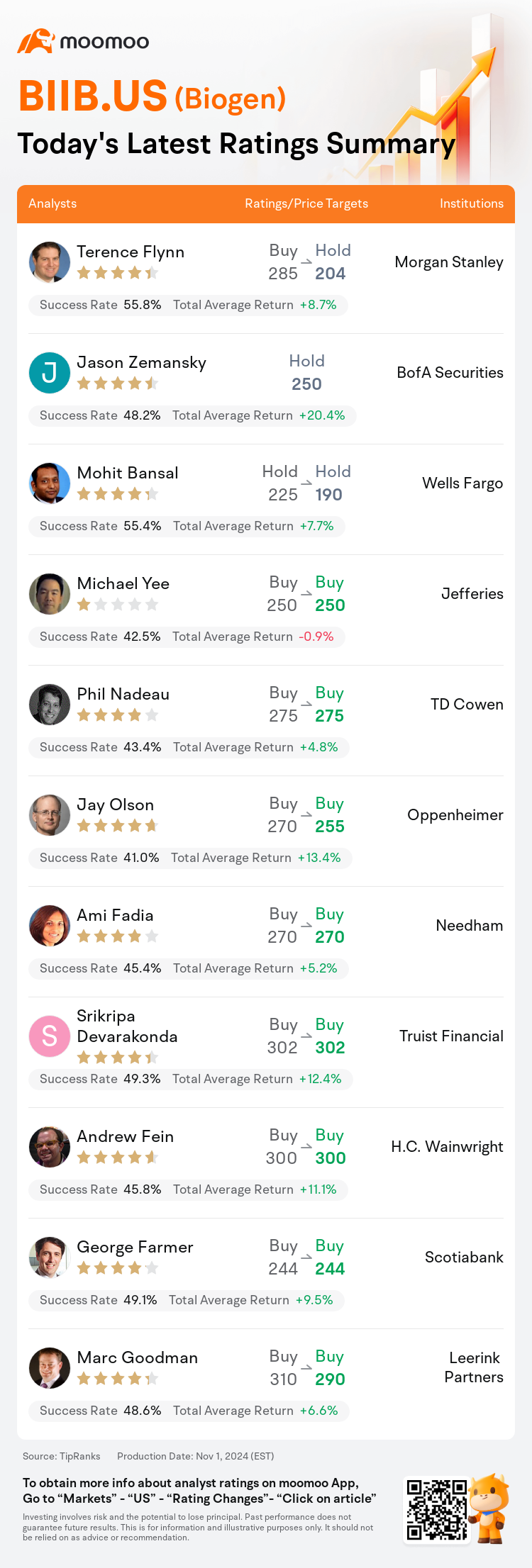

On Nov 01, major Wall Street analysts update their ratings for $Biogen (BIIB.US)$, with price targets ranging from $190 to $302.

Morgan Stanley analyst Terence Flynn downgrades to a hold rating, and adjusts the target price from $285 to $204.

BofA Securities analyst Jason Zemansky initiates coverage with a hold rating, and sets the target price at $250.

Wells Fargo analyst Mohit Bansal maintains with a hold rating, and adjusts the target price from $225 to $190.

Wells Fargo analyst Mohit Bansal maintains with a hold rating, and adjusts the target price from $225 to $190.

Jefferies analyst Michael Yee maintains with a buy rating, and maintains the target price at $250.

TD Cowen analyst Phil Nadeau maintains with a buy rating, and maintains the target price at $275.

Furthermore, according to the comprehensive report, the opinions of $Biogen (BIIB.US)$'s main analysts recently are as follows:

The company's recent product launches continue to face challenges amidst a backdrop of intensifying competition. Furthermore, significant developments from the company's emerging pipeline appear to be projected for 2026 and later.

The launch of Leqembi has not met expectations, and there appears to be a limited range of pipeline opportunities in the coming year. The analyst acknowledges a prior underestimation of the initial reimbursement and logistical challenges faced by Leqembi. A balanced risk/reward perspective is now seen for Biogen, with a cautious projection for lecanemab's progress.

Biogen's third-quarter financial performance was robust, with total revenues of $2.47 billion surpassing estimates of $2.38 billion and consensus of $2.43 billion, while adjusted earnings per share of $4.08 exceeded the anticipated $3.75 and consensus of $3.77. The sales trajectory of Leqembi is seen to be exceeding consensus, indicating a vigorous build-up of infrastructure. It is expected that the intravenous maintenance and subcutaneous forms will considerably enhance adoption in the year 2025.

Biogen's Q3 revenue met expectations while EPS surpassed projections. The company also increased its EPS guidance for 2024. The launch of Leqembi is gathering pace, although logistical and capacity constraints are still impeding wider adoption.

Here are the latest investment ratings and price targets for $Biogen (BIIB.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月1日,多家华尔街大行更新了$渤健公司 (BIIB.US)$的评级,目标价介于190美元至302美元。

摩根士丹利分析师Terence Flynn下调至持有评级,并将目标价从285美元下调至204美元。

美银证券分析师Jason Zemansky首予持有评级,目标价250美元。

富国集团分析师Mohit Bansal维持持有评级,并将目标价从225美元下调至190美元。

富国集团分析师Mohit Bansal维持持有评级,并将目标价从225美元下调至190美元。

富瑞集团分析师Michael Yee维持买入评级,维持目标价250美元。

TD Cowen分析师Phil Nadeau维持买入评级,维持目标价275美元。

此外,综合报道,$渤健公司 (BIIB.US)$近期主要分析师观点如下:

公司最近的产品推出在日益激烈的竞争背景下仍然面临挑战。此外,该公司新兴管线的重大进展似乎被预计在2026年及以后出现。

Leqembi的推出未达到预期,并且未来一年似乎存在有限的管线机会。分析师承认之前低估了Leqembi面临的初始报销和后勤挑战。现在,对于Biogen的风险/回报观点变得平衡,对lecanemab的进展持谨慎态度。

渤健公司第三季度的财务表现强劲,总营业收入为24.7亿美元,超过了23.8亿美元的预期和24.3亿美元的共识,而每股调整收益为4.08美元,超过了预期的3.75美元和共识的3.77美元。Leqembi的销售轨迹超出了共识,表明制造行业正在大力发展。预计2025年静脉维护和皮下形式将大幅提升采用率。

渤健公司第三季度营业收入符合预期,而每股收益超过了预期。该公司还提高了2024年的每股收益指引。Leqembi的推出正在加速,尽管后勤和产能约束仍在阻碍更广泛的采用。

以下为今日11位分析师对$渤健公司 (BIIB.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Mohit Bansal维持持有评级,并将目标价从225美元下调至190美元。

富国集团分析师Mohit Bansal维持持有评级,并将目标价从225美元下调至190美元。

Wells Fargo analyst Mohit Bansal maintains with a hold rating, and adjusts the target price from $225 to $190.

Wells Fargo analyst Mohit Bansal maintains with a hold rating, and adjusts the target price from $225 to $190.