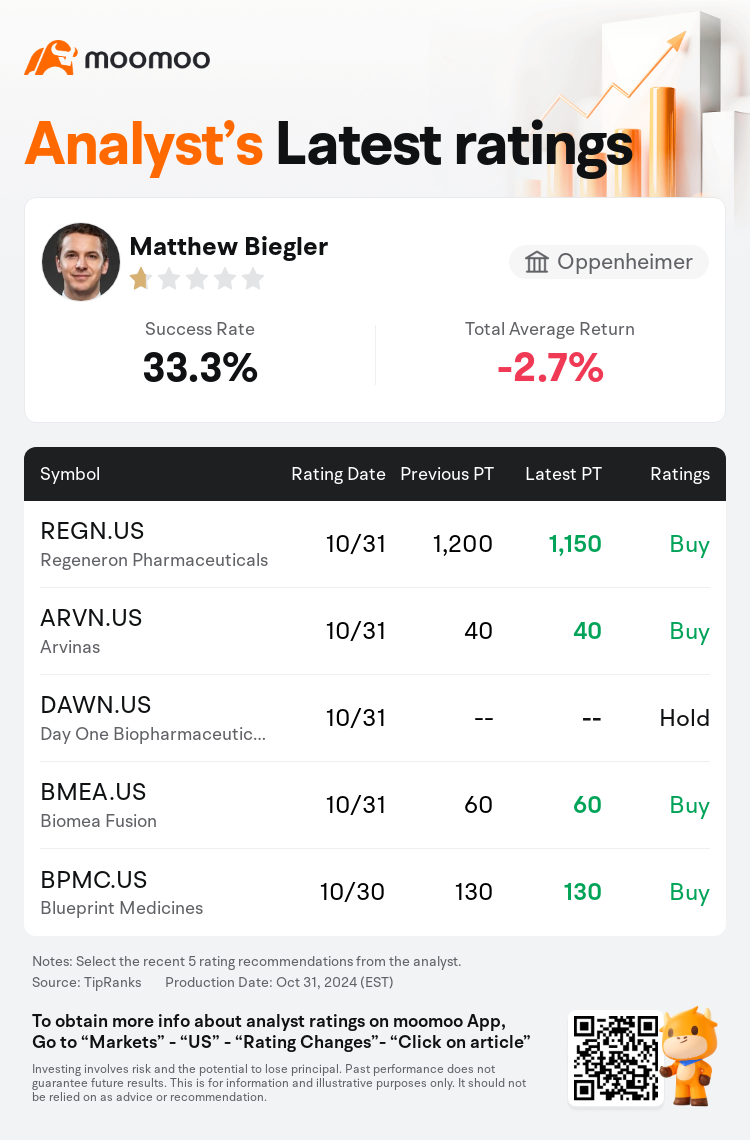

Oppenheimer analyst Matthew Biegler maintains $Regeneron Pharmaceuticals (REGN.US)$ with a buy rating, and adjusts the target price from $1,200 to $1,150.

According to TipRanks data, the analyst has a success rate of 33.3% and a total average return of -2.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Regeneron Pharmaceuticals (REGN.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Regeneron Pharmaceuticals (REGN.US)$'s main analysts recently are as follows:

The recent downward movement in Regeneron's stock price following Q3 earnings and stock weakness since the earlier biosimilar launch was unexpected. The narrative had shifted beyond near- and long-term consensus estimates for the optho franchise, which were seen as overly optimistic. The focus is now on the company's pipeline and expansion opportunities for Dupixent, which are expected to compensate for the projected decline in Eylea's performance. Despite the challenges of a core profit driver decreasing and potentially stagnant or declining near-term EPS until new growth drivers emerge, the underlying value of the company is perceived to be substantially higher than the current stock price. Should the recent earnings recalibrate expectations for Eylea, several forthcoming catalysts are anticipated to positively influence the stock's valuation.

Regeneron's third-quarter revenue aligned with optimistic estimates, alongside an earnings beat, yet the company is navigating through persistent challenges related to its Eylea product line and potential biosimilar competition. Despite difficulty in estimating the precise effect of Amgen's biosimilar, the perspective shared suggests that the market's response might be exaggerated, particularly given the unimpressive debut of similar lucentis biosimilars. Additionally, the market's unfavorable reaction to the rate at which patients are switching to Eylea HD is contributing to the stock's current downward movement.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

奥本海默控股分析师Matthew Biegler维持$再生元制药公司 (REGN.US)$买入评级,并将目标价从1,200美元下调至1,150美元。

根据TipRanks数据显示,该分析师近一年总胜率为33.3%,总平均回报率为-2.7%。

此外,综合报道,$再生元制药公司 (REGN.US)$近期主要分析师观点如下:

此外,综合报道,$再生元制药公司 (REGN.US)$近期主要分析师观点如下:

Regeneron股价最近的下行趋势出乎意料,其Q3收益和自之前生物类似药物推出以来的股价疲软。叙事已经超越近期和长期的眼科特许经营的共识估计,这被视为过于乐观。现在的重点是公司的产品线和Dupixent的扩张机会,预计会弥补Eylea表现下降的预期。尽管核心利润驱动因素减少,且可能会出现短期EPS停滞或下降,直到新的增长驱动因素出现,但公司的潜在价值被认为远高于当前股价。如果最近的收益重新校准了对Eylea的期望,预期将有数个即将到来的催化剂有望对股价估值产生积极影响。

Regeneron第三季度营收符合乐观估计,加上收益超出预期,然而公司正在应对与其Eylea产品线和潜在生物类似药竞争有关的持续挑战。尽管难以估算安进的生物类似药的具体影响,但共享的观点表明市场的反应可能夸大了,特别是考虑到类似lucentis生物类似药的不可观的推出。此外,市场对患者转换为Eylea HD的速度的负面反应也促使股价目前下行。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$再生元制药公司 (REGN.US)$近期主要分析师观点如下:

此外,综合报道,$再生元制药公司 (REGN.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of