On Nov 01, major Wall Street analysts update their ratings for $Twilio (TWLO.US)$, with price targets ranging from $50 to $110.

Morgan Stanley analyst Meta Marshall maintains with a hold rating, and adjusts the target price from $65 to $77.

Goldman Sachs analyst Kash Rangan maintains with a hold rating, and sets the target price at $77.

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $78 to $83.

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $78 to $83.

UBS analyst Taylor McGinnis maintains with a buy rating, and adjusts the target price from $74 to $88.

Wells Fargo analyst Michael Turrin maintains with a hold rating, and adjusts the target price from $75 to $80.

Furthermore, according to the comprehensive report, the opinions of $Twilio (TWLO.US)$'s main analysts recently are as follows:

The company is witnessing an upswing in momentum within its primary channels currently.

The company's robust second-quarter performance exceeded expectations in all areas, encompassing revenue, operating margin, and free cash flow. Analyst sentiment has improved regarding the company's notable success in Diversified Communications and the initial indications of substantial returns on investment from AI products.

Twilio's return to double-digit revenue growth has come sooner than anticipated, as evidenced by a reported acceleration to 10% year-over-year growth in Q3, an increase from the 7% year-over-year organic growth observed in the first half of the year. This performance surge is credited to robust areas like Messaging, email, and various growth endeavors involving Independent Software Vendors, self-service options, and cross-selling opportunities. The shares are perceived as holding appeal due to prospects of sustaining over 10% growth and ongoing margin improvement. Furthermore, an upcoming Investor Day could serve as a pivotal moment should the company present an effective AI narrative and affirm that the growth can maintain its current rate.

Following a 'strong' Q3 performance, Twilio has shown a return to double-digit revenue growth alongside continued operating leverage. The forecast for 2025 appears increasingly plausible. Although there is potential in terms of valuation, a more solid perspective on the forward growth outlook is necessary.

The anticipation of potential growth acceleration has been a key focus, and Twilio's recent uptick in growth during Q3 is seen as a significant positive move, aligning with the overall objective of returning to a consistent double-digit revenue growth trajectory.

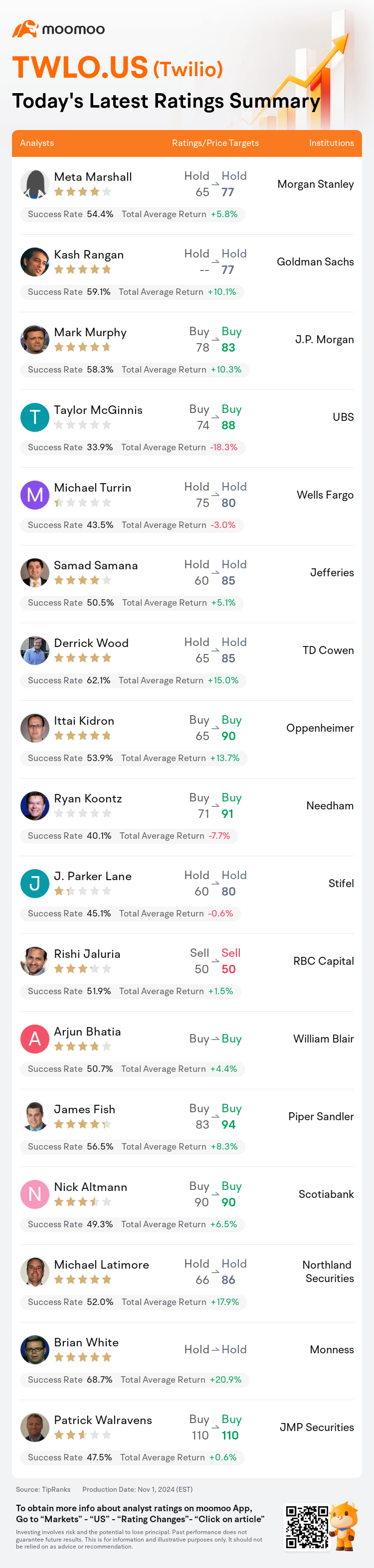

Here are the latest investment ratings and price targets for $Twilio (TWLO.US)$ from 17 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月1日,多家华尔街大行更新了$Twilio (TWLO.US)$的评级,目标价介于50美元至110美元。

摩根士丹利分析师Meta Marshall维持持有评级,并将目标价从65美元上调至77美元。

高盛集团分析师Kash Rangan维持持有评级,目标价77美元。

摩根大通分析师Mark Murphy维持买入评级,并将目标价从78美元上调至83美元。

摩根大通分析师Mark Murphy维持买入评级,并将目标价从78美元上调至83美元。

瑞士银行分析师Taylor McGinnis维持买入评级,并将目标价从74美元上调至88美元。

富国集团分析师Michael Turrin维持持有评级,并将目标价从75美元上调至80美元。

此外,综合报道,$Twilio (TWLO.US)$近期主要分析师观点如下:

公司目前在其主要渠道中正经历势头上升。

该公司强劲的第二季度业绩超过了所有领域的预期,包括营业收入、营业利润率和自由现金流。 分析师对该公司在多种通信-半导体中取得的显著成功以及人工智能产品初期迹象表现出改善的情绪。

twilio的双位数营业收入增长的回归比预期提前,据报道,Q3的年同比增长率加速至10%,较之前一年上半年观察到的7%的有机增长率有所增加。 这种业绩激增归功于消息传递、电子邮件等强劲领域,以及独立软件供应商、自助选项以及跨销售机会等各种增长尝试。 这些股票被认为具有吸引力,因为有望维持10%以上的增长并持续改进利润率。 此外,即将举行的投资者日可能成为一个关键时刻,如果公司提出有效的人工智能叙事并确认增长可以保持当前速度。

在'强劲'的Q3业绩之后,twilio表现出双位数营业收入增长和持续的营运杠杆。 对2025年的预测看起来越来越可信。 尽管在估值方面存在潜力,但需要对未来增长前景有更坚实的展望。

对潜在增长加速的期待一直是一个重点关注的问题,twilio在Q3期间增长的预期增长被视为一个重要的积极举措,符合返回稳定的双位数营业收入增长轨迹的总体目标。

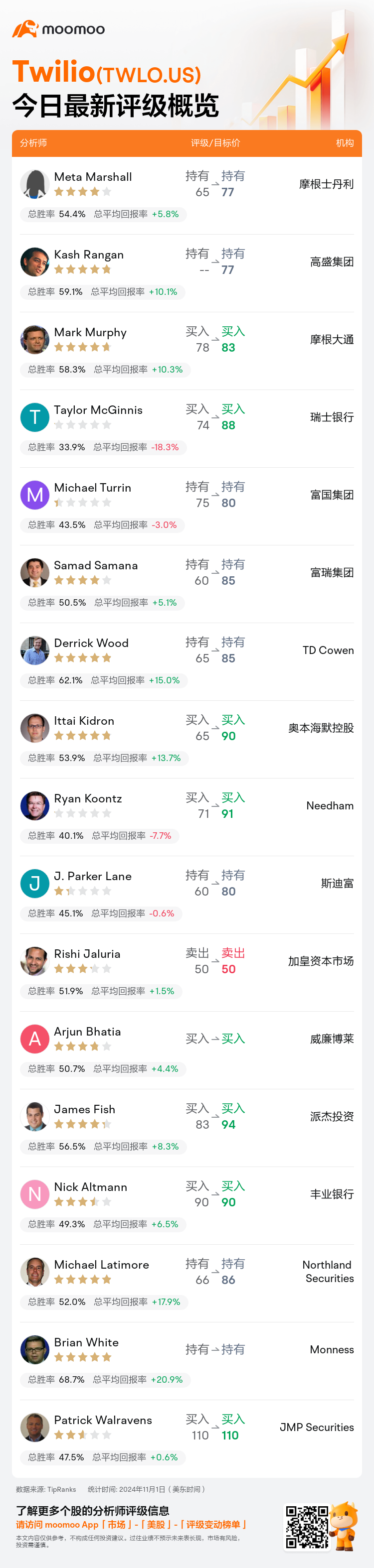

以下为今日17位分析师对$Twilio (TWLO.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

摩根大通分析师Mark Murphy维持买入评级,并将目标价从78美元上调至83美元。

摩根大通分析师Mark Murphy维持买入评级,并将目标价从78美元上调至83美元。

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $78 to $83.

J.P. Morgan analyst Mark Murphy maintains with a buy rating, and adjusts the target price from $78 to $83.