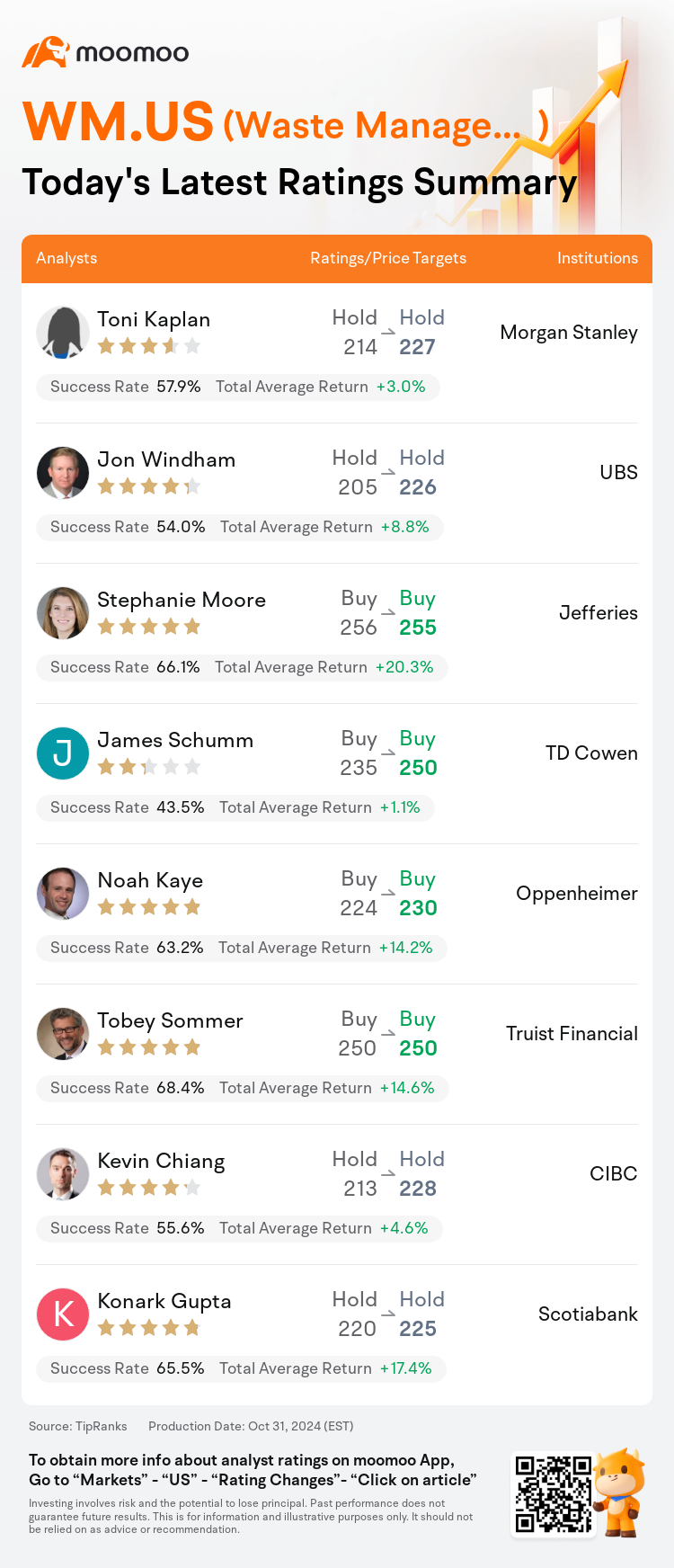

On Oct 31, major Wall Street analysts update their ratings for $Waste Management (WM.US)$, with price targets ranging from $225 to $255.

Morgan Stanley analyst Toni Kaplan maintains with a hold rating, and adjusts the target price from $214 to $227.

UBS analyst Jon Windham maintains with a hold rating, and adjusts the target price from $205 to $226.

Jefferies analyst Stephanie Moore maintains with a buy rating, and adjusts the target price from $256 to $255.

Jefferies analyst Stephanie Moore maintains with a buy rating, and adjusts the target price from $256 to $255.

TD Cowen analyst James Schumm maintains with a buy rating, and adjusts the target price from $235 to $250.

Oppenheimer analyst Noah Kaye maintains with a buy rating, and adjusts the target price from $224 to $230.

Furthermore, according to the comprehensive report, the opinions of $Waste Management (WM.US)$'s main analysts recently are as follows:

Following a 'solid' Q3 report, the implied Q4 outlook is viewed as 'very achievable,' and the setup for 2025 is considered 'far more interesting.'

The company's Q3 earnings surpassed expectations, which is seen as a positive indicator of its consistent core unit profitability growth. Additionally, there is optimism surrounding the visible earnings increase due to maturing green capital expenditures and the enhancement of free cash flow conversion.

The company is poised to achieve exceptional growth in 2025 due to a mix of enhanced returns from its investments related to sustainability, strategic acquisitions, and inherent advancements in its solid waste segment. Nonetheless, it's assessed that this positive outlook is considerably incorporated into the present market valuation.

WM's shares experienced an uptick following a third-quarter performance that surpassed top and bottom line consensus expectations, coupled with an increase in the projected midpoint for FY24 free cash flow, outpacing market predictions. The company's focus on technology-driven productivity investments continues to enhance favorable industry-level price cost dynamics, potentially leading to significant core margin growth extending into FY25.

Following a robust Q3 earnings release, the company demonstrated considerable pricing and volume growth along with a new peak in Adjusted EBITDA margin at 30.5%. The company has been experiencing benefits from an expanded price-cost spread, the divestment of low-margin volume, enhanced employee retention, and ongoing technology investments. Expectations are set for ongoing growth in the Solid Waste segment, greater contributions from sustainability investments, and the assimilation of Stericycle, which is anticipated to lead to significant advancements in revenue, earnings, and free cash flow.

Here are the latest investment ratings and price targets for $Waste Management (WM.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

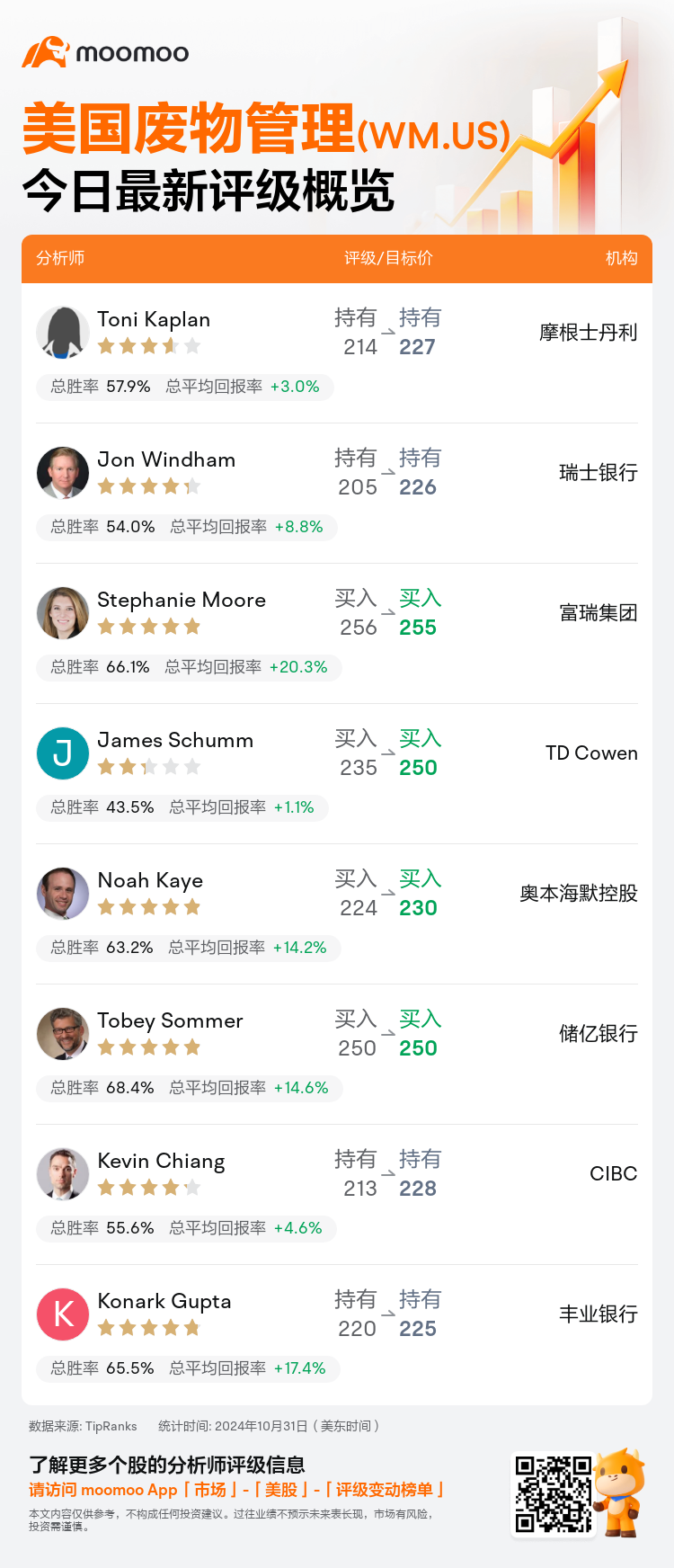

美东时间10月31日,多家华尔街大行更新了$美国废物管理 (WM.US)$的评级,目标价介于225美元至255美元。

摩根士丹利分析师Toni Kaplan维持持有评级,并将目标价从214美元上调至227美元。

瑞士银行分析师Jon Windham维持持有评级,并将目标价从205美元上调至226美元。

富瑞集团分析师Stephanie Moore维持买入评级,并将目标价从256美元下调至255美元。

富瑞集团分析师Stephanie Moore维持买入评级,并将目标价从256美元下调至255美元。

TD Cowen分析师James Schumm维持买入评级,并将目标价从235美元上调至250美元。

奥本海默控股分析师Noah Kaye维持买入评级,并将目标价从224美元上调至230美元。

此外,综合报道,$美国废物管理 (WM.US)$近期主要分析师观点如下:

在一份“扎实”的第三季度报告之后,暗示第四季度展望被视为“非常可实现的”,2025年的设置被认为“更有趣。”

公司第三季度收益超出预期,被视为其持续核心单位盈利增长的积极指标。此外,由于成熟的绿色资本支出和自由现金流转换的增强,人们对可见的收入增长感到乐观。

由于可持续性相关投资、战略收购以及固体废物业务领域的内在进展相结合,公司有望在2025年实现卓越增长。尽管如此,人们评估认为这一积极展望已经被充分纳入现有的市场估值中。

WM公司股价在第三季度表现超出市场预期的销售收入和净利润预期后出现上涨,同时FY24自由现金流的中点预期增长,超过市场预测。公司对以技术驱动的生产力投资的关注继续提升有利的行业水平价格成本动态,可能导致核心利润率显著增长延伸至FY25。

在强劲的第三季度收益发布之后,公司展示了相当大的价格和成交量增长,调整后的EBITDA利润率创下新高,为30.5%。公司正从扩大的价格成本差异、剥离低利润成交量、增强员工留任和持续的技术投资中获益。预计固体废物业务领域将持续增长,可持续性投资将贡献更多,同时Stericycle的整合预计将带来收入、盈利和自由现金流的重大进展。

以下为今日8位分析师对$美国废物管理 (WM.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富瑞集团分析师Stephanie Moore维持买入评级,并将目标价从256美元下调至255美元。

富瑞集团分析师Stephanie Moore维持买入评级,并将目标价从256美元下调至255美元。

Jefferies analyst Stephanie Moore maintains with a buy rating, and adjusts the target price from $256 to $255.

Jefferies analyst Stephanie Moore maintains with a buy rating, and adjusts the target price from $256 to $255.