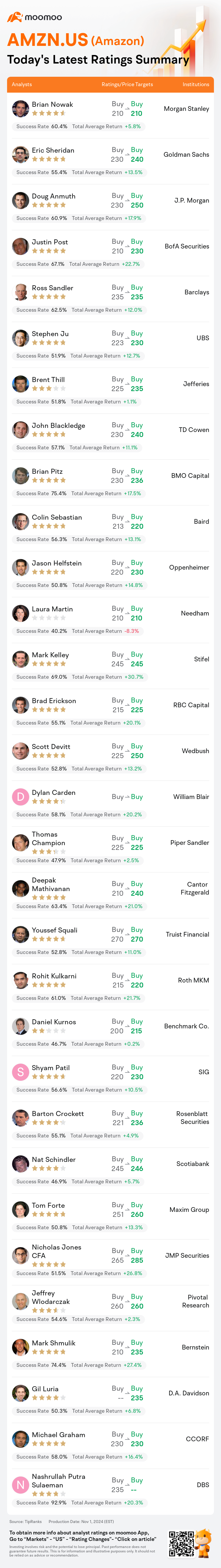

On Nov 01, major Wall Street analysts update their ratings for $Amazon (AMZN.US)$, with price targets ranging from $210 to $285.

Morgan Stanley analyst Brian Nowak maintains with a buy rating, and maintains the target price at $210.

Goldman Sachs analyst Eric Sheridan maintains with a buy rating, and adjusts the target price from $230 to $240.

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $230 to $250.

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $230 to $250.

BofA Securities analyst Justin Post maintains with a buy rating, and adjusts the target price from $210 to $230.

Barclays analyst Ross Sandler maintains with a buy rating, and maintains the target price at $235.

Furthermore, according to the comprehensive report, the opinions of $Amazon (AMZN.US)$'s main analysts recently are as follows:

Amazon.com's third-quarter report surpassed profitability expectations, with the guidance for the fourth quarter's operating income being higher than where investors anticipated the upper range might be, reflecting a more positive outlook despite previous concerns over a softer guidance.

Amazon.com's margin outperformance in Q3, especially with AWS achieving a new peak, has led analysts to adopt a more optimistic stance on the company's revenue, particularly noting the international segment's strong performance and the potential for robust holiday sales as suggested by Amazon's projections. Looking ahead to 2025, expectations for revenue and GAAP EPS have been adjusted upwards based on the recent positive developments.

Following Amazon's recent quarterly results, it is noted that the company has numerous opportunities for continued margin growth. The focus on managing headcount and operating expenses is highlighted, with the expectation that the margin improvement will be sustainable.

Amazon.com exhibited robust performance with results surpassing expectations in terms of both revenue and operating income for Q3, along with a positive outlook for Q4. Analysts note that the company's strategy of offering low-priced everyday essentials could prove to be as profitable, if not more, than other products when sold in large quantities and distributed through Amazon's expedited delivery network, which is consistently working to lower service costs. Amazon is highlighted as a top pick in the internet sector.

Amazon.com's third-quarter results were deemed solid, with revenues exceeding expectations due to accelerated growth in Online Stores and Subscription Services. It is anticipated that Amazon will sustain a combination of robust consolidated revenue growth and operating margin improvement over the coming years while continuing to invest in initiatives that are essential for long-term expansion.

Here are the latest investment ratings and price targets for $Amazon (AMZN.US)$ from 31 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月1日,多家华尔街大行更新了$亚马逊 (AMZN.US)$的评级,目标价介于210美元至285美元。

摩根士丹利分析师Brian Nowak维持买入评级,维持目标价210美元。

高盛集团分析师Eric Sheridan维持买入评级,并将目标价从230美元上调至240美元。

摩根大通分析师Doug Anmuth维持买入评级,并将目标价从230美元上调至250美元。

摩根大通分析师Doug Anmuth维持买入评级,并将目标价从230美元上调至250美元。

美银证券分析师Justin Post维持买入评级,并将目标价从210美元上调至230美元。

巴克莱银行分析师Ross Sandler维持买入评级,维持目标价235美元。

此外,综合报道,$亚马逊 (AMZN.US)$近期主要分析师观点如下:

亚马逊.com第三季度报告超出盈利预期,第四季度营业收入指引高于投资者预期的上限区间,反映出更为积极的展望,尽管之前对更为保守的指引存在担忧。

亚马逊.com在Q3表现出色,尤其是AWS达到新高,导致分析师们对公司营业收入持更加乐观的态度,特别是注意到国际板块表现强劲以及亚马逊预测的强劲假日销售潜力。展望到2025年,对营业收入和GAAP每股收益的预期也已基于最近的积极发展做出上调。

根据亚马逊最近的季度业绩,公司有多项机会持续提高利润率。关注管理人数和营业费用的重点被突出,预计利润率改善将是可持续的。

亚马逊.com在第三季度表现强劲,营收和营业收入均超出预期,第四季度展望积极。分析师指出公司提供低价日常必需品的策略可能会被证明像其他产品一样,甚至更有利可图,特别是当以大量销售并通过亚马逊的快速配送网络分销时,后者一直致力于降低服务成本。亚马逊在互联网板块被视为首选。

亚马逊.com第三季度业绩被认为稳健,由于在线商店和订阅服务的快速增长,收入超出预期。预计亚马逊将在未来几年内保持强劲的综合收入增长和营业利润率改善,并继续投资对长期扩张至关重要的举措。

以下为今日31位分析师对$亚马逊 (AMZN.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

摩根大通分析师Doug Anmuth维持买入评级,并将目标价从230美元上调至250美元。

摩根大通分析师Doug Anmuth维持买入评级,并将目标价从230美元上调至250美元。

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $230 to $250.

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $230 to $250.