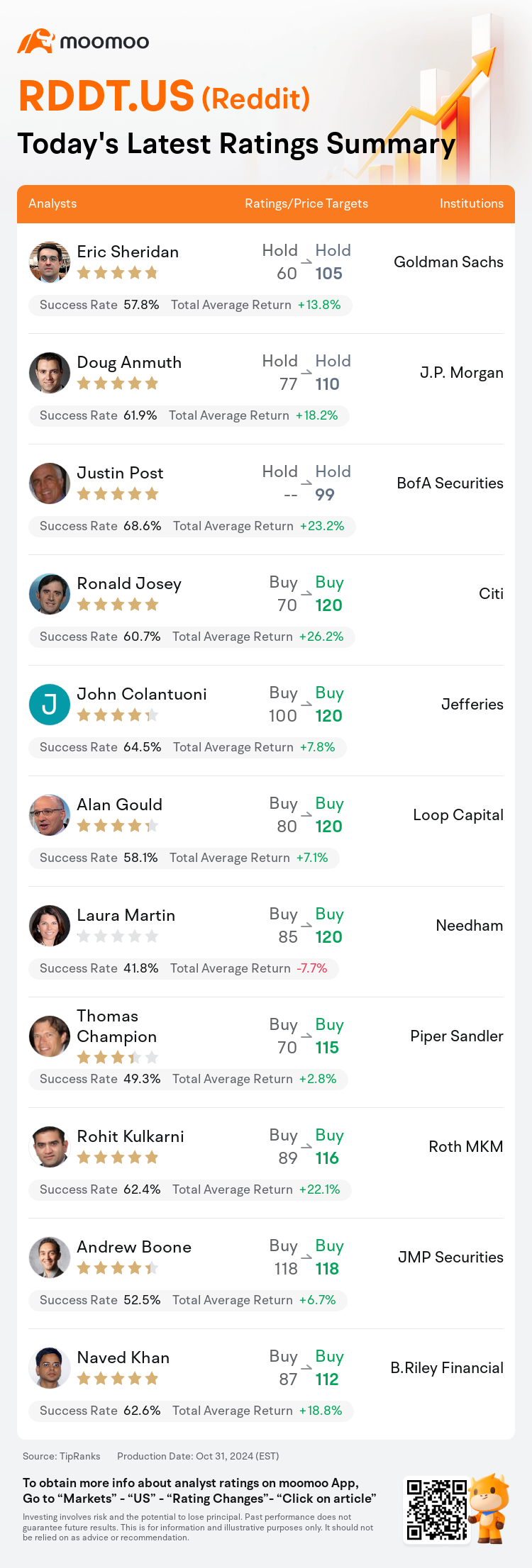

On Oct 31, major Wall Street analysts update their ratings for $Reddit (RDDT.US)$, with price targets ranging from $99 to $120.

Goldman Sachs analyst Eric Sheridan maintains with a hold rating, and adjusts the target price from $60 to $105.

J.P. Morgan analyst Doug Anmuth maintains with a hold rating, and adjusts the target price from $77 to $110.

BofA Securities analyst Justin Post maintains with a hold rating, and sets the target price at $99.

BofA Securities analyst Justin Post maintains with a hold rating, and sets the target price at $99.

Citi analyst Ronald Josey maintains with a buy rating, and adjusts the target price from $70 to $120.

Jefferies analyst John Colantuoni maintains with a buy rating, and adjusts the target price from $100 to $120.

Furthermore, according to the comprehensive report, the opinions of $Reddit (RDDT.US)$'s main analysts recently are as follows:

The company's third-quarter performance exceeded expectations and was coupled with a robust forecast for the fourth quarter. Reddit is seeing advantages from structural enhancements as it effectively carries out its comprehensive strategy, which spans product development, user growth, and revenue generation.

The firm's price target adjustment for Reddit is set aside, focusing on the robust Q3 performance and the Q4 revenue and EBITDA forecast exceeding market expectations. Post-results, estimates have been adjusted to accommodate increased advertising revenue, though balanced by a slight dip in data revenues. The consistent strong performance in advertising is seen positively, but there's an implication that the current high valuation of the stock may cap its growth potential.

The company's quarterly results were notably strong, with revenue exceeding consensus forecasts by 11% and EBITDA surpassing the high-end of guidance by 57%. The impressive financial performance is underpinned by sustained growth in user numbers and increased engagement, with daily active users growing by 47% compared to the same period last year. This growth has been partly fueled by heightened platform interaction and the implementation of machine translation on a global scale. The expectation is that these positive trends will persist as the company introduces new advertising formats and begins monetizing additional features such as search, video, and shopping, thereby improving operating leverage.

Reddit reported a more significant outperformance this quarter than in its first complete quarter as a public entity and notably achieved GAAP earnings positivity in the period. This performance was propelled by a 56% increase in advertising revenues. Reddit is considered to still be at a preliminary stage of enhancing user growth and escalating monetization efforts.

Here are the latest investment ratings and price targets for $Reddit (RDDT.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

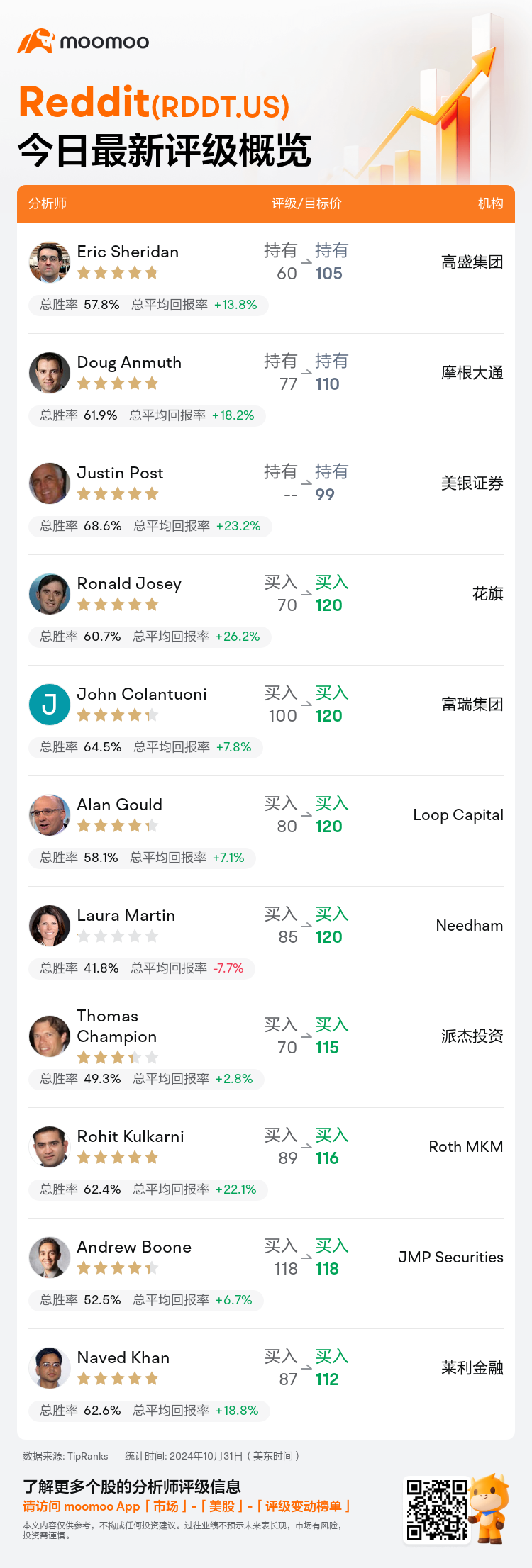

美东时间10月31日,多家华尔街大行更新了$Reddit (RDDT.US)$的评级,目标价介于99美元至120美元。

高盛集团分析师Eric Sheridan维持持有评级,并将目标价从60美元上调至105美元。

摩根大通分析师Doug Anmuth维持持有评级,并将目标价从77美元上调至110美元。

美银证券分析师Justin Post维持持有评级,目标价99美元。

美银证券分析师Justin Post维持持有评级,目标价99美元。

花旗分析师Ronald Josey维持买入评级,并将目标价从70美元上调至120美元。

富瑞集团分析师John Colantuoni维持买入评级,并将目标价从100美元上调至120美元。

此外,综合报道,$Reddit (RDDT.US)$近期主要分析师观点如下:

该公司第三季度的表现超出预期,并伴随着对第四季度的强劲预测。Reddit正从结构性增强中获益,有效执行其全面的策略,涵盖产品开发、用户增长和营收生成。

针对Reddit的公司股票价格目标调整已确定,专注于强劲的Q3表现以及Q4营收和EBITDA预测超出市场预期。在业绩公布后,估值已作出调整以适应增加的广告营收,尽管受到数据营收稍微下滑的影响。广告业务持续强劲的表现被看作积极,但也暗示着目前股价的高估值可能限制其增长潜力。

该公司季度业绩明显强劲,营收较共识预测高出11%,EBITDA超过指导性上限的57%。令人印象深刻的财务表现得到了用户数量持续增长和增加参与度的支撑,日活跃用户较去年同期增长了47%。这种增长在一定程度上得益于加强的平台互动和全球范围内的机器翻译的实施。预期这些积极的趋势将持续下去,因为公司推出新的广告格式,并开始赚取额外功能的货币化收益,比如搜索、视频和购物,从而改善运营杠杆。

Reddit本季度的超常表现比其作为上市实体的首个完整季度更为显著,并在该时期实现了盈利。这一表现主要由广告营收增长56%所推动。Reddit被认为仍处于提升用户增长和加大货币化力度的初级阶段。

以下为今日11位分析师对$Reddit (RDDT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师Justin Post维持持有评级,目标价99美元。

美银证券分析师Justin Post维持持有评级,目标价99美元。

BofA Securities analyst Justin Post maintains with a hold rating, and sets the target price at $99.

BofA Securities analyst Justin Post maintains with a hold rating, and sets the target price at $99.