On Nov 01, major Wall Street analysts update their ratings for $IQVIA Holdings (IQV.US)$, with price targets ranging from $235 to $270.

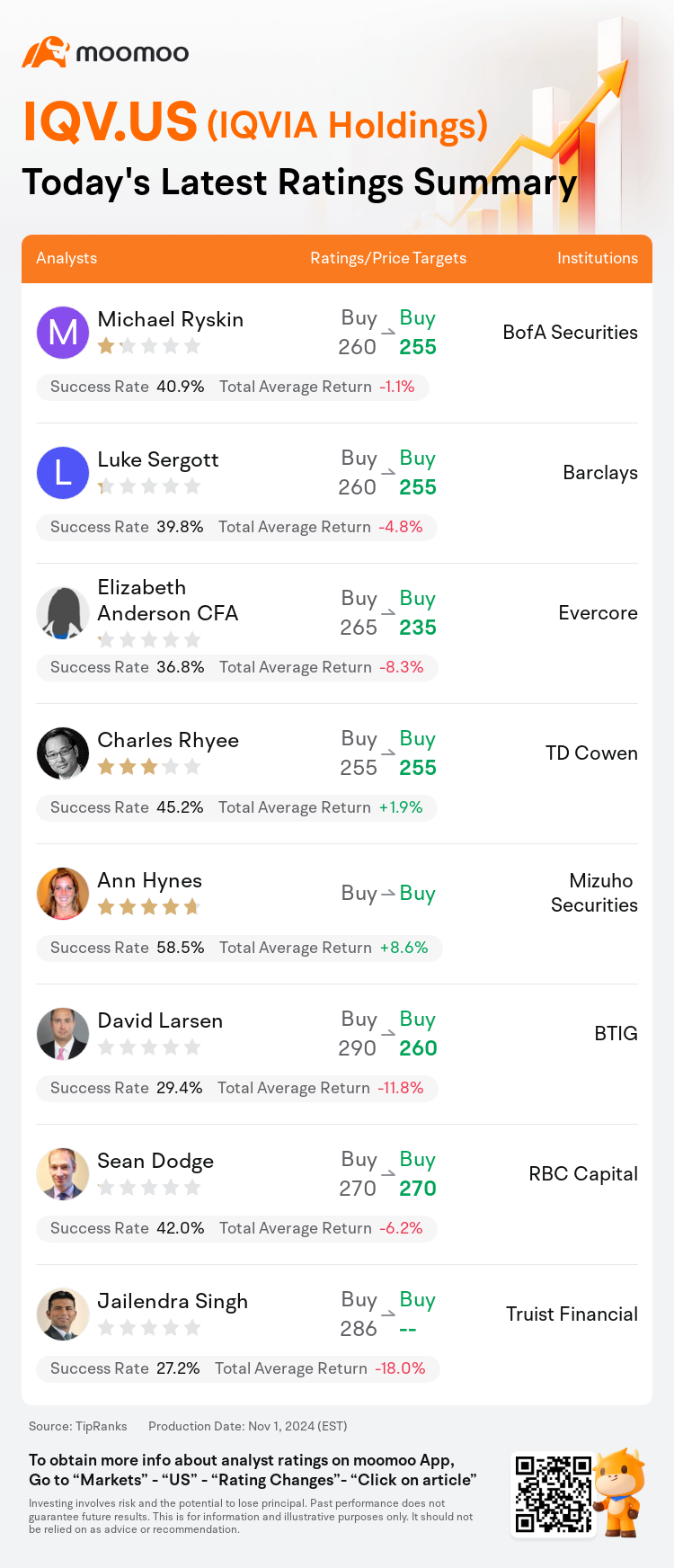

BofA Securities analyst Michael Ryskin maintains with a buy rating, and adjusts the target price from $260 to $255.

Barclays analyst Luke Sergott maintains with a buy rating, and adjusts the target price from $260 to $255.

Evercore analyst Elizabeth Anderson CFA maintains with a buy rating, and adjusts the target price from $265 to $235.

Evercore analyst Elizabeth Anderson CFA maintains with a buy rating, and adjusts the target price from $265 to $235.

TD Cowen analyst Charles Rhyee maintains with a buy rating, and maintains the target price at $255.

Mizuho Securities analyst Ann Hynes maintains with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $IQVIA Holdings (IQV.US)$'s main analysts recently are as follows:

The market's stability was noted by the company, while issues with bookings were attributed to delays and drug failures rather than significant effects from pipeline rationalization.

The company has been navigating a difficult industry operating landscape. Commentary from the company indicates that the pharmaceutical portfolio adjustments related to the IRA may be concluding, and the company seems poised to benefit from the pharmaceutical industry's trend towards vendor consolidation.

Iqvia's recent financial performance surpassed consensus expectations in total revenue, adjusted EBITDA, and adjusted EPS. However, the company has revised its 2024 guidance downwards for all metrics. This revision is attributed to the challenges posed by the Inflation Reduction Act and broader economic factors. Additionally, the guidance for R&DS has been impacted by the delay and cancellation of two significant trials.

Concerns are being raised about near-term CRO marketplace dynamics. With a significant portion of the company experiencing a slow or weakening trend, there are questions about whether the improving segment will do more than just maintain equilibrium.

Here are the latest investment ratings and price targets for $IQVIA Holdings (IQV.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月1日,多家华尔街大行更新了$艾昆纬 (IQV.US)$的评级,目标价介于235美元至270美元。

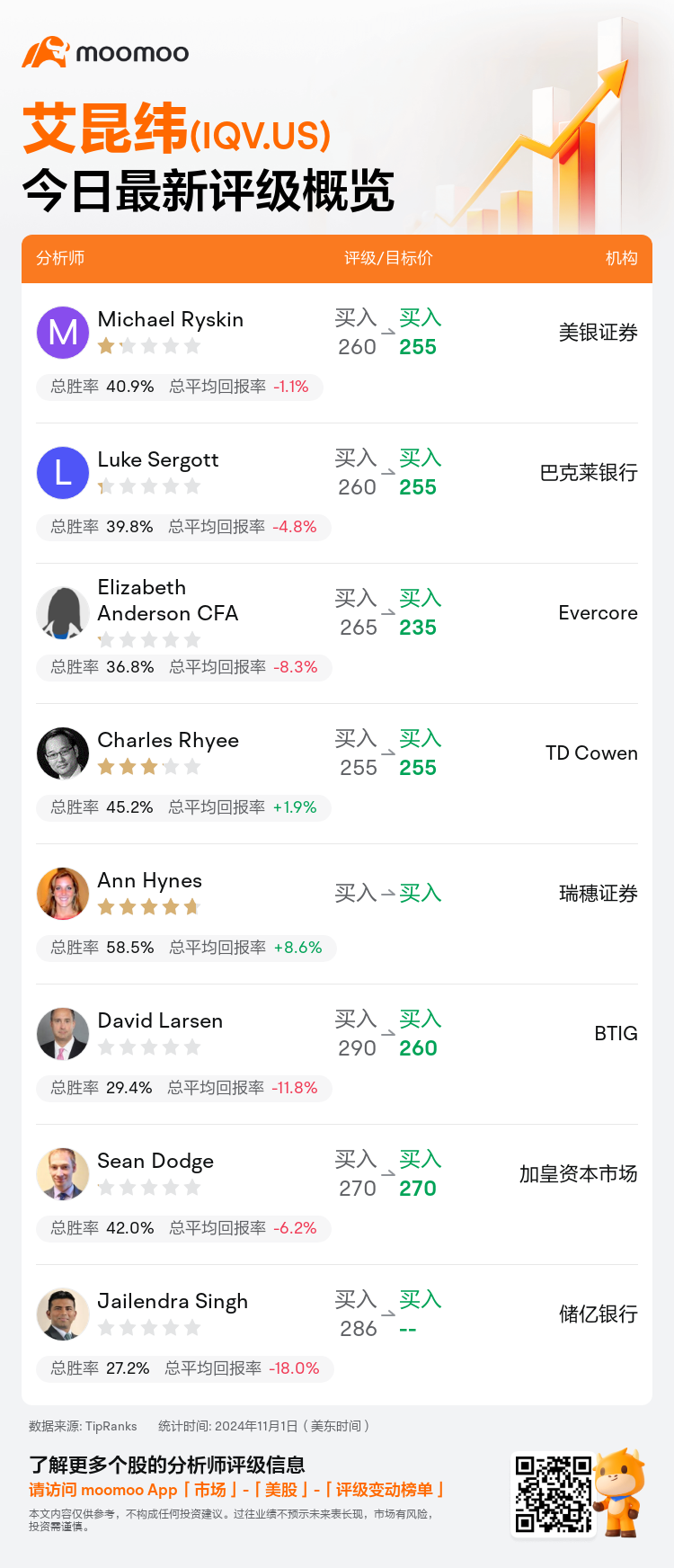

美银证券分析师Michael Ryskin维持买入评级,并将目标价从260美元下调至255美元。

巴克莱银行分析师Luke Sergott维持买入评级,并将目标价从260美元下调至255美元。

Evercore分析师Elizabeth Anderson CFA维持买入评级,并将目标价从265美元下调至235美元。

Evercore分析师Elizabeth Anderson CFA维持买入评级,并将目标价从265美元下调至235美元。

TD Cowen分析师Charles Rhyee维持买入评级,维持目标价255美元。

瑞穗证券分析师Ann Hynes维持买入评级。

此外,综合报道,$艾昆纬 (IQV.US)$近期主要分析师观点如下:

该公司注意到市场的稳定性,预订问题被归因于延迟和药品失败,而不是主要受到管道合理化的明显影响。

该公司一直在应对艰难的行业运营环境。公司的评论表明,与IRA相关的药品组合调整可能正在结束,公司似乎将受益于药品行业向供应商整合的趋势。

Iqvia最近的财务表现超过了市场预期的总收入、调整后的EBITDA和调整后的每股收益。然而,该公司已将其2024年的所有指标的指引下调。这次修订被归因于通胀减少法案和更广泛的经济因素带来的挑战。此外,研发的指引受到两项重大试验的延迟和取消影响。

人们提出了关于近期CRO市场动态的担忧。随着公司的大部分经历缓慢或趋弱,有人质疑改进的部分是否会超过仅仅维持平衡的作用。

以下为今日8位分析师对$艾昆纬 (IQV.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Evercore分析师Elizabeth Anderson CFA维持买入评级,并将目标价从265美元下调至235美元。

Evercore分析师Elizabeth Anderson CFA维持买入评级,并将目标价从265美元下调至235美元。

Evercore analyst Elizabeth Anderson CFA maintains with a buy rating, and adjusts the target price from $265 to $235.

Evercore analyst Elizabeth Anderson CFA maintains with a buy rating, and adjusts the target price from $265 to $235.