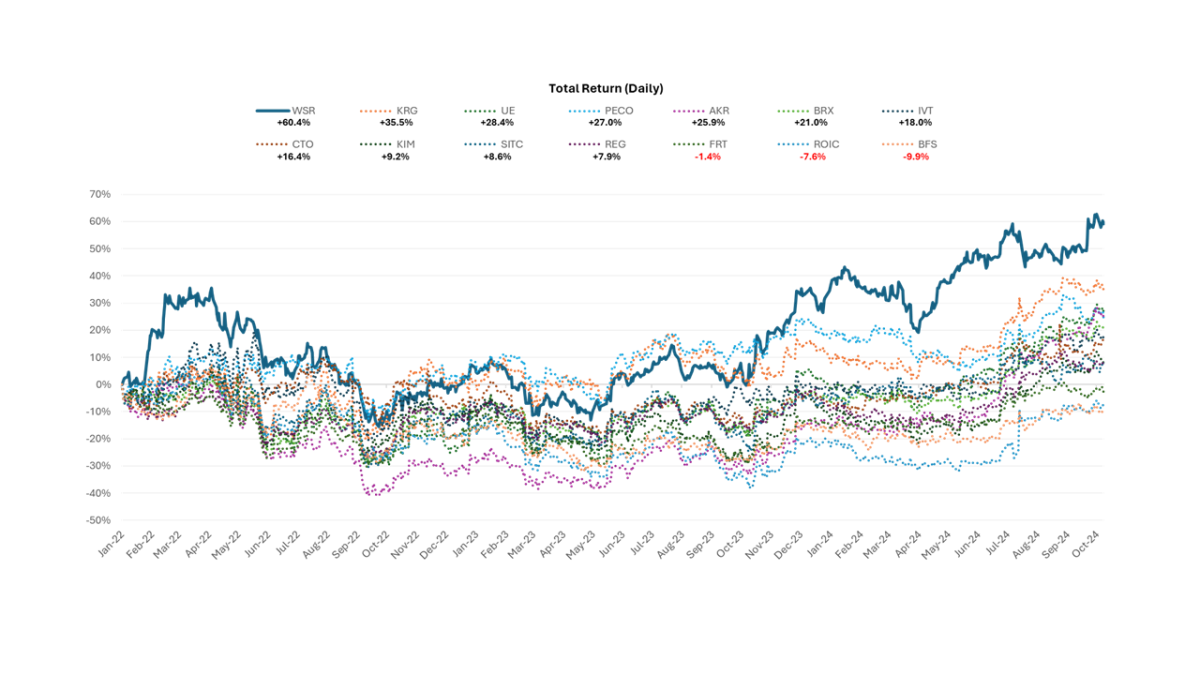

Whitestone's strong performance has driven total shareholder returns of over 60% since the current management team took over on January 18, 2022.

- Whitestone REIt董事会认为这一兴趣表示选择了对Whitestone的表现具有投机性优势的时机,因为公司在新管理团队的领导下仍在蓄势。考虑到全现金的兴趣表示,Whitestone认为在这一估值水平上进行交易将使所有其他Whitestone股东失去最大化投资价值的机会,同时直接将附加价值转移给MCb。

- Whitestone REIt已经做好了增长准备。正如我们今天披露的财务结果所示,Whitestone在实现战略目标方面取得了巨大进展,同时推动股东价值的增长。关键亮点包括:

- 2024年每股核心FFO的再确认估计为0.98美元至1.04美元,目标是将2024年的增长率定为11%,较2023年(中间值)增长

- 经过今年迄今为止的同店销售净营业收入增长4.9%后,同店净营业收入增长目标提高至3.75%至4.75%

- 2024年第三季度债务/经调整后息税前利润及折旧前摊薄后税息前利润比率为7.2倍,较一年前提高了0.6倍

- 通过以超过100个基点低于收购资产的收购利率出售资产,同时将Whitestone定位为未来增长。

- 2024年每股核心FFO的再确认估计为0.98美元至1.04美元,目标是将2024年的增长率定为11%,较2023年(中间值)增长

- 自2022年1月18日管理团队接手以来,Whitestone的强劲业绩推动了超过60%的股东回报。

Source: S&P Capital IQ (Oct 25, 2024 Closing Price)

来源:标普资本智识(2024年10月25日收盘价)

The Whitestone Board of Trustees continues to consider MCB an important shareholder and remains committed to acting in the best interests of all shareholders to maximize shareholder value.

Whitestone董事会继续认为MCb是重要股东,并致力于为所有股东的最大化股东价值而采取行动。

Sincerely,

此致敬礼,

Whitestone Board of Trustees:

Whitestone董事会:

David T. Taylor

Nandita V. Berry

Julia B. Buthman

Amy S. Feng

David K. Holeman

Jeffrey A. Jones

David T. Taylor

Nandita V. Berry

Julia b. Buthman

Amy S. Feng

David k. Holeman

Jeffrey A. Jones