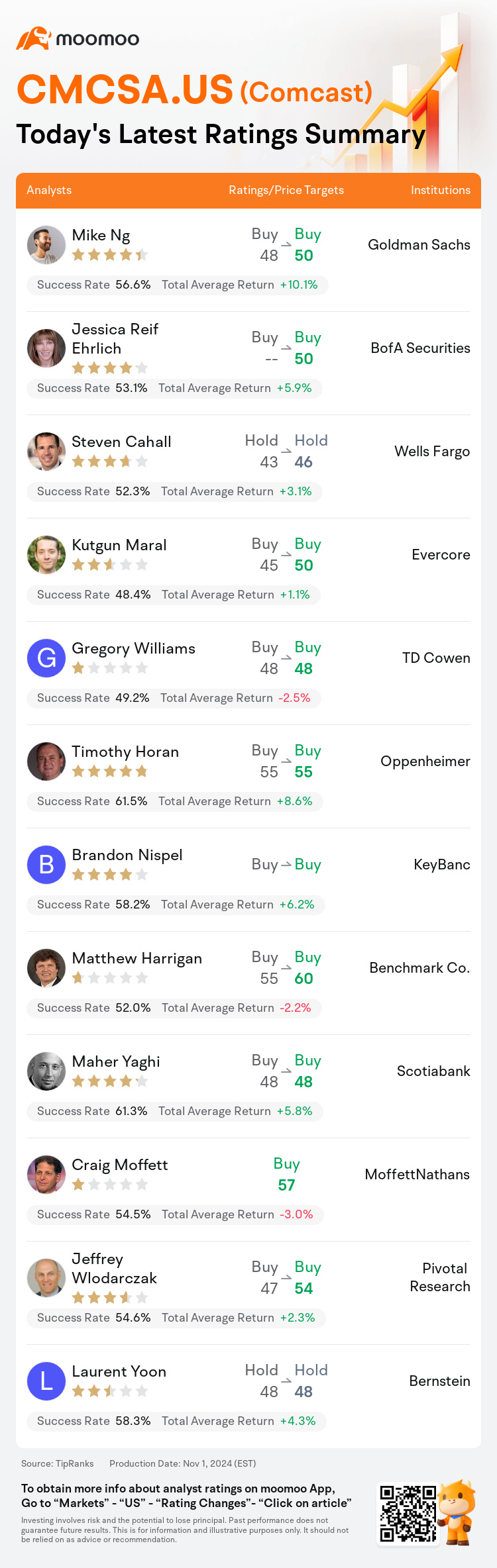

On Nov 01, major Wall Street analysts update their ratings for $Comcast (CMCSA.US)$, with price targets ranging from $46 to $60.

Goldman Sachs analyst Mike Ng maintains with a buy rating, and adjusts the target price from $48 to $50.

BofA Securities analyst Jessica Reif Ehrlich maintains with a buy rating, and sets the target price at $50.

Wells Fargo analyst Steven Cahall maintains with a hold rating, and adjusts the target price from $43 to $46.

Wells Fargo analyst Steven Cahall maintains with a hold rating, and adjusts the target price from $43 to $46.

Evercore analyst Kutgun Maral maintains with a buy rating, and adjusts the target price from $45 to $50.

TD Cowen analyst Gregory Williams maintains with a buy rating, and maintains the target price at $48.

Furthermore, according to the comprehensive report, the opinions of $Comcast (CMCSA.US)$'s main analysts recently are as follows:

The firm considers Comcast's Q3 report to be 'encouraging,' although they believe that a potential spinoff of the networks would not have a significant impact.

Comcast's Q3 results surpassed expectations, driven by a strong performance in Broadband and controlled operating expenditures. Additionally, the company is considering a spin-off of its cable network assets. This move could potentially involve a combination with cable networks of a similar nature, which might lead to a reassessment of the company's valuation.

The third quarter performance for Comcast did not significantly alter the overarching investment thesis, but did present several clear positives. A particularly notable development arising from Comcast's third quarter results was the revelation that the company is contemplating the potential separation of assets from NBCUniversal's cable networks portfolio. Although the extent of a prospective separation, as currently envisioned by management, may not align with the preferences of some investors, it signifies a notable departure from a long-standing emphasis on the synergies between its two primary segments. This move indicates that management is receptive to different strategies for its established assets, which face enduring industry challenges, while simultaneously continuing to prioritize investment in its six areas identified for growth.

The company's third-quarter 2024 results were favorable, showing improved broadband losses and a positive reserve adjustment related to the Affordable Connectivity Program. Additionally, revenue from the Olympics and the exploration of a potential spinoff of the cable networks were highlighted.

Comcast's evolving media strategy and broadband trends are seen as marginally positive developments, though they are not considered transformative for the company's business trajectory.

Here are the latest investment ratings and price targets for $Comcast (CMCSA.US)$ from 12 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

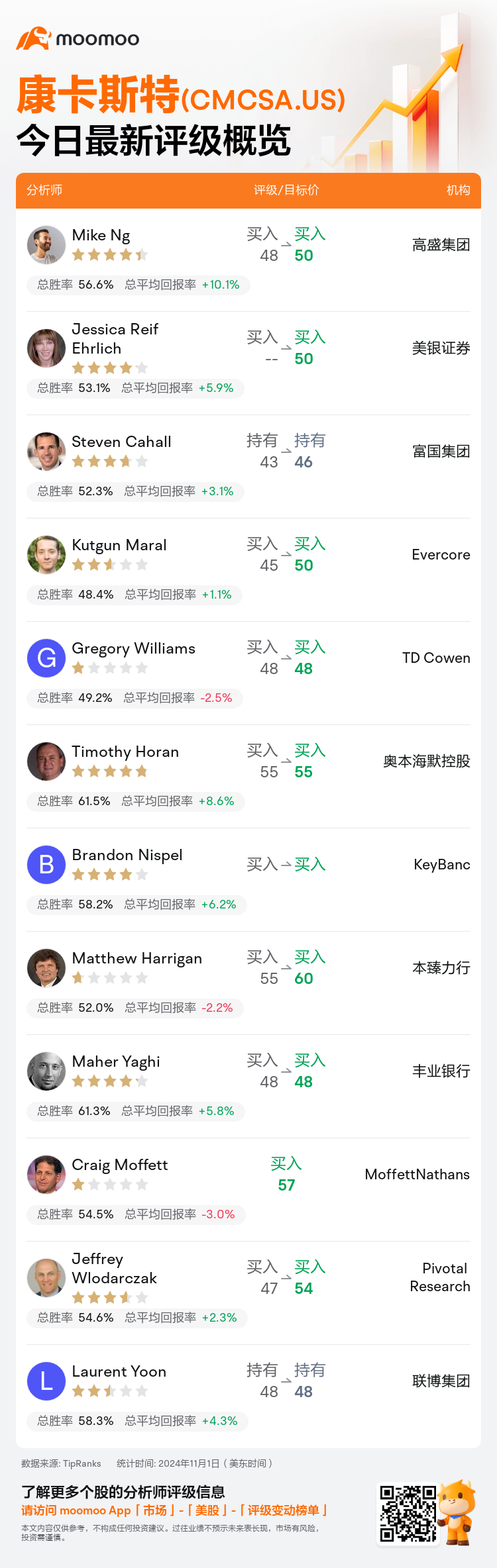

美东时间11月1日,多家华尔街大行更新了$康卡斯特 (CMCSA.US)$的评级,目标价介于46美元至60美元。

高盛集团分析师Mike Ng维持买入评级,并将目标价从48美元上调至50美元。

美银证券分析师Jessica Reif Ehrlich维持买入评级,目标价50美元。

富国集团分析师Steven Cahall维持持有评级,并将目标价从43美元上调至46美元。

富国集团分析师Steven Cahall维持持有评级,并将目标价从43美元上调至46美元。

Evercore分析师Kutgun Maral维持买入评级,并将目标价从45美元上调至50美元。

TD Cowen分析师Gregory Williams维持买入评级,维持目标价48美元。

此外,综合报道,$康卡斯特 (CMCSA.US)$近期主要分析师观点如下:

公司认为康卡斯特的第三季度报告“令人鼓舞”,尽管他们认为网络的潜在剥离不会产生重大影响。

康卡斯特的第三季度业绩超出预期,由宽带业务的强劲表现以及控制运营支出推动。此外,公司正在考虑剥离其有线网络资产。此举可能涉及与类似性质的有线网络进行组合,这可能导致对公司估值的重新评估。

康卡斯特的第三季度业绩并未显著改变总体投资论点,但呈现了一些明显的积极因素。康卡斯特第三季度业绩带来的一个特别显著发展是,公司正在考虑从NBCUniversal的有线网络投资组合中分离资产的潜在性。虽然管理层目前设想的潜在分离程度可能与一些投资者的偏好不符,但这表明公司正在重视其两个主要业务板块之间的协同优势长期以来。这一举措表明管理层愿意接受不同的业务策略,以因应持续存在的行业挑战,同时继续优先投资于其确定的六个增长领域。

公司2024年第三季度业绩良好,显示宽带损失减少和与“可负担得起的连接计划”相关的积极准备金调整。此外,奥运收入和有线网络剥离的探讨受到强调。

康卡斯特不断发展的媒体策略和宽带趋势被视为边际积极的发展,尽管它们不被认为对公司的业务轨迹具有变革性影响。

以下为今日12位分析师对$康卡斯特 (CMCSA.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Steven Cahall维持持有评级,并将目标价从43美元上调至46美元。

富国集团分析师Steven Cahall维持持有评级,并将目标价从43美元上调至46美元。

Wells Fargo analyst Steven Cahall maintains with a hold rating, and adjusts the target price from $43 to $46.

Wells Fargo analyst Steven Cahall maintains with a hold rating, and adjusts the target price from $43 to $46.