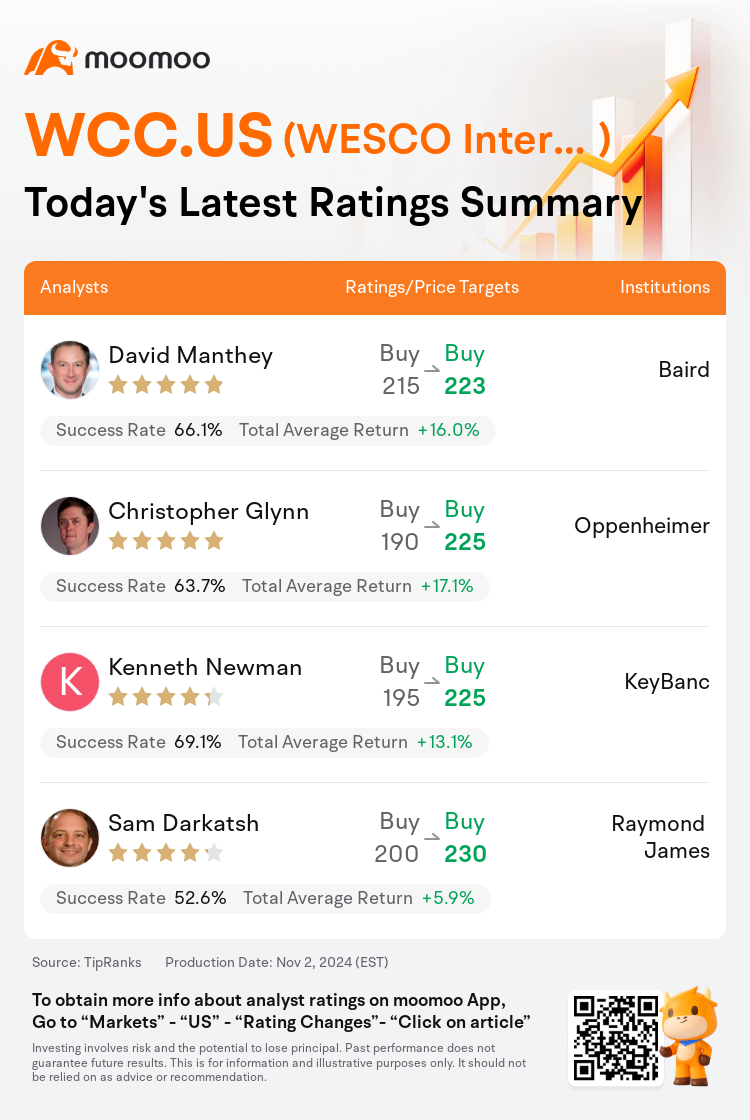

On Nov 02, major Wall Street analysts update their ratings for $WESCO International (WCC.US)$, with price targets ranging from $223 to $230.

Baird analyst David Manthey maintains with a buy rating, and adjusts the target price from $215 to $223.

Oppenheimer analyst Christopher Glynn maintains with a buy rating, and adjusts the target price from $190 to $225.

KeyBanc analyst Kenneth Newman maintains with a buy rating, and adjusts the target price from $195 to $225.

KeyBanc analyst Kenneth Newman maintains with a buy rating, and adjusts the target price from $195 to $225.

Raymond James analyst Sam Darkatsh maintains with a buy rating, and adjusts the target price from $200 to $230.

Furthermore, according to the comprehensive report, the opinions of $WESCO International (WCC.US)$'s main analysts recently are as follows:

Wesco's recent quarterly earnings surpassed expectations. The company's performance across various end markets remained relatively stable compared to the previous sequence, with sectors such as utility, broadband, industrial, and solar experiencing fluctuations but not deteriorating. Additionally, the firm's datacenter segment showcased a notable positive trend, achieving a remarkable 40% growth.

The firm indicated that the in-line results and guidance from Wesco were greeted with a notable relief rally. This reaction suggests that investors had braced for a potential shortfall or reduction in forecasts, as evidenced by the increased short interest leading up to the investor day.

The company's shares have shown outperformance subsequent to the third-quarter earnings surpass, which was propelled by robust results in the Data Center sector, more than compensating for the persisting softness in the Utility and Broadband segments. Analysts maintain a positive outlook on the company's potential to foster long-term expansion and consider it well-situated to capitalize on a number of secular growth trends that continue to demonstrate vigorous progress.

Here are the latest investment ratings and price targets for $WESCO International (WCC.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

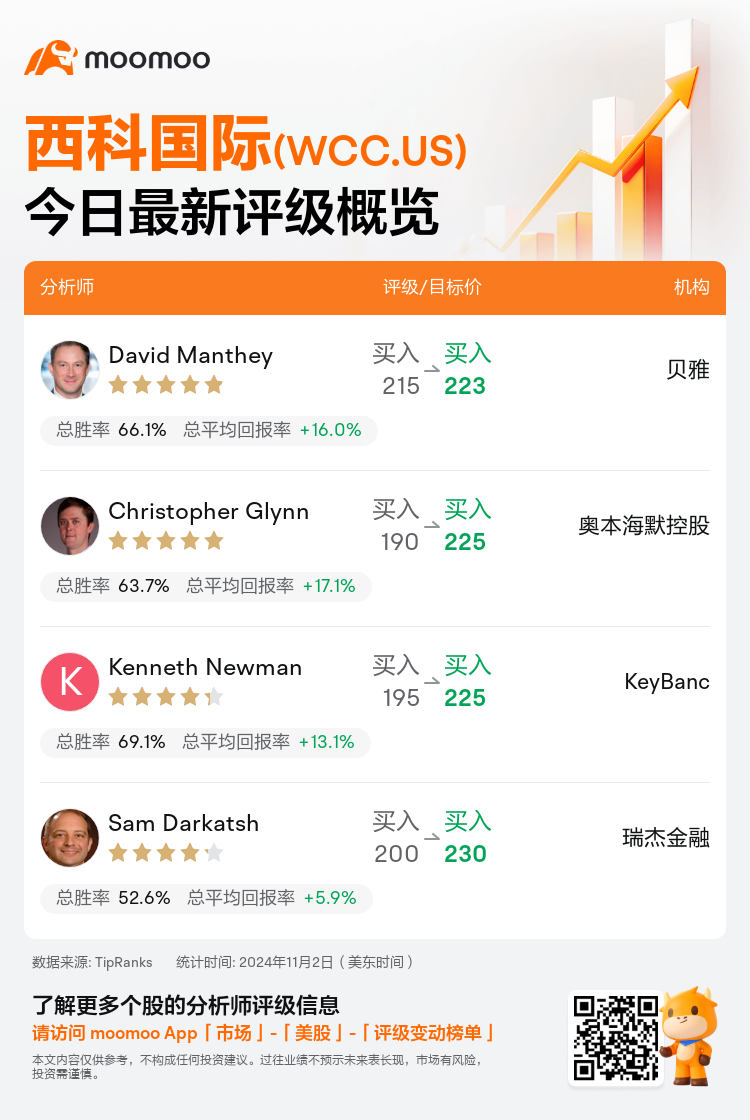

美东时间11月2日,多家华尔街大行更新了$西科国际 (WCC.US)$的评级,目标价介于223美元至230美元。

贝雅分析师David Manthey维持买入评级,并将目标价从215美元上调至223美元。

奥本海默控股分析师Christopher Glynn维持买入评级,并将目标价从190美元上调至225美元。

KeyBanc分析师Kenneth Newman维持买入评级,并将目标价从195美元上调至225美元。

KeyBanc分析师Kenneth Newman维持买入评级,并将目标价从195美元上调至225美元。

瑞杰金融分析师Sam Darkatsh维持买入评级,并将目标价从200美元上调至230美元。

此外,综合报道,$西科国际 (WCC.US)$近期主要分析师观点如下:

Wesco最近的季度收益超出了预期。与上一个周期相比,公司在各个终端市场的表现相对稳定,公用事业、宽带、工业和太阳能等板块出现波动但未恶化。此外,公司的数据中心板块展现出明显的积极趋势,实现了令人瞩目的40%增长。

公司表示,市场对Wesco的业绩和指引的正面回应令人鼓舞。这一反应表明投资者已经做好准备迎接潜在的缺口或减少预测,正如投资者日临近时增加的空头持仓所证实的那样。

公司股票自第三季度超预期收益后表现出色,这得益于数据中心板块强劲的业绩,更多地弥补了公用事业和宽带板块持续疲软的局面。分析师对该公司长期拓展潜力持有积极展望,并认为它有很好的机会利用一系列持续表现强劲的结构增长趋势。

以下为今日4位分析师对$西科国际 (WCC.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

KeyBanc分析师Kenneth Newman维持买入评级,并将目标价从195美元上调至225美元。

KeyBanc分析师Kenneth Newman维持买入评级,并将目标价从195美元上调至225美元。

KeyBanc analyst Kenneth Newman maintains with a buy rating, and adjusts the target price from $195 to $225.

KeyBanc analyst Kenneth Newman maintains with a buy rating, and adjusts the target price from $195 to $225.