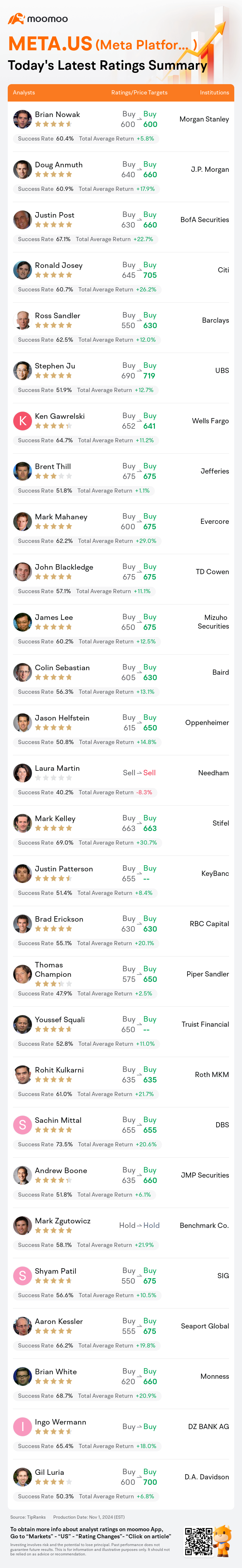

On Nov 01, major Wall Street analysts update their ratings for $Meta Platforms (META.US)$, with price targets ranging from $600 to $719.

Morgan Stanley analyst Brian Nowak maintains with a buy rating, and maintains the target price at $600.

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $640 to $660.

BofA Securities analyst Justin Post maintains with a buy rating, and adjusts the target price from $630 to $660.

BofA Securities analyst Justin Post maintains with a buy rating, and adjusts the target price from $630 to $660.

Citi analyst Ronald Josey maintains with a buy rating, and adjusts the target price from $645 to $705.

Barclays analyst Ross Sandler maintains with a buy rating, and adjusts the target price from $550 to $630.

Furthermore, according to the comprehensive report, the opinions of $Meta Platforms (META.US)$'s main analysts recently are as follows:

Meta Platforms continues to project a substantial rise in capital expenditures for 2025. Results also showcased several counterbalances that demonstrate the anticipated returns on these investments, such as an increase in revenue dollar growth in 2024, estimated at approximately $28 billion. There is also a possibility for advertising revenue growth in 2026 and subsequent years, owing to the opportunity to generate additional revenue through new products enabled by generative AI.

Following the Q3 earnings release, there was a slight downturn in share value, which can be ascribed to a robust Q4 revenue forecast being counterbalanced by projections of substantial capital expenditure and infrastructure-related costs for 2025. Despite a shift in focus from immediate earnings to long-term potential, it's recognized that the company has reaped considerable benefits from AI within its core advertising segment and possesses an impressive product roadmap with initiatives such as Meta AI and Llama. The strong fundamental revenue growth and consistent operational performance provide the company with the latitude to make significant investments in AI technology. Revenue projections for 2025 and 2026 have been modestly revised upwards based on the latest earnings outcomes.

Following Meta Platforms' Q3 revenue and EPS surpassing expectations, along with a Q4 outlook that aligns with existing market projections, revenue estimates for 2025 have been increased by 3% and EPS by 6%. This adjustment accounts for an anticipated rise in ad monetization, which is slightly tempered by an expected increase in R&D and capital expenditures.

Meta Platforms appears to be regaining its strong market position, as demonstrated by growth surpassing that of the digital advertising industry, enhancements in the business driven by artificial intelligence, and the CEO's assertive strategic planning, which includes significant investments. Long-term technology investors may view these developments positively, yet the recent peak in the company's multiples may also present concerns.

Following the Q3 report, there's an observation of a 20% year-over-year increase in advertising revenue when adjusted for currency fluctuations, along with growth in both ad impressions and pricing. This suggests Meta Platforms is continuing to capture a larger share of overall ad budgets. The enhanced engagement observed on Instagram and Facebook, propelled by Meta's artificial intelligence recommendation engine, underscores the early-stage yet promising returns on its AI investments. Investors are encouraged to consider any post-earnings decline in the share price as an opportunity.

Here are the latest investment ratings and price targets for $Meta Platforms (META.US)$ from 28 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

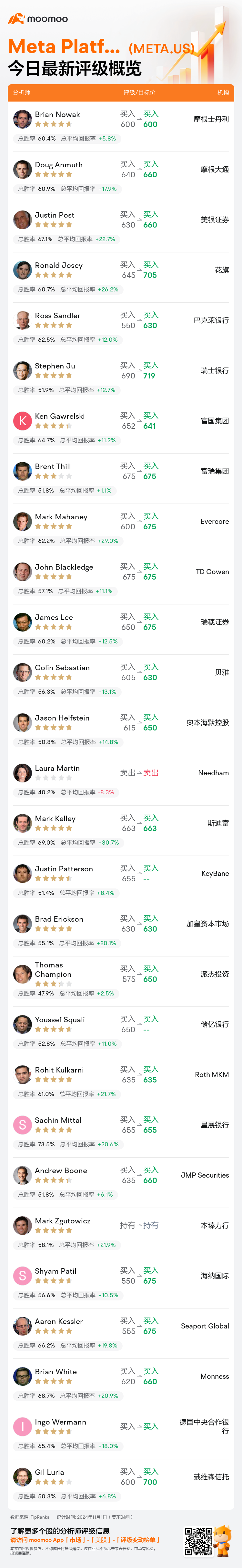

美东时间11月1日,多家华尔街大行更新了$Meta Platforms (META.US)$的评级,目标价介于600美元至719美元。

摩根士丹利分析师Brian Nowak维持买入评级,维持目标价600美元。

摩根大通分析师Doug Anmuth维持买入评级,并将目标价从640美元上调至660美元。

美银证券分析师Justin Post维持买入评级,并将目标价从630美元上调至660美元。

美银证券分析师Justin Post维持买入评级,并将目标价从630美元上调至660美元。

花旗分析师Ronald Josey维持买入评级,并将目标价从645美元上调至705美元。

巴克莱银行分析师Ross Sandler维持买入评级,并将目标价从550美元上调至630美元。

此外,综合报道,$Meta Platforms (META.US)$近期主要分析师观点如下:

meta platforms继续预测2025年资本支出将大幅增加。结果还展示了几项抵消措施,显示了对这些投资的预期回报,比如2024年营业收入美元增长预计约为$280亿。由于通过生成人工智能实现新产品推出的机会,2026年及以后可能出现广告营收增长的可能性,从而通过新产品创造额外营收。

在Q3收益发布之后,股票价值出现轻微下降,这可以归因于对2025年大规模资本支出和基础设施相关成本的强劲Q4营收预测。尽管将重点从即时收益转移到长期潜力,但公司已经意识到其核心广告业务部门内人工智能带来的相当大利益,并拥有Meta 人工智能和Llama等项目的出色产品路线图。强劲的基本营收增长和持续的运营表现为公司提供了资金余地,以在人工智能技术方面进行重大投资。根据最新收益结果,2025年和2026年的营收预测已经略有上调。

在meta platforms的Q3营收和每股收益超过预期,以及Q4展望与现有市场预测相一致之后,预计2025年的营收增加了3%,每股收益增加了6%。这一调整考虑到了广告变现的预期增长,稍受到研发和资本支出的预期增长的抑制。

meta platforms似乎正在恢复其强劲的市场地位,这可通过增长超过数字广告行业、人工智能推动业务的增强以及CEO的果断战略规划来展示,其中包括重大投资。长期科技投资者可能会积极看待这些发展,但公司倍数最近的峰值也可能引起担忧。

根据第三季度报告,经调整货币波动影响,广告营收年增长率达到20%,广告展示量和价格均呈增长趋势。这表明Meta平台正在继续占据更大的整体广告预算份额。Instagram和Facebook上观察到的增强互动,得益于Meta的人工智能推荐引擎,突显了其人工智能投资的早期但有希望的回报。投资者被鼓励将股价尾盘下跌视为机会。

以下为今日28位分析师对$Meta Platforms (META.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师Justin Post维持买入评级,并将目标价从630美元上调至660美元。

美银证券分析师Justin Post维持买入评级,并将目标价从630美元上调至660美元。

BofA Securities analyst Justin Post maintains with a buy rating, and adjusts the target price from $630 to $660.

BofA Securities analyst Justin Post maintains with a buy rating, and adjusts the target price from $630 to $660.