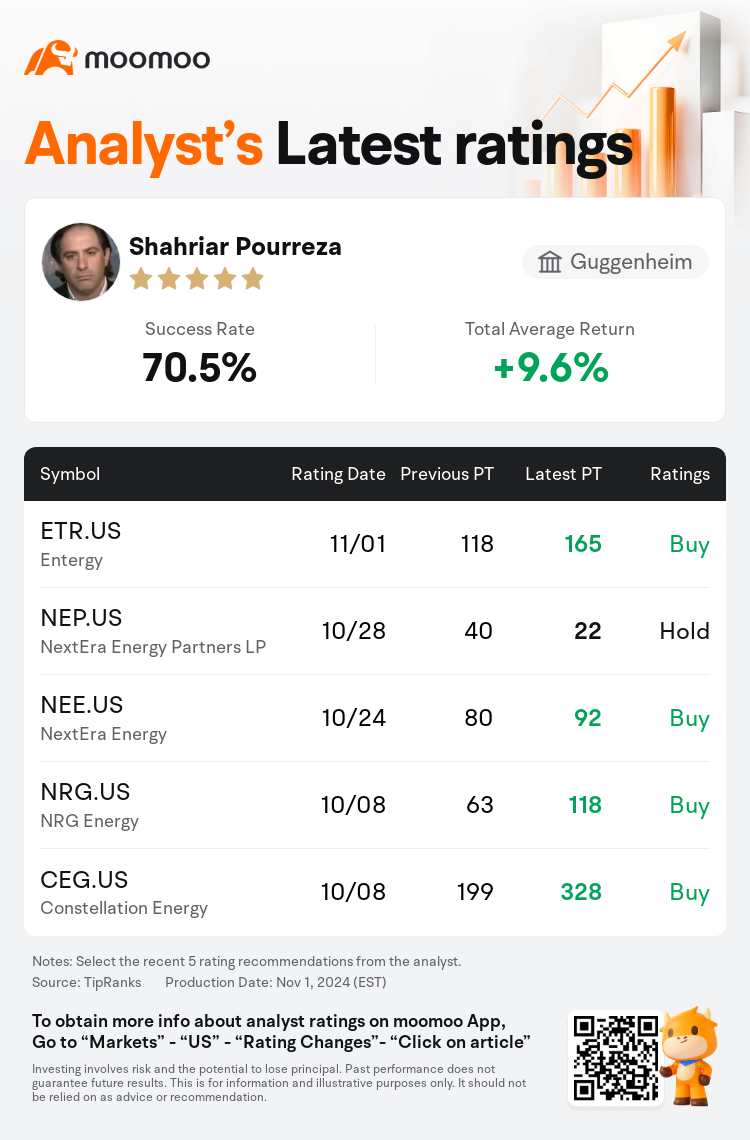

Guggenheim analyst Shahriar Pourreza maintains $Entergy (ETR.US)$ with a buy rating, and adjusts the target price from $118 to $165.

According to TipRanks data, the analyst has a success rate of 70.5% and a total average return of 9.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Entergy (ETR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Entergy (ETR.US)$'s main analysts recently are as follows:

Entergy's recent report of a Q3 EPS beat, alongside the adjustment of the lower end of the 2024 EPS guidance, and the provision of fundamental updates that lead to an early outlook for the 2026-2028 EPS target increasing to 8%-9%, demonstrates sustained fundamental strength. The company's top quartile EPS growth and conservative plan transition the Entergy investment narrative into one that may be considered a premium story.

Entergy delivered a substantial financial update. It has been noted that Entergy's notable industrial sales growth profile is distinctive and has not been fully recognized. A significant update alongside Q3 results was not expected. Entergy has escalated its 5-year capital expenditure plans by 20% and the earnings per share guidance ranges for 2026-2028 by 4%-9%, predominantly due to increased projected investments in transmission and generation.

Entergy has reaffirmed its 2024 guidance and anticipates a 6%-8% EPS growth rate extending into 2025. The company's long-term EPS compound annual growth rate is now projected to be between 8%-9%. This adjustment is supported by a significant uptick in the industrial sales forecast and an expanded capital plan, which is influenced by the arrival of a significant data center client and increased demand within the region. These developments support the ongoing positive outlook on Entergy's growth prospects, particularly given the substantial growth potential in its service areas.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

Guggenheim分析师Shahriar Pourreza维持$安特吉 (ETR.US)$买入评级,并将目标价从118美元上调至165美元。

根据TipRanks数据显示,该分析师近一年总胜率为70.5%,总平均回报率为9.6%。

此外,综合报道,$安特吉 (ETR.US)$近期主要分析师观点如下:

此外,综合报道,$安特吉 (ETR.US)$近期主要分析师观点如下:

Entergy最近报告称,第三季度每股收益超过预期,同时调整了2024年每股收益指引的下限,并提供了基本面更新,使2026-2028年每股收益目标的早期展望增至8%-9%,显示了持续的基本面走强。该公司前四分之一的每股收益增长和保守的计划将Entergy的投资叙述转变为可以被视为溢价的故事。

Entergy发布了重要的财务最新情况。有人指出,Entergy显著的工业销售增长状况与众不同,尚未得到充分认可。预计第三季度业绩不会有重大更新。Entergy已将其5年资本支出计划上调了20%,将2026-2028年的每股收益指导区间上调了4%-9%,这主要是由于预计对输电和发电的投资增加。

Entergy重申了其2024年的指导方针,并预计将持续到2025年的每股收益增长率为6%-8%。该公司的长期每股收益复合年增长率现在预计在8%-9%之间。这一调整得到了工业销售预测的大幅上升和资本计划的扩大的支持,后者受重要数据中心客户的到来和该地区需求增加的影响。这些事态发展支持了Entergy持续乐观的增长前景,特别是考虑到其服务领域的巨大增长潜力。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$安特吉 (ETR.US)$近期主要分析师观点如下:

此外,综合报道,$安特吉 (ETR.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of