On Nov 02, major Wall Street analysts update their ratings for $Onto Innovation (ONTO.US)$, with price targets ranging from $230 to $275.

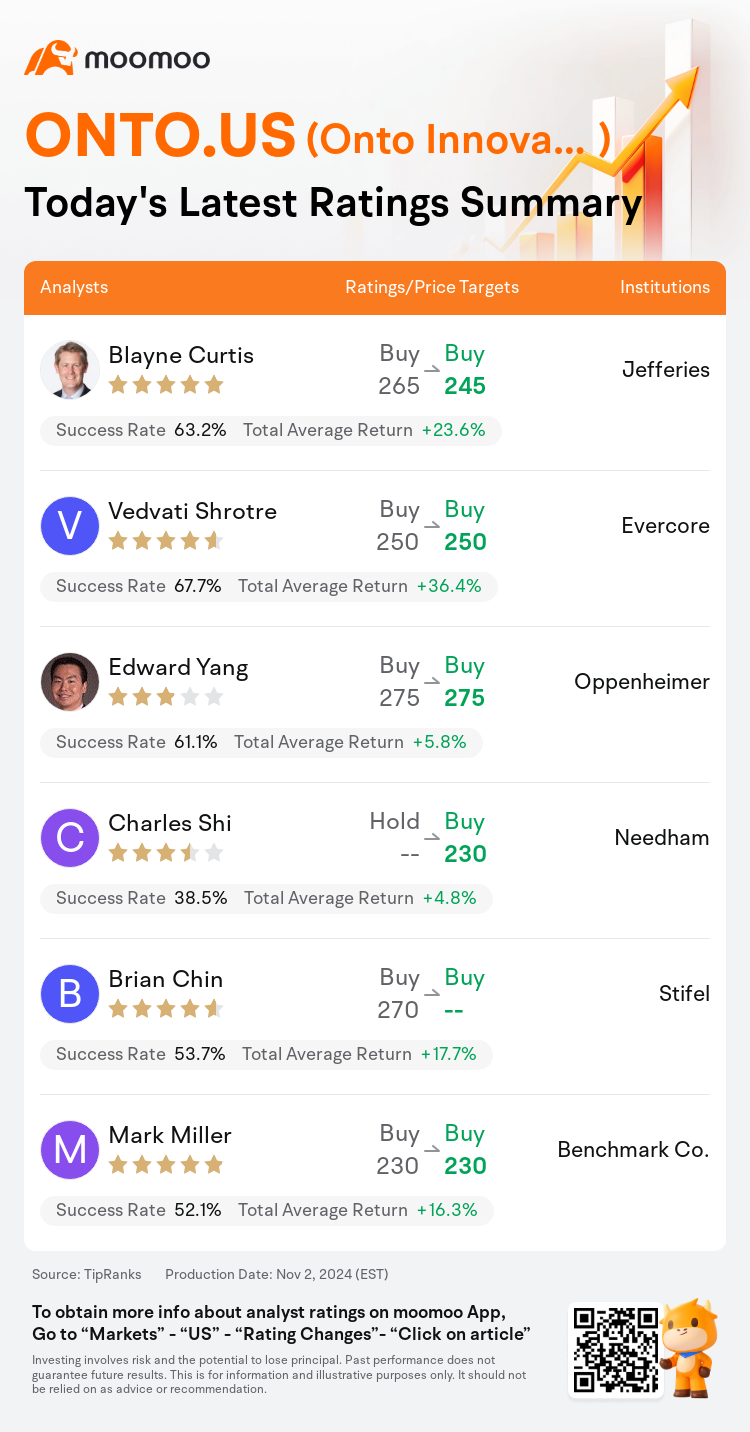

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $265 to $245.

Evercore analyst Vedvati Shrotre maintains with a buy rating, and maintains the target price at $250.

Oppenheimer analyst Edward Yang maintains with a buy rating, and maintains the target price at $275.

Oppenheimer analyst Edward Yang maintains with a buy rating, and maintains the target price at $275.

Needham analyst Charles Shi upgrades to a buy rating, and sets the target price at $230.

Stifel analyst Brian Chin maintains with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $Onto Innovation (ONTO.US)$'s main analysts recently are as follows:

The ongoing hiatus in HBM persists, yet the fortification provided by the robustness in advanced DRAM and Power Semiconductors assists in counterbalancing the ongoing postponement. It is posited that a resurgence to vigorous growth is likely to be merely a question of time.

Onto Innovation's Q3 revenue growth matched expectations, fueled by robust demand for Dragonfly, a resurgence in Advanced Nodes, and unprecedented power semiconductor performance. This was balanced by a $10M deferral in orders for JetStep Lithography. Despite increasing visibility in CoWos, Onto is cautiously not incorporating comparable incremental high bandwidth memory revenue, according to the analyst.

Onto Innovation's Q3 results modestly exceeded expectations, and the quarter might have shown a more significant outperformance if it were not for a shortfall in lithography shipments, as mentioned by an analyst. Looking ahead to 2025, the company's management expresses the greatest optimism for DRAM, with advanced logic and AI packaging also being areas of positive expectations.

Here are the latest investment ratings and price targets for $Onto Innovation (ONTO.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月2日,多家华尔街大行更新了$Onto Innovation (ONTO.US)$的评级,目标价介于230美元至275美元。

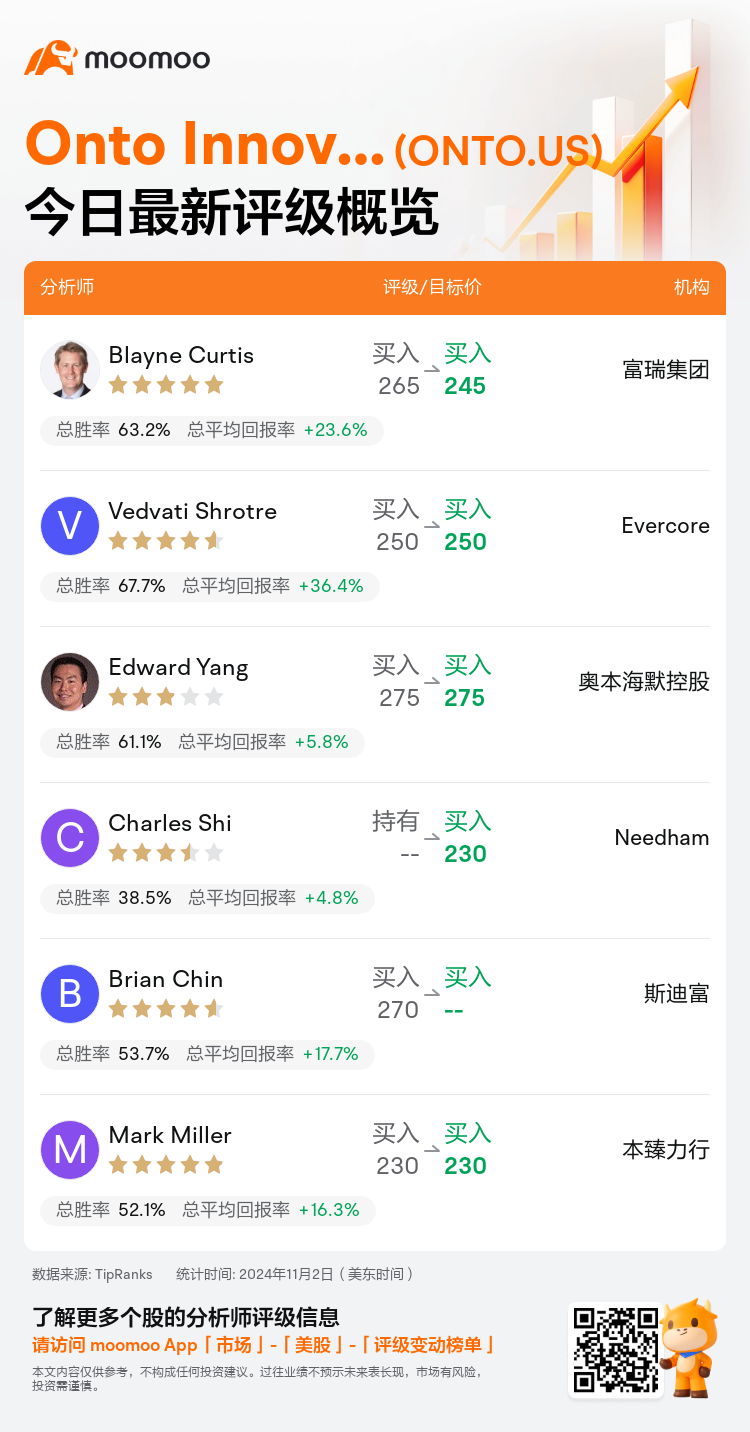

富瑞集团分析师Blayne Curtis维持买入评级,并将目标价从265美元下调至245美元。

Evercore分析师Vedvati Shrotre维持买入评级,维持目标价250美元。

奥本海默控股分析师Edward Yang维持买入评级,维持目标价275美元。

奥本海默控股分析师Edward Yang维持买入评级,维持目标价275美元。

Needham分析师Charles Shi上调至买入评级,目标价230美元。

斯迪富分析师Brian Chin维持买入评级。

此外,综合报道,$Onto Innovation (ONTO.US)$近期主要分析师观点如下:

HBm持续的中断仍在持续,但先进的DRAm和功率半导体的强劲表现有助于平衡持续的延迟。有人提出,恢复强劲增长很可能只是时间问题。

Onto Innovation的第三季度营业收入增长符合预期,受驱动蜻蜓Dragonfly的强劲需求、先进节点的复苏以及前所未有的功率半导体表现推动。这被JetStep光刻机订单1000万美元的推迟所抵消。尽管云外设(CoWos)的能见度增加,但根据分析师,Onto谨慎地没有将增量比较高带宽记忆收入纳入其中。

Onto Innovation的第三季度业绩略高于预期,如果没有光刻机出货量不足的问题(一位分析师提到),这一季可能会有更显著的业绩。展望2025年,公司管理层对DRAm表现出最大的乐观态度,先进逻辑和人工智能封装也是乐观预期的领域。

以下为今日6位分析师对$Onto Innovation (ONTO.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

奥本海默控股分析师Edward Yang维持买入评级,维持目标价275美元。

奥本海默控股分析师Edward Yang维持买入评级,维持目标价275美元。

Oppenheimer analyst Edward Yang maintains with a buy rating, and maintains the target price at $275.

Oppenheimer analyst Edward Yang maintains with a buy rating, and maintains the target price at $275.