On Nov 02, major Wall Street analysts update their ratings for $Estee Lauder (EL.US)$, with price targets ranging from $70 to $107.

Morgan Stanley analyst Dara Mohsenian maintains with a hold rating, and adjusts the target price from $100 to $85.

Goldman Sachs analyst Bonnie Herzog maintains with a hold rating, and adjusts the target price from $115 to $75.

J.P. Morgan analyst Andrea Faria Teixeira downgrades to a hold rating, and adjusts the target price from $113 to $74.

J.P. Morgan analyst Andrea Faria Teixeira downgrades to a hold rating, and adjusts the target price from $113 to $74.

BofA Securities analyst Bryan Spillane maintains with a hold rating, and adjusts the target price from $100 to $75.

UBS analyst Peter Grom maintains with a hold rating, and adjusts the target price from $104 to $74.

Furthermore, according to the comprehensive report, the opinions of $Estee Lauder (EL.US)$'s main analysts recently are as follows:

Estee Lauder's first quarter performance exceeded expectations, but this was overshadowed by second quarter guidance that didn't meet consensus, alongside the withdrawal of guidance for the second half and a reduction in dividends. An analyst notes that visibility is currently quite limited, and there is anticipation of potential changes in strategy and additional plans to improve productivity with the arrival of new leadership. It is believed that an expanded restructuring plan should be implemented to address the company's significant cost structure.

The expectation for Estee Lauder's dividend commitment to remain near a 40% payout ratio suggests a net income projection of $1.2 billion, or an earnings potential of $3.50 per share over time. The analyst believes it may be too soon to capitalize on the stock's recent decline, given the ongoing deceleration in China and the upcoming transition to a new CEO in January.

Estee Lauder has been experiencing ongoing sales declines and a lack of foreseeable clarity, prompting management to retract their financial guidance. The absence of clear direction is anticipated to persist for the upcoming quarter. Challenges stemming from diminished volumes in China and Asia's travel retail sector have led to operational leverage issues, suggesting a postponement in the execution of the company's strategy and potential returns. It is advisable for investors to look for more positive indicators of demand recovery before proceeding.

Despite previously set low expectations, Estee Lauder's fiscal first-quarter results and updated guidance fell short of forecasts, marked by the withdrawal of fiscal 2025 guidance, a second-quarter outlook that failed to meet expectations, and a reduced dividend. The stock is anticipated to experience a notable decline and may approach historical low points. The deteriorating trends in China and the absence of clear strategic direction from the soon-to-be CEO, Stephane de la Faverie, contribute to the uncertainty surrounding Estee Lauder's sales and earnings prospects.

Estee Lauder's recent earnings announcement was unexpectedly weak. Although Q1 results were roughly in line with expectations, management's Q2 forecast, withdrawal of guidance, and reduced dividend were seen as letdowns. Despite these challenges, it's believed that the stock's current valuation has significantly deviated from what's considered its fair value.

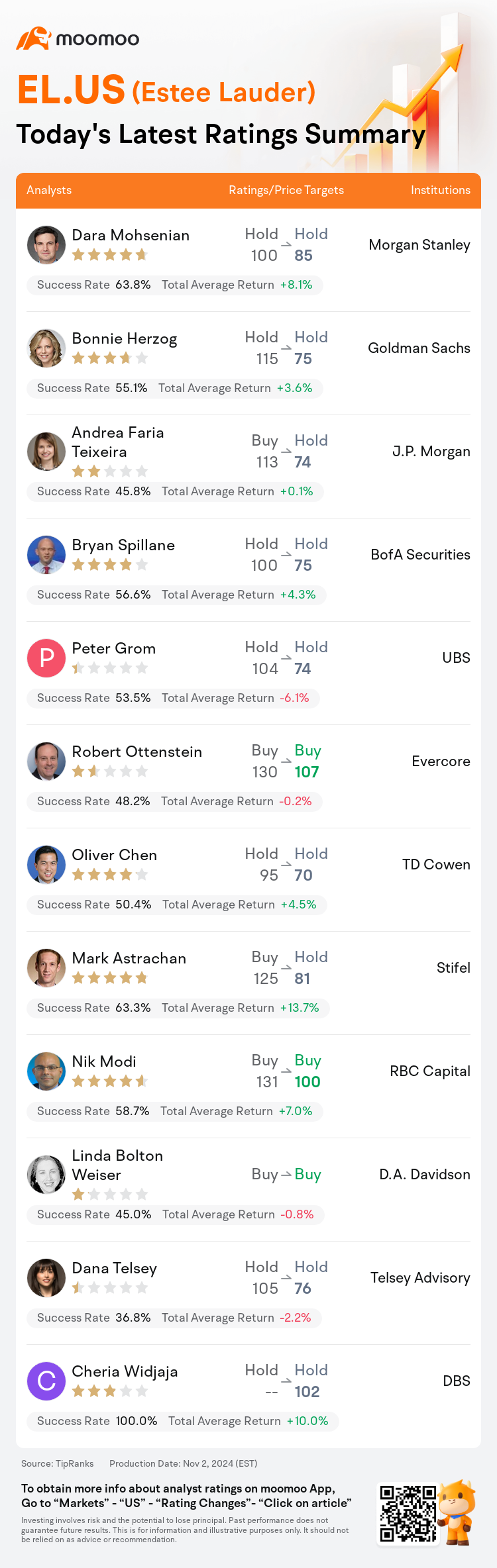

Here are the latest investment ratings and price targets for $Estee Lauder (EL.US)$ from 12 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月2日,多家华尔街大行更新了$雅诗兰黛 (EL.US)$的评级,目标价介于70美元至107美元。

摩根士丹利分析师Dara Mohsenian维持持有评级,并将目标价从100美元下调至85美元。

高盛集团分析师Bonnie Herzog维持持有评级,并将目标价从115美元下调至75美元。

摩根大通分析师Andrea Faria Teixeira下调至持有评级,并将目标价从113美元下调至74美元。

摩根大通分析师Andrea Faria Teixeira下调至持有评级,并将目标价从113美元下调至74美元。

美银证券分析师Bryan Spillane维持持有评级,并将目标价从100美元下调至75美元。

瑞士银行分析师Peter Grom维持持有评级,并将目标价从104美元下调至74美元。

此外,综合报道,$雅诗兰黛 (EL.US)$近期主要分析师观点如下:

雅诗兰黛的第一季度表现超出预期,但被第二季度的指引未达共识所掩盖,再加上第二半年的指引撤回和分红派息减少。一位分析师指出,目前可见度非常有限,预期随着新领导的到来,可能会有潜在策略变化和额外的提高生产力计划。人们认为应该实施扩大的重组计划,以解决公司庞大的成本结构问题。

预计雅诗兰黛的分红承诺将维持在40%左右的支付比率,这意味着净利润预计为12亿美元,或者随着时间推移,每股盈利潜力为3.50美元。分析师认为,鉴于中国的持续放缓和明年一月即将上任的新CEO,现在可能还为时过早抓住股票最近的下跌。

雅诗兰黛一直在经历持续的销售下滑和缺乏可预见性,促使管理层收回财务指引。缺乏明确方向预计会持续到下一个季度。由于中国和亚洲旅行零售行业销售量的下降引发了运营杠杆问题,提示公司策略和潜在回报的执行可能推迟。建议投资者在继续之前寻找更多需求恢复的积极因子。

尽管先前设定了较低预期,雅诗兰黛的财政第一季度业绩和更新后的指引仍未达预期,标志着撤回2025财年指引、第二季度展望未能达到预期以及分红减少。预计股票将经历显着下滑,并可能接近历史低点。中国的恶化趋势以及即将上任的CEO Stephane de la Faverie没有明确的战略方向,增加了对雅诗兰黛销售和盈利前景的不确定性。

雅诗兰黛最近的盈利公告出乎意料地疲软。尽管第一季度的业绩大致符合预期,但管理层对第二季度的预测、撤销指导以及降低分红派息被视为令人失望。尽管面临这些挑战,人们认为股票当前的估值已经明显偏离了被认为合理的价值。

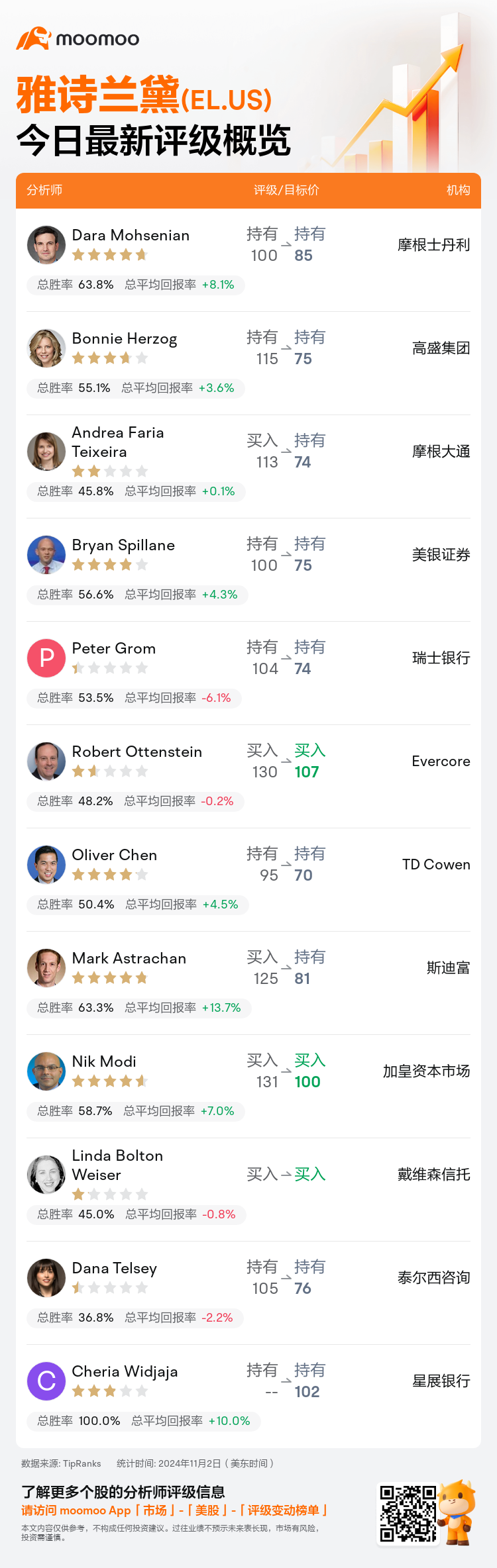

以下为今日12位分析师对$雅诗兰黛 (EL.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

摩根大通分析师Andrea Faria Teixeira下调至持有评级,并将目标价从113美元下调至74美元。

摩根大通分析师Andrea Faria Teixeira下调至持有评级,并将目标价从113美元下调至74美元。

J.P. Morgan analyst Andrea Faria Teixeira downgrades to a hold rating, and adjusts the target price from $113 to $74.

J.P. Morgan analyst Andrea Faria Teixeira downgrades to a hold rating, and adjusts the target price from $113 to $74.