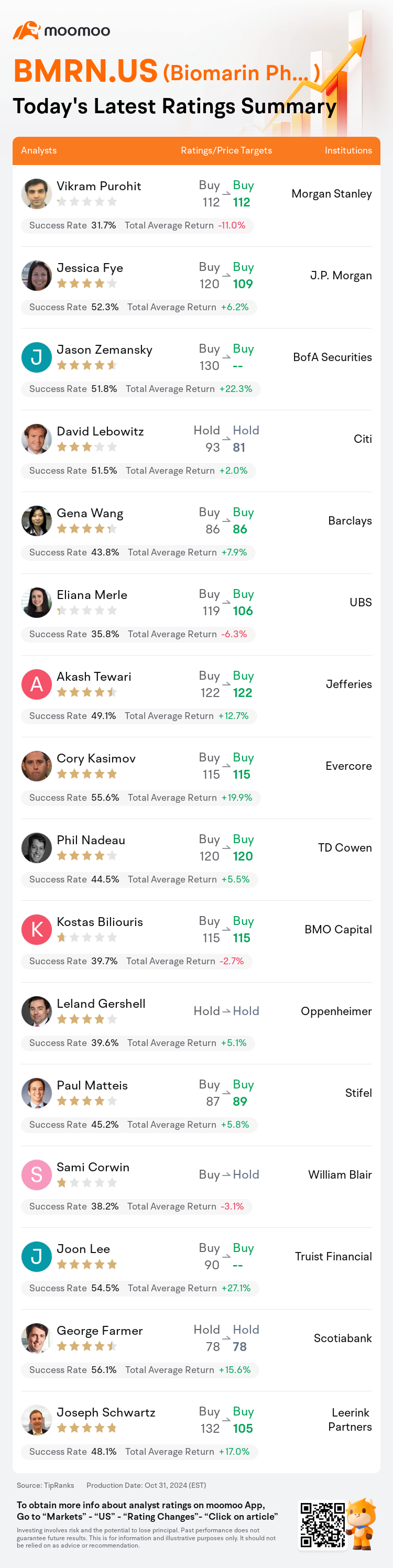

On Oct 31, major Wall Street analysts update their ratings for $Biomarin Pharmaceutical (BMRN.US)$, with price targets ranging from $78 to $122.

Morgan Stanley analyst Vikram Purohit maintains with a buy rating, and maintains the target price at $112.

J.P. Morgan analyst Jessica Fye maintains with a buy rating, and adjusts the target price from $120 to $109.

BofA Securities analyst Jason Zemansky maintains with a buy rating.

BofA Securities analyst Jason Zemansky maintains with a buy rating.

Citi analyst David Lebowitz maintains with a hold rating, and adjusts the target price from $93 to $81.

Barclays analyst Gena Wang maintains with a buy rating, and maintains the target price at $86.

Furthermore, according to the comprehensive report, the opinions of $Biomarin Pharmaceutical (BMRN.US)$'s main analysts recently are as follows:

BioMarin experienced a strong quarter, with a slight increase in both top and bottom line forecasts. Analysts believe that the value of the company's enzyme replacement therapy business is at least equal to the current share price. Furthermore, the anticipation that BMN333, scheduled to enter clinical trials in early 2025, may notably contribute to the company's value by maintaining its position in achondroplasia and potentially expanding to additional indications where Voxzogo is undergoing studies.

BioMarin's third-quarter financial results surpassed expectations both in terms of revenue and earnings, with a slight increase in the forecast for fiscal 2024 across all key indicators. Despite Voxzogo's performance falling short of projections, the shortfall was compensated by stronger-than-anticipated outcomes from a number of products within the company's enzyme replacement therapy segment.

The firm recognizes an appealing entry point for BioMarin's shares, highlighting the company's solid foundational business and the prospects for significant operating margin growth in the coming years.

BioMarin's third-quarter 2024 financials and pipeline updates were generally aligned with market forecasts. The slight increase in the company's 2024 guidance is positive; however, the perceived deceleration in Voxzogo's growth, which is seen as a pivotal element for BioMarin's success, may not meet investor expectations.

Here are the latest investment ratings and price targets for $Biomarin Pharmaceutical (BMRN.US)$ from 16 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

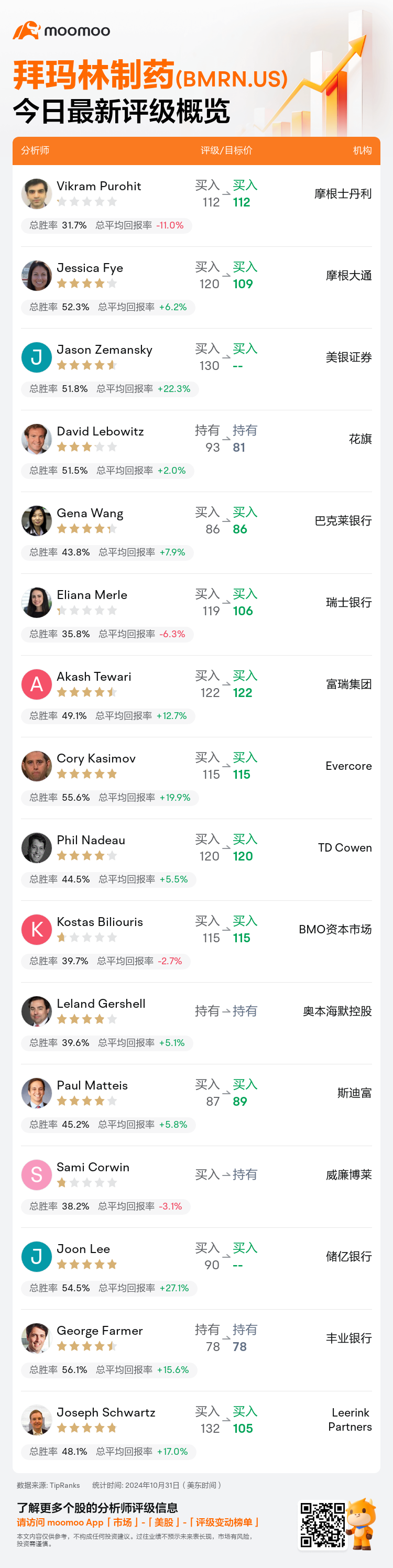

美东时间10月31日,多家华尔街大行更新了$拜玛林制药 (BMRN.US)$的评级,目标价介于78美元至122美元。

摩根士丹利分析师Vikram Purohit维持买入评级,维持目标价112美元。

摩根大通分析师Jessica Fye维持买入评级,并将目标价从120美元下调至109美元。

美银证券分析师Jason Zemansky维持买入评级。

美银证券分析师Jason Zemansky维持买入评级。

花旗分析师David Lebowitz维持持有评级,并将目标价从93美元下调至81美元。

巴克莱银行分析师Gena Wang维持买入评级,维持目标价86美元。

此外,综合报道,$拜玛林制药 (BMRN.US)$近期主要分析师观点如下:

BioMarin在这一季度表现强劲,预测的营收和盈利都略微增长。分析师认为公司的酶替代疗法业务价值至少等于当前股价。此外,预计BMN333将于2025年初进入临床试验,可能通过在肢端畸形领域保持地位并有望扩展到Voxzogo正在进行研究的其他适应症,从而显著增加公司价值。

BioMarin第三季度的财务业绩超出预期,不仅在营收和盈利方面有微小增长,而且在所有关键指标上,对2024财政年度的预测也有轻微增加。尽管Voxzogo的业绩未达预期,但公司酶替代疗法部门中一些产品取得了比预期更强的成果,弥补了Voxzogo表现不佳的情况。

该公司认为BioMarin股票具有吸引人的入场点,突出了公司坚实的基础业务和未来几年营业利润率增长的前景。

BioMarin第三季度2024财务状况和产品管道更新基本符合市场预期。公司2024指引的轻微增加是积极的;然而,Voxzogo增长放缓的局面被视为BioMarin成功的关键因素,却可能无法满足投资者的期望。

以下为今日16位分析师对$拜玛林制药 (BMRN.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师Jason Zemansky维持买入评级。

美银证券分析师Jason Zemansky维持买入评级。

BofA Securities analyst Jason Zemansky maintains with a buy rating.

BofA Securities analyst Jason Zemansky maintains with a buy rating.