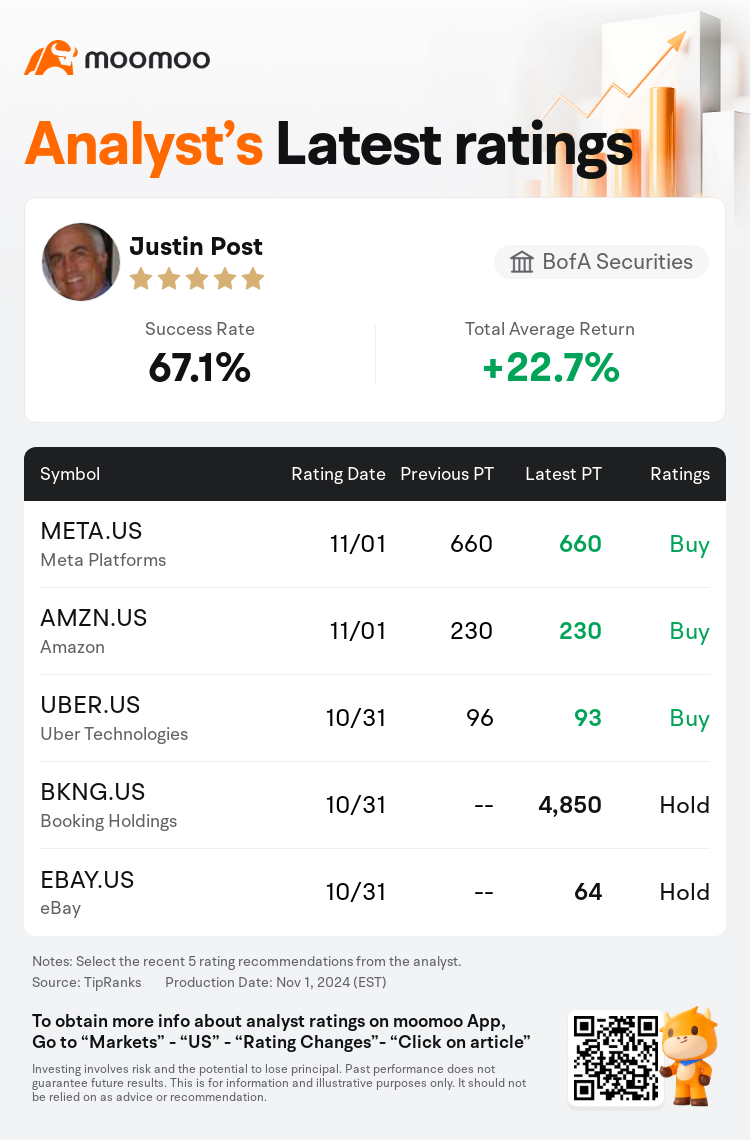

BofA Securities analyst Justin Post maintains $Meta Platforms (META.US)$ with a buy rating, and maintains the target price at $660.

According to TipRanks data, the analyst has a success rate of 67.1% and a total average return of 22.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Meta Platforms (META.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Meta Platforms (META.US)$'s main analysts recently are as follows:

Meta Platforms continues to indicate a substantial rise in capital expenditures planned for 2025. Nonetheless, the company has also revealed several factors that may counterbalance these investments, such as the anticipated increase in revenue growth starting in 2024, which is estimated at around $28 billion. Moreover, there's a possibility for advertisement revenue growth for 2026 and the years following, largely owing to the opportunity to generate additional revenue through new GenAI products.

The company's shares experienced a 3% decline following the third quarter results, despite a robust revenue forecast for the fourth quarter, due to anticipated substantial increases in capital expenditures and infrastructure-related costs for 2025. While acknowledging that the company's current emphasis may be less on immediate earnings and more on long-term potential, analysts have noted that the company has already realized significant advantages from AI in its principal advertising business. With a robust pipeline of products in development, including Meta AI and Llama, it's suggested that the company's solid foundation in revenue growth and a proven track record of execution provide it with the latitude to heavily invest in AI. Post-earnings report, revenue projections for 2025 and 2026 have been adjusted upward by 2% and 3%, respectively.

Following a third-quarter revenue and earnings per share outperformance along with a fourth-quarter outlook that aligns with market expectations, forecasts for 2025 revenue and earnings per share have been revised upwards. This adjustment is attributed to an increase in advertising monetization, balanced with an anticipated rise in research and development expenses for capital expenditures.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

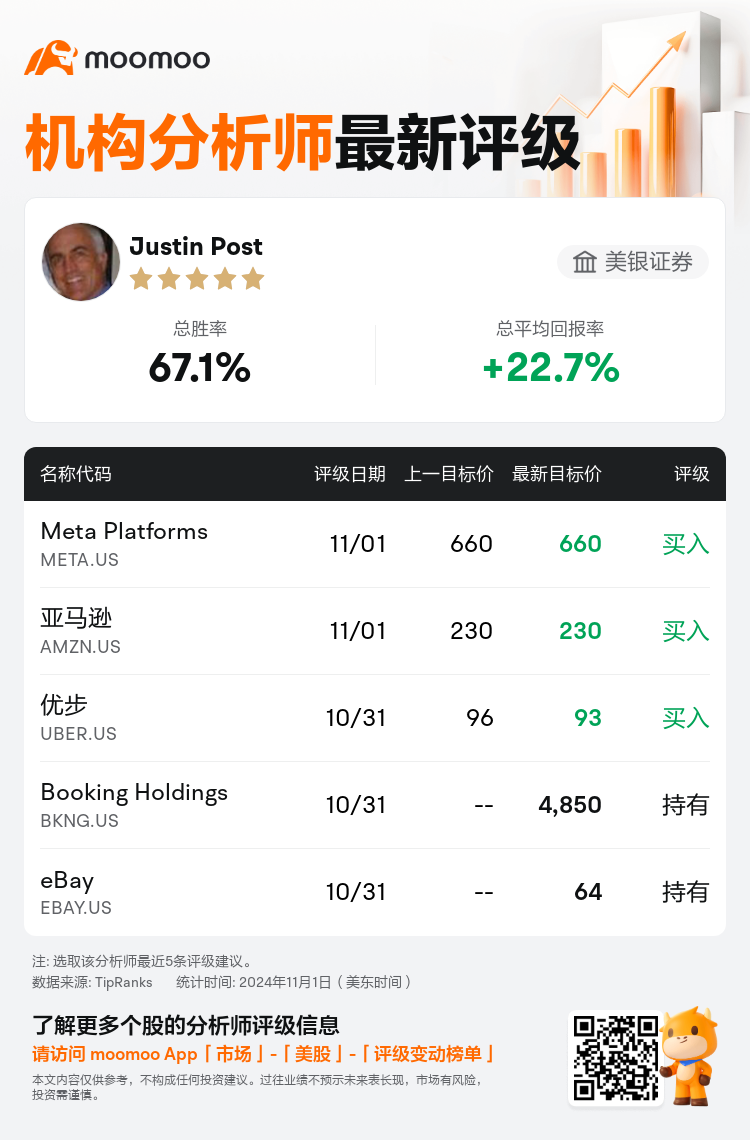

美银证券分析师Justin Post维持$Meta Platforms (META.US)$买入评级,维持目标价660美元。

根据TipRanks数据显示,该分析师近一年总胜率为67.1%,总平均回报率为22.7%。

此外,综合报道,$Meta Platforms (META.US)$近期主要分析师观点如下:

此外,综合报道,$Meta Platforms (META.US)$近期主要分析师观点如下:

Meta Platforms继续表示,计划于2025年进行的资本支出将大幅增加。尽管如此,该公司还透露了可能抵消这些投资的几个因素,例如预计从2024年开始的收入增长将增加,估计约为280亿美元。此外,2026年及以后几年的广告收入有可能增长,这主要是由于有机会通过新的GenAI产品创造额外收入。

尽管第四季度的收入预测强劲,但由于预计2025年资本支出和基础设施相关成本将大幅增加,该公司的股价在第三季度业绩公布后仍下跌了3%。分析师承认,该公司目前的重点可能与其说是眼前收益,不如说是长期潜力,但他们指出,该公司已经意识到人工智能在其主要广告业务中的巨大优势。随着包括Meta AI和Llama在内的强大产品线正在开发中,这表明该公司在收入增长方面的坚实基础和良好的执行记录为其提供了大量投资人工智能的自由度。财报发布后,2025年和2026年的收入预测分别向上调整了2%和3%。

继第三季度收入和每股收益跑赢大盘,以及与市场预期一致的第四季度展望之后,对2025年收入和每股收益的预测已向上修正。这一调整归因于广告货币化的增加,加上资本支出研发费用的预期增加。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Meta Platforms (META.US)$近期主要分析师观点如下:

此外,综合报道,$Meta Platforms (META.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of