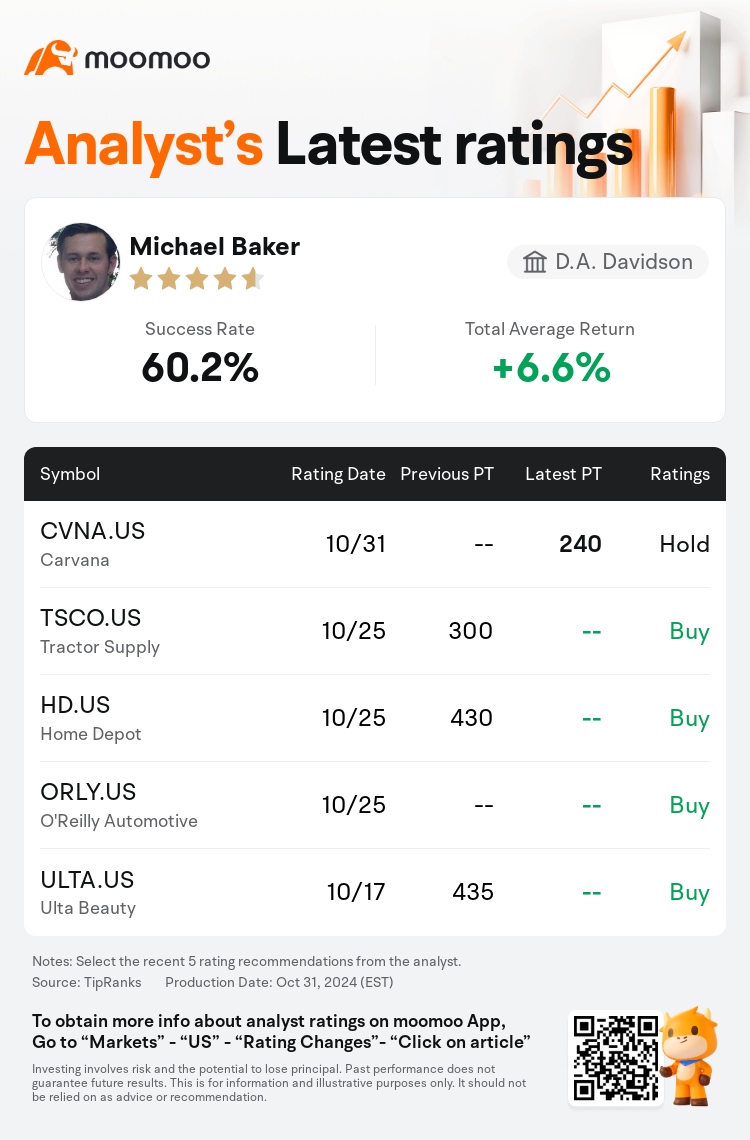

D.A. Davidson analyst Michael Baker maintains $Carvana (CVNA.US)$ with a hold rating, and sets the target price at $240.

According to TipRanks data, the analyst has a success rate of 60.2% and a total average return of 6.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Carvana (CVNA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Carvana (CVNA.US)$'s main analysts recently are as follows:

Carvana's core business operations persist in surpassing expectations, with the company's re-entry into the marketplace showcasing its significant 'infrastructure moat'. The enhancement of EBIDTA estimates reflects the company's strong positioning as a leading choice within the auto retail ecosystem.

Carvana has once more surpassed the expected Gross Profit per Unit estimates, which has led to an increase in gross profit dollars, coinciding with a predicted retail unit sales exceed. This occurred while maintaining a stable operating expenditure, resulting in an EBITDA that exceeded expectations by 30%. Forecasts for retail unit sales in the fourth quarter and thereafter are being adjusted upwards, guided by company insights and excess physical capacity. Carvana is focusing on expanding its inventory to enhance conversion rates and unit growth.

The firm acknowledges Carvana's third-quarter results, especially noting the gross profit per unit of $7,685, which surpassed the Street's estimated $6,599 as a highlight of the quarter.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

戴维森信托分析师Michael Baker维持$Carvana (CVNA.US)$持有评级,目标价240美元。

根据TipRanks数据显示,该分析师近一年总胜率为60.2%,总平均回报率为6.6%。

此外,综合报道,$Carvana (CVNA.US)$近期主要分析师观点如下:

此外,综合报道,$Carvana (CVNA.US)$近期主要分析师观点如下:

carvana的核心业务运营持续超出预期,公司重新进入市场展示出其重要的“制造行业壕沟”。EBIDTA预估的提升反映出公司在汽车零售生态系统中的领先地位。

carvana再次超出预期的每单位毛利润估算,导致毛利润增加,与预期的零售单位销售量增加相吻合。这一增长发生在保持稳定运营支出的同时,导致EBITDA超出预期30%。第四季度及以后的零售单位销售预测正在上调,以公司见解和过剩的实体能力为指导。carvana专注于扩大库存以增加转化率和单位增长。

该公司承认carvana第三季度的业绩,特别是强调每单位毛利润为$7,685,超过了街道预估的$6,599,成为本季度的亮点。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Carvana (CVNA.US)$近期主要分析师观点如下:

此外,综合报道,$Carvana (CVNA.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of