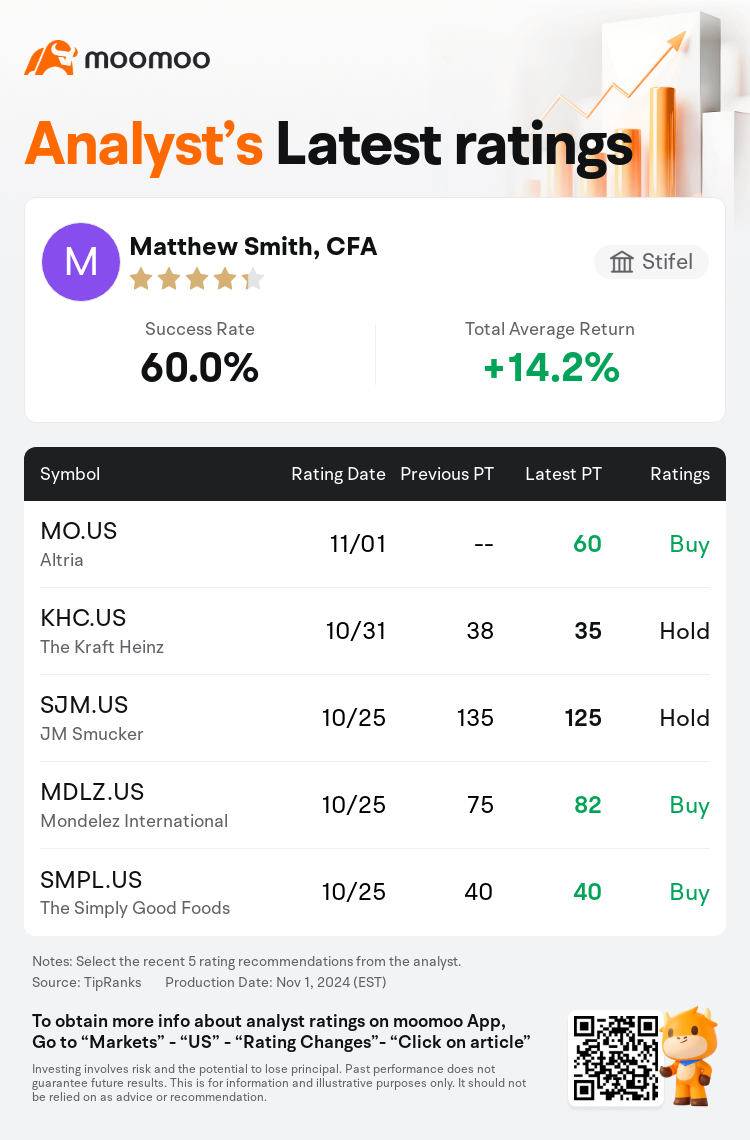

Stifel analyst Matthew Smith, CFA maintains $Altria (MO.US)$ with a buy rating, and sets the target price at $60.

According to TipRanks data, the analyst has a success rate of 60.0% and a total average return of 14.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Altria (MO.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Altria (MO.US)$'s main analysts recently are as follows:

The new 'Optimize & Accelerate' initiative by Altria Group, aimed at generating significant savings over the coming five years to reinvest in top-line growth, is seen positively given the company's modest progress towards its Smoke-free Vision so far. However, the substantial stock movement recently is perceived more as a shift from other underperforming staples stocks to the comparatively stable tobacco sector, rather than a reaction to the company's third-quarter performance and future prospects.

Altria Group's Q3 results showcased effective performance amidst challenging economic conditions, leading to substantial net price realization and a resurgence in OCI dollar profit growth within its Smokeables segment. Although the cig inventory timing benefit is anticipated to reverse in Q4, it is expected to be generally counterbalanced by an extra shipping day, which is estimated to provide a benefit comparable to that seen in Q3.

Altria Group showcased a robust profit performance in its Smokeable business, which benefited from unexpectedly favorable inventory movements, leading to a stronger third quarter business performance than anticipated. This quarter's EPS beat was influenced by inventory factors, but the reassuring profitability of the Smokeable business was particularly notable as the company has been dealing with increased investment levels from the previous year. The company's medium-term guidance appears achievable, supported by a new $600M cost savings plan that is expected to provide capital for reinvestment in smoke-free products.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

斯迪富分析师Matthew Smith, CFA维持$奥驰亚 (MO.US)$买入评级,目标价60美元。

根据TipRanks数据显示,该分析师近一年总胜率为60.0%,总平均回报率为14.2%。

此外,综合报道,$奥驰亚 (MO.US)$近期主要分析师观点如下:

此外,综合报道,$奥驰亚 (MO.US)$近期主要分析师观点如下:

奥驰亚集团推出的新“优化与加速”倡议旨在在未来五年实现显著节省,以便重新投资于顶线增长,这一举措受到积极评价,因为公司在其“无烟愿景”方面取得了适度进展。然而,最近股票大幅波动更多被视为从其他表现不佳的必需品股票转向相对稳定的烟草板块,而不是对公司第三季度业绩和未来前景的反应。

奥驰亚集团的第三季度业绩表现出色,在充满挑战的经济环境下取得有效成果,实现了实质性的净价格实现和其可吸烟产品部门的OCI美元利润增长。尽管香烟库存定时受益预计将在第四季度出现逆转,但预计一般将通过额外的发货日进行抵消,预计将提供与第三季度相当的好处。

奥驰亚集团展示了其可吸烟业务的强劲盈利业绩,受益于令人意外的库存变动,从而导致比预期更强的第三季度业务表现。本季度的每股收益超出预期受到库存因素的影响,但可吸烟业务的盈利能力令人振奋,特别值得注意,因为公司一直在应对前一年度增加的投资水平。公司的中期指引似乎是可以实现的,支持一项新的60000万美元的成本节约计划,预计将为再投资于无烟产品提供资金。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$奥驰亚 (MO.US)$近期主要分析师观点如下:

此外,综合报道,$奥驰亚 (MO.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of