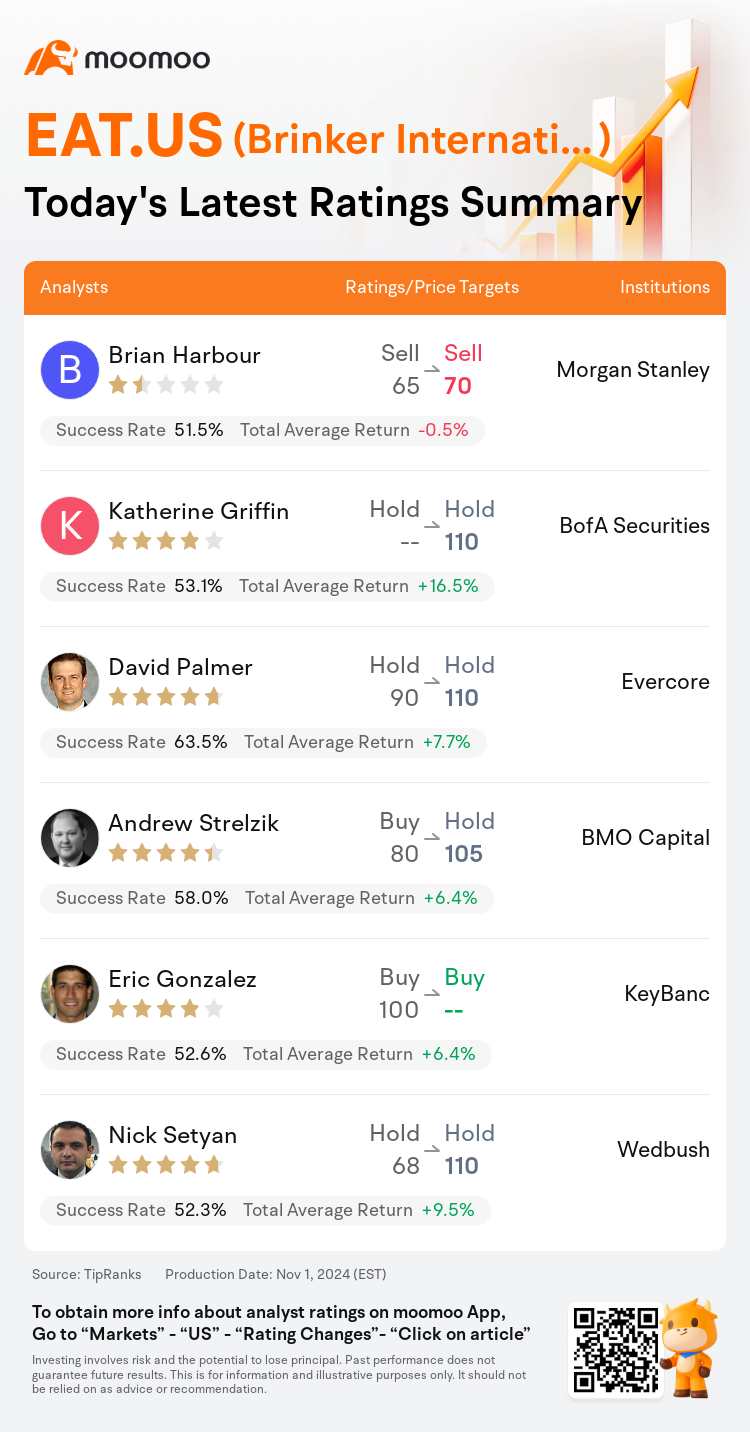

On Nov 01, major Wall Street analysts update their ratings for $Brinker International (EAT.US)$, with price targets ranging from $70 to $110.

Morgan Stanley analyst Brian Harbour maintains with a sell rating, and adjusts the target price from $65 to $70.

BofA Securities analyst Katherine Griffin maintains with a hold rating, and sets the target price at $110.

Evercore analyst David Palmer maintains with a hold rating, and adjusts the target price from $90 to $110.

Evercore analyst David Palmer maintains with a hold rating, and adjusts the target price from $90 to $110.

BMO Capital analyst Andrew Strelzik downgrades to a hold rating, and adjusts the target price from $80 to $105.

KeyBanc analyst Eric Gonzalez maintains with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $Brinker International (EAT.US)$'s main analysts recently are as follows:

The company's focus on value offerings and a strong marketing mix, which includes both conventional media advertisements and social media interactions, has been instrumental in advancing traffic growth that surpasses industry standards. There is potential to boost recognition via television promotions, and it is anticipated that the company can sustain the upward trajectory of its top line for Chili's during the second fiscal quarter by continuing to effectively utilize advertising.

The firm anticipates that the company's share strength post-earnings will continue in the near term, supported by the company's commentary on trends and industry outperformance that improved throughout the quarter and into October. This is expected to position the company for a potentially higher guidance update in fiscal Q2.

The company's fiscal Q1 results surpassed expectations across the board, and its positive momentum persisted into October. Nonetheless, the current stock valuation is considered to reflect its full potential.

The stock is perceived as having reached its full potential in terms of valuation. CEO Kevin Hochman has been commended for his impressive efforts in revitalizing and sharpening the focus of a brand that, arguably, experienced its lowest point in the unprofitable quarter of Q1 of fiscal 2023.

The firm believes that a robust first quarter and raised guidance for fiscal year 2025 suggest continued momentum in the near term. It is perceived that the current valuation of Brinker adequately reflects the enhanced near-term clarity into same-store growth and margin trends, balanced by a still-obscured outlook on medium- and long-term revenue and profit factors, notwithstanding a significant increase in near-term marketing expenditures.

Here are the latest investment ratings and price targets for $Brinker International (EAT.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月1日,多家华尔街大行更新了$布林克国际 (EAT.US)$的评级,目标价介于70美元至110美元。

摩根士丹利分析师Brian Harbour维持卖出评级,并将目标价从65美元上调至70美元。

美银证券分析师Katherine Griffin维持持有评级,目标价110美元。

Evercore分析师David Palmer维持持有评级,并将目标价从90美元上调至110美元。

Evercore分析师David Palmer维持持有评级,并将目标价从90美元上调至110美元。

BMO资本市场分析师Andrew Strelzik下调至持有评级,并将目标价从80美元上调至105美元。

KeyBanc分析师Eric Gonzalez维持买入评级。

此外,综合报道,$布林克国际 (EAT.US)$近期主要分析师观点如下:

公司专注于提供价值,并采用强大的营销组合,在传统媒体广告和社交媒体互动方面表现出色,这有助于推动超越行业标准的流量增长。通过电视推广,可以提升知名度,预计公司能够持续利用广告效果有效,从而在Chili's第二财季保持营业收入的增长势头。

公司预计,公司在盈利后的股票强势将在短期内继续,得到公司对趋势和行业超额表现的评论的支持,这种表现在整个季度和10月份持续改善。预计这将使公司为在财政第二季度有望大幅提高预期而做好准备。

公司的财政第一季度业绩在各方面均超出预期,其正面势头持续到了10月份。尽管如此,目前的股票估值被认为已反映了其全部潜力。

就估值而言,股票被视为已达到其全部潜力。CEO凯文·霍克曼因在振兴和聚焦品牌方面取得的令人印象深刻的努力而受到赞扬。可以说,在2023财政第一季度亏损的最低点,他改善了局面。

公司认为,强劲的第一季度和对2025财政年度提高的指引显示了短期内持续势头。人们认为,Brinker目前的估值充分反映了增强的短期内同店增长和利润趋势的透明度,尽管短期市场营销支出大幅增加,但对中长期营收和利润因素的前景仍然不明朗。

以下为今日6位分析师对$布林克国际 (EAT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Evercore分析师David Palmer维持持有评级,并将目标价从90美元上调至110美元。

Evercore分析师David Palmer维持持有评级,并将目标价从90美元上调至110美元。

Evercore analyst David Palmer maintains with a hold rating, and adjusts the target price from $90 to $110.

Evercore analyst David Palmer maintains with a hold rating, and adjusts the target price from $90 to $110.