Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (SZSE:300760) Stock Goes Ex-Dividend In Just Two Days

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (SZSE:300760) Stock Goes Ex-Dividend In Just Two Days

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (SZSE:300760) stock is about to trade ex-dividend in two days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Thus, you can purchase Shenzhen Mindray Bio-Medical Electronics' shares before the 7th of November in order to receive the dividend, which the company will pay on the 7th of November.

迈瑞医疗股票将在两天后开始控件。 分红除权日比纪录日早一天,该日为股东需要在公司账簿上登记以收取分红的截止日。 分红除权日很重要,因为任何股票交易都必须在纪录日之前结算,才有资格获得分红。 因此,您可以在11月7日之前购买迈瑞医疗的股票,以便在11月7日收到公司支付的分红。

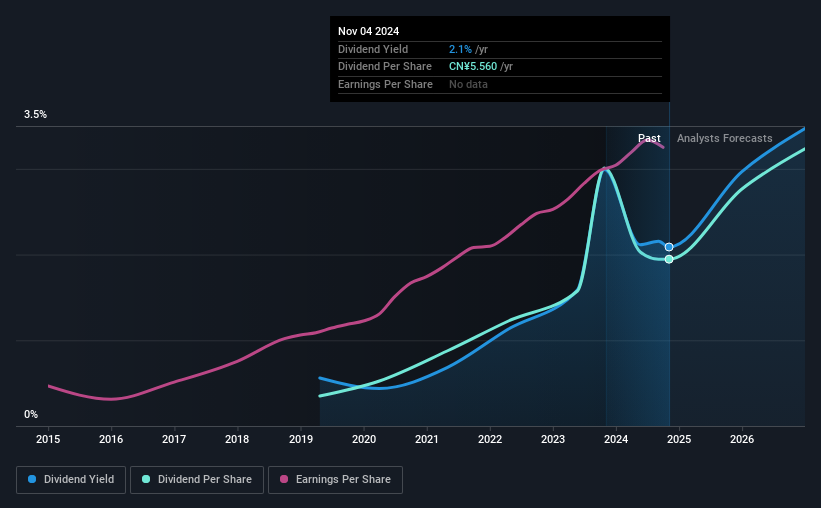

The company's upcoming dividend is CN¥1.65 a share, following on from the last 12 months, when the company distributed a total of CN¥5.56 per share to shareholders. Last year's total dividend payments show that Shenzhen Mindray Bio-Medical Electronics has a trailing yield of 2.1% on the current share price of CN¥266.25. If you buy this business for its dividend, you should have an idea of whether Shenzhen Mindray Bio-Medical Electronics's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

公司即将派息1.65人民币每股,继续自上一年分配总额为5.56人民币每股的情况。 去年的总分红显示,迈瑞医疗在当前每股价格266.25人民币上的滚动收益率为2.1%。 如果您购买此业务是为了获得分红,您应该了解迈瑞医疗的分红是否可靠且可持续。 因此,我们需要检查分红支付是否得到覆盖以及收益是否增长。

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Shenzhen Mindray Bio-Medical Electronics paid out 71% of its earnings to investors last year, a normal payout level for most businesses. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out 98% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Cash flows are usually much more volatile than earnings, so this could be a temporary effect - but we'd generally want to look more closely here.

分红通常来自公司收益。如果一家公司支付的分红超过了其利润,那么分红可能是不可持续的。 迈瑞医疗去年向投资者支付了其收入的71%,这是大多数企业的正常分红水平。 然而,现金流通通常比利润更重要,用于评估分红的可持续性,因此我们应始终检查公司是否产生足够的现金来支付其分红。 去年,该公司以其自由现金流的98%形式支付了分红,这对大多数企业来说超出了舒适区。 现金流通通常比利润更具波动性,因此这可能是暂时影响-但我们通常会更仔细地审查这里。

While Shenzhen Mindray Bio-Medical Electronics's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were Shenzhen Mindray Bio-Medical Electronics to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

虽然迈瑞医疗的分红得到了公司报告的利润的支持,但现金更为重要,因此看到该公司未能产生足够现金支付其分红并不是好事。 众所周知,现金为王,如果迈瑞医疗反复支付未能被现金流覆盖的分红,我们会认为这是一个警告信号。

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

点击此处查看公司的支付比率以及未来分红的分析师预期。

Have Earnings And Dividends Been Growing?

收益和股息一直在增长吗?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's comforting to see Shenzhen Mindray Bio-Medical Electronics's earnings have been skyrocketing, up 25% per annum for the past five years. Earnings have been growing quickly, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

业务增长前景强劲的企业通常是最佳的分红派息者,因为当每股收益提高时,增加分红更容易。投资者热衷于分红,所以如果收益下滑,分红减少,股票也将会大幅抛售。因此,看到迈瑞医疗的收益一直在飙升,过去五年年均增长25%,这让人感到欣慰。收益增长迅速,但我们担忧去年分红支付占据了公司大部分现金流。

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, six years ago, Shenzhen Mindray Bio-Medical Electronics has lifted its dividend by approximately 33% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

大多数投资者评估公司的分红前景的主要方式是查看历史分红增长率。自我们的数据开始六年前以来,迈瑞医疗每年分红平均增长约33%。看到过去几年收益和每股分红都迅速增长令人振奋。

Final Takeaway

最后的结论

From a dividend perspective, should investors buy or avoid Shenzhen Mindray Bio-Medical Electronics? Earnings per share growth is a positive, and the company's payout ratio looks normal. However, we note Shenzhen Mindray Bio-Medical Electronics paid out a much higher percentage of its free cash flow, which makes us uncomfortable. In summary, it's hard to get excited about Shenzhen Mindray Bio-Medical Electronics from a dividend perspective.

从分红派息的角度来看,投资者应该买入还是避开迈瑞医疗?每股收益增长是积极的,公司的派息比率看起来正常。然而,我们注意到迈瑞医疗支付了较高比例的自由现金流,这让我们感到不安。总的来说,从分红派息的角度看,很难对迈瑞医疗感到兴奋。

So if you want to do more digging on Shenzhen Mindray Bio-Medical Electronics, you'll find it worthwhile knowing the risks that this stock faces. Our analysis shows 1 warning sign for Shenzhen Mindray Bio-Medical Electronics and you should be aware of this before buying any shares.

因此,如果您希望对迈瑞医疗进行更深入的研究,了解这支股票面临的风险是值得的。我们的分析显示迈瑞医疗有1个警示信号,您在购买任何股份之前应该意识到这一点。

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

一般来说,我们不建议仅仅购买第一个股息股票。下面是一个经过策划的有趣的、股息表现良好的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

While Shenzhen Mindray Bio-Medical Electronics's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were Shenzhen Mindray Bio-Medical Electronics to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

While Shenzhen Mindray Bio-Medical Electronics's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were Shenzhen Mindray Bio-Medical Electronics to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.