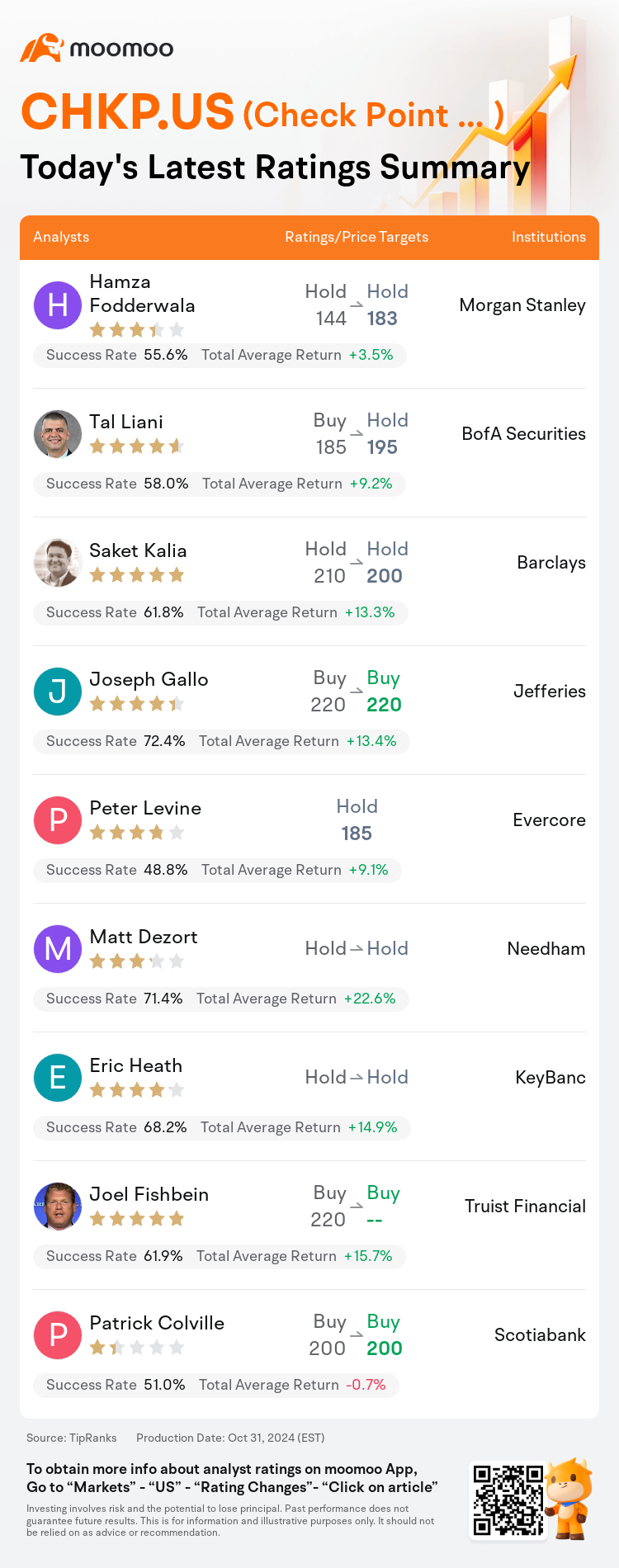

On Oct 31, major Wall Street analysts update their ratings for $Check Point Software (CHKP.US)$, with price targets ranging from $183 to $220.

Morgan Stanley analyst Hamza Fodderwala maintains with a hold rating, and adjusts the target price from $144 to $183.

BofA Securities analyst Tal Liani downgrades to a hold rating, and adjusts the target price from $185 to $195.

Barclays analyst Saket Kalia maintains with a hold rating, and adjusts the target price from $210 to $200.

Barclays analyst Saket Kalia maintains with a hold rating, and adjusts the target price from $210 to $200.

Jefferies analyst Joseph Gallo maintains with a buy rating, and maintains the target price at $220.

Evercore analyst Peter Levine initiates coverage with a hold rating, and sets the target price at $185.

Furthermore, according to the comprehensive report, the opinions of $Check Point Software (CHKP.US)$'s main analysts recently are as follows:

The firm's projection for Check Point reflects a tempered billings outcome in Q3. Looking forward, the anticipation is for a high-single digit expansion in Q4, as the delayed transactions may contribute 3 points to growth, and Cyberint could potentially add another point. Additionally, the analyst forecasts approximately 5% growth for FY25, acknowledging that future comparisons may present more challenging scenarios.

The company's third-quarter billings fell short of consensus estimates. However, if adjustments are considered, there would have been a slight improvement in billings growth compared to the previous quarter. The growth in Subscription revenue did not meet expectations, attributed to underwhelming performance in the cloud and endpoint security sectors. To view the company's prospects more favorably, a thorough evaluation of the potential for Cyberint, Perimeter 81, and Harmony Email/Avanan against the additional weaknesses observed in cloud and endpoint security subscriptions would be necessary.

Q3 results for Check Point were a combination of positives and negatives, with billings falling slightly short of consensus expectations due to the deferment of deals in Europe, despite a 4% year-over-year increase in product revenue.

The company experienced a growth of 6% in Q3 billings, falling short of the anticipated 8% consensus estimates and a 10% expectation by others, with a portion of the shortfall attributed to deals that were postponed to Q4. The long-term potential for Check Point is still evident, but investors may rightfully harbor concerns about the near-term outlook considering the Q3 underperformance coupled with a prudent Q4 budget outlook.

Here are the latest investment ratings and price targets for $Check Point Software (CHKP.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

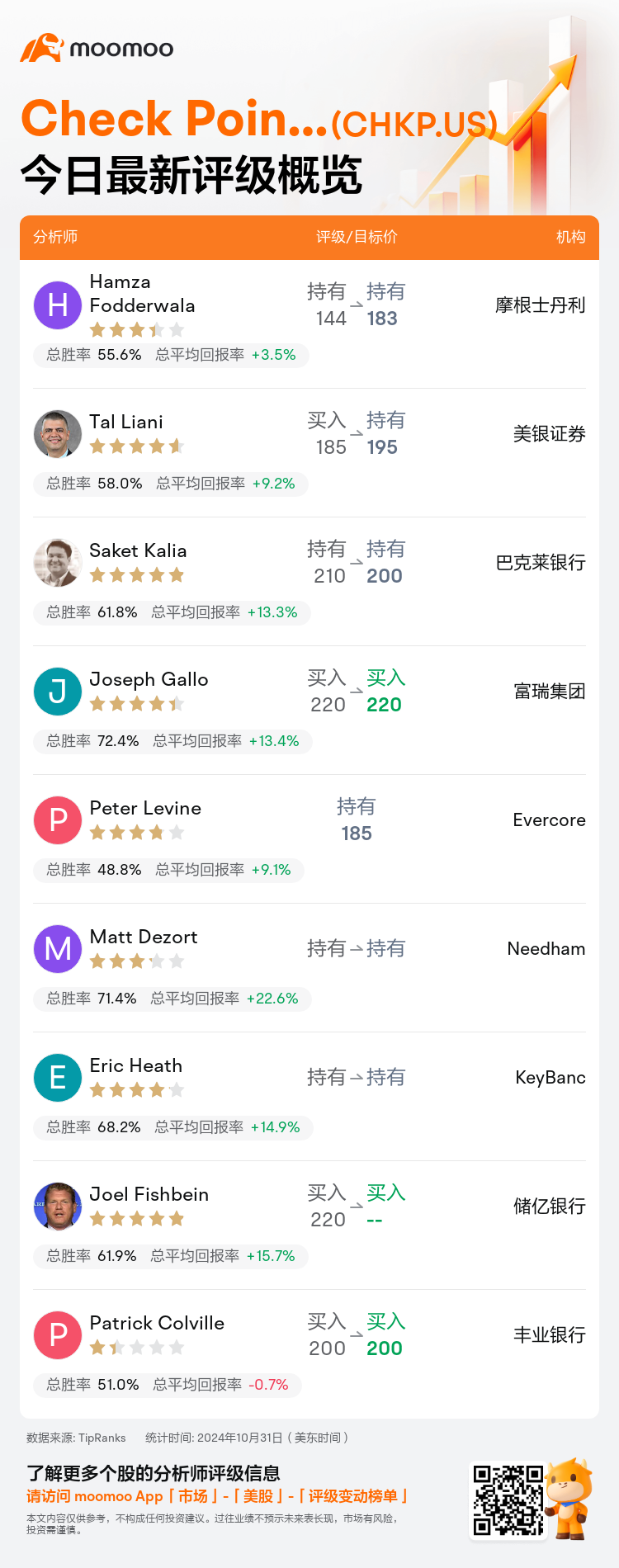

美东时间10月31日,多家华尔街大行更新了$Check Point软件 (CHKP.US)$的评级,目标价介于183美元至220美元。

摩根士丹利分析师Hamza Fodderwala维持持有评级,并将目标价从144美元上调至183美元。

美银证券分析师Tal Liani下调至持有评级,并将目标价从185美元上调至195美元。

巴克莱银行分析师Saket Kalia维持持有评级,并将目标价从210美元下调至200美元。

巴克莱银行分析师Saket Kalia维持持有评级,并将目标价从210美元下调至200美元。

富瑞集团分析师Joseph Gallo维持买入评级,维持目标价220美元。

Evercore分析师Peter Levine首予持有评级,目标价185美元。

此外,综合报道,$Check Point软件 (CHKP.US)$近期主要分析师观点如下:

公司对石像鬼的预测反映出Q3的账单结果有所温和。展望未来,预期Q4将有高个位数的增长,因为延迟的交易可能对增长贡献3个点,而Cyberint可能另外增加1个点。此外,分析师预测FY25将增长约5%,承认未来的比较可能提出更具挑战性的情景。

公司第三季度的账单与共识预期相差甚远。然而,如果考虑调整,与上一季度相比,在账单增长方面可能会略有改善。订阅收入的增长未达到预期,归因于云和端点安全领域表现不佳。为了更有利地查看公司的前景,需要对Cyberint,Perimeter 81和Harmony Email/Avanan的潜力进行彻底评估,以应对云和端点安全订阅中观察到的额外弱点。

石像鬼的Q3结果积极性和消极性并存,由于欧洲交易的延期,账单略低于共识预期,尽管产品收入同比增长4%。

公司在Q3的账单上增长了6%,远低于预期的8%共识和其他人的10%期望,其中部分差距归因于延迟到Q4的交易。石像鬼的长期潜力仍然明显,但投资者可能会担忧近期展望,考虑到Q3的表现不佳以及谨慎的Q4预算展望。

以下为今日9位分析师对$Check Point软件 (CHKP.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Saket Kalia维持持有评级,并将目标价从210美元下调至200美元。

巴克莱银行分析师Saket Kalia维持持有评级,并将目标价从210美元下调至200美元。

Barclays analyst Saket Kalia maintains with a hold rating, and adjusts the target price from $210 to $200.

Barclays analyst Saket Kalia maintains with a hold rating, and adjusts the target price from $210 to $200.