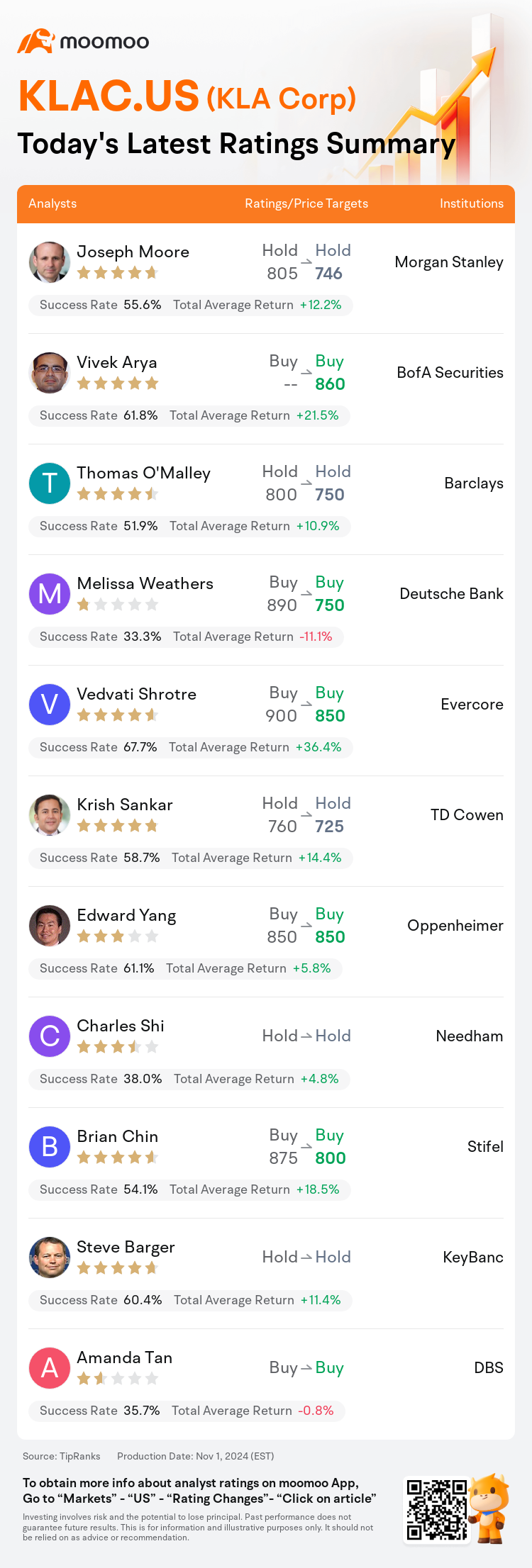

On Nov 01, major Wall Street analysts update their ratings for $KLA Corp (KLAC.US)$, with price targets ranging from $725 to $860.

Morgan Stanley analyst Joseph Moore maintains with a hold rating, and adjusts the target price from $805 to $746.

BofA Securities analyst Vivek Arya maintains with a buy rating, and sets the target price at $860.

Barclays analyst Thomas O'Malley maintains with a hold rating, and adjusts the target price from $800 to $750.

Barclays analyst Thomas O'Malley maintains with a hold rating, and adjusts the target price from $800 to $750.

Deutsche Bank analyst Melissa Weathers maintains with a buy rating, and adjusts the target price from $890 to $750.

Evercore analyst Vedvati Shrotre maintains with a buy rating, and adjusts the target price from $900 to $850.

Furthermore, according to the comprehensive report, the opinions of $KLA Corp (KLAC.US)$'s main analysts recently are as follows:

The projection for KLA Corp. has been adjusted with the anticipation that China's evolving market dynamics will necessitate the Leading-edge to effectively manage a transition that will sustain above-market growth into 2025 following the company's earnings report.

KLA Corp. reported a notable quarter with results surpassing expectations and provided an encouraging outlook, coupled with a positive stance on the robustness of leading-edge wafer fab expenditure projected through 2025.

KLA Corp.'s recent financial results exceeded expectations once again, fueled by robust foundry and logic expenditure at the 2nm/3nm nodes, along with a solid demand for their services, which is projected to lead to substantial growth in the second half of the year compared to the first half.

KLA Corp. reported fiscal Q1 results and guidance that surpassed expectations. With the company's shares having decreased 20% from their peak, it is deemed a suitable moment for investment. The sentiment contrasts with ASML's, which is currently at the other end of the spectrum. A favorable 6-9 month investment period is anticipated as government intervention activities wind down for the year, shifting investor focus back to the robust artificial intelligence theme.

Here are the latest investment ratings and price targets for $KLA Corp (KLAC.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月1日,多家华尔街大行更新了$科磊 (KLAC.US)$的评级,目标价介于725美元至860美元。

摩根士丹利分析师Joseph Moore维持持有评级,并将目标价从805美元下调至746美元。

美银证券分析师Vivek Arya维持买入评级,目标价860美元。

巴克莱银行分析师Thomas O'Malley维持持有评级,并将目标价从800美元下调至750美元。

巴克莱银行分析师Thomas O'Malley维持持有评级,并将目标价从800美元下调至750美元。

德意志银行分析师Melissa Weathers维持买入评级,并将目标价从890美元下调至750美元。

Evercore分析师Vedvati Shrotre维持买入评级,并将目标价从900美元下调至850美元。

此外,综合报道,$科磊 (KLAC.US)$近期主要分析师观点如下:

考虑到中国不断发展的市场动态,预计科磊公司的预测已经调整,需要引领业内有效管理转型,以保持在2025年公司业绩报告后实现超过市场增长。

科磊公司报告称,本季度表现显著,结果超出预期,并提供了令人鼓舞的展望,同时对预计到2025年的领先边缘晶圆厂支出的强劲态势持乐观态度。

科磊公司最近的财务业绩再次超出预期,得益于2nm/3nm节点处的强劲晶圆厂和逻辑支出,以及对他们服务的强劲需求,预计将在今年下半年实现实质性增长,与上半年相比。

科磊公司报告财政Q1的业绩和指引超出预期。鉴于该公司股票已从高峰下跌了20%,现被视为投资的合适时机。这一情绪与ASML形成对比,后者目前正处于另一个极端。预计有一个有利的6-9个月投资期,因为政府干预活动正在年底逐渐减少,将投资者焦点转回强劲的人工智能主题。

以下为今日11位分析师对$科磊 (KLAC.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Thomas O'Malley维持持有评级,并将目标价从800美元下调至750美元。

巴克莱银行分析师Thomas O'Malley维持持有评级,并将目标价从800美元下调至750美元。

Barclays analyst Thomas O'Malley maintains with a hold rating, and adjusts the target price from $800 to $750.

Barclays analyst Thomas O'Malley maintains with a hold rating, and adjusts the target price from $800 to $750.