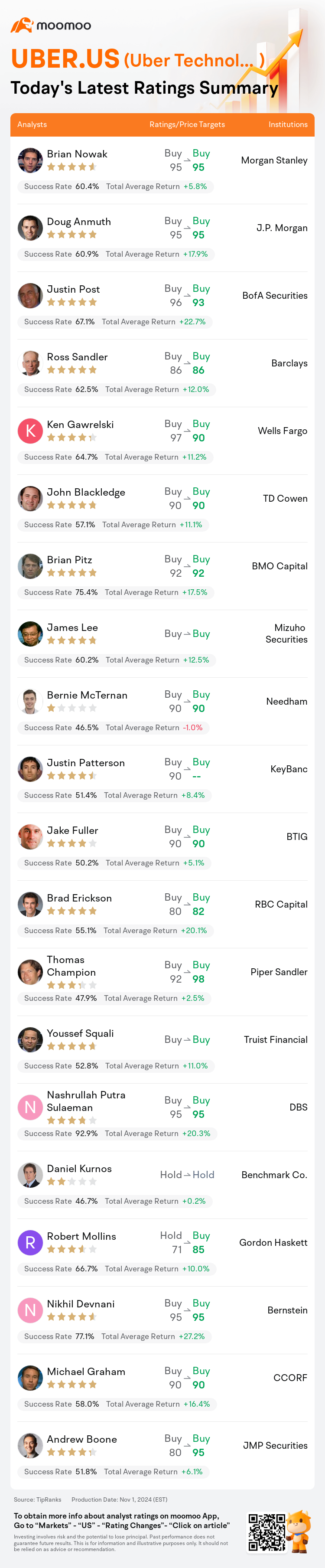

On Nov 01, major Wall Street analysts update their ratings for $Uber Technologies (UBER.US)$, with price targets ranging from $82 to $98.

Morgan Stanley analyst Brian Nowak maintains with a buy rating, and maintains the target price at $95.

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and maintains the target price at $95.

BofA Securities analyst Justin Post maintains with a buy rating, and adjusts the target price from $96 to $93.

BofA Securities analyst Justin Post maintains with a buy rating, and adjusts the target price from $96 to $93.

Barclays analyst Ross Sandler maintains with a buy rating, and maintains the target price at $86.

Wells Fargo analyst Ken Gawrelski maintains with a buy rating, and adjusts the target price from $97 to $90.

Furthermore, according to the comprehensive report, the opinions of $Uber Technologies (UBER.US)$'s main analysts recently are as follows:

The combination of a modest shortfall in mobility and a stimulating conversation on autonomous vehicles may have prompted an immediate sell-off. Nevertheless, this situation presents an 'obvious opportunity.' The company continues to exhibit robust growth rates above 20%, and its emerging business segments are expanding rapidly.

The drivers of mobility deceleration and the path to stabilized growth continue to be central discussions following the recent quarter. While Uber maintains a solid growth narrative, it is anticipated that further reports and guidance will be necessary to alleviate concerns regarding growth.

The observed deceleration in Mobility gross bookings alongside a more subdued Trips growth in the third quarter might lead to apprehensions about a potential slow-down in the Mobility sector. Despite these observations, it is not anticipated that this will have an adverse effect on profitability.

Following a modestly better-than-expected third quarter earnings report with robust underlying fundamentals, the view that Uber maintains its position as a global leader in Ridesharing and Online Delivery continues to be reinforced.

Here are the latest investment ratings and price targets for $Uber Technologies (UBER.US)$ from 20 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

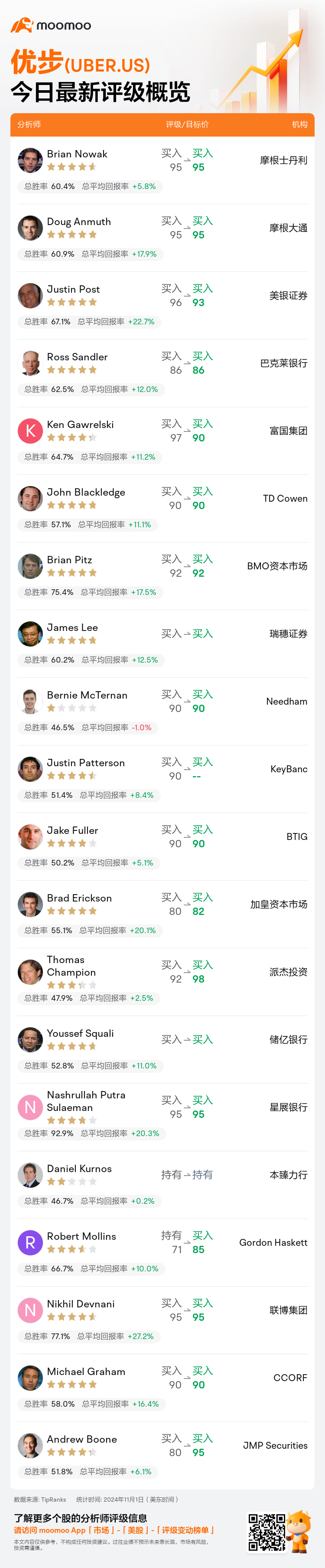

美东时间11月1日,多家华尔街大行更新了$优步 (UBER.US)$的评级,目标价介于82美元至98美元。

摩根士丹利分析师Brian Nowak维持买入评级,维持目标价95美元。

摩根大通分析师Doug Anmuth维持买入评级,维持目标价95美元。

美银证券分析师Justin Post维持买入评级,并将目标价从96美元下调至93美元。

美银证券分析师Justin Post维持买入评级,并将目标价从96美元下调至93美元。

巴克莱银行分析师Ross Sandler维持买入评级,维持目标价86美元。

富国集团分析师Ken Gawrelski维持买入评级,并将目标价从97美元下调至90美元。

此外,综合报道,$优步 (UBER.US)$近期主要分析师观点如下:

在移动性略微不足和有关自动驾驶车辆的激动人心对话的共同作用下,可能引发立即的卖出。尽管如此,这种情况提供了一个“明显的机会”。该公司继续展示超过20%的强劲增长率,其新兴业务板块正在迅速扩张。

在最近一个季度之后,移动性减速的驱动因素和实现稳定增长的途径仍然是核心讨论的焦点。尽管优步保持着稳健的增长故事,但预计进一步的报告和指引将是必要的,以缓解有关增长的担忧。

在第三季度移动性毛收入增长放缓以及出行增长较为温和的情况下,可能会引发人们对移动性板块潜在放缓的担忧。尽管存在这些观察结果,但预计这不会对盈利能力产生不利影响。

在第三季度业绩报告略好于预期并具有稳健基本面之后,认为优步仍然保持全球领先地位的观点在继续得到强化,公司在顺风车和在线交付领域保持领先地位。

以下为今日20位分析师对$优步 (UBER.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师Justin Post维持买入评级,并将目标价从96美元下调至93美元。

美银证券分析师Justin Post维持买入评级,并将目标价从96美元下调至93美元。

BofA Securities analyst Justin Post maintains with a buy rating, and adjusts the target price from $96 to $93.

BofA Securities analyst Justin Post maintains with a buy rating, and adjusts the target price from $96 to $93.