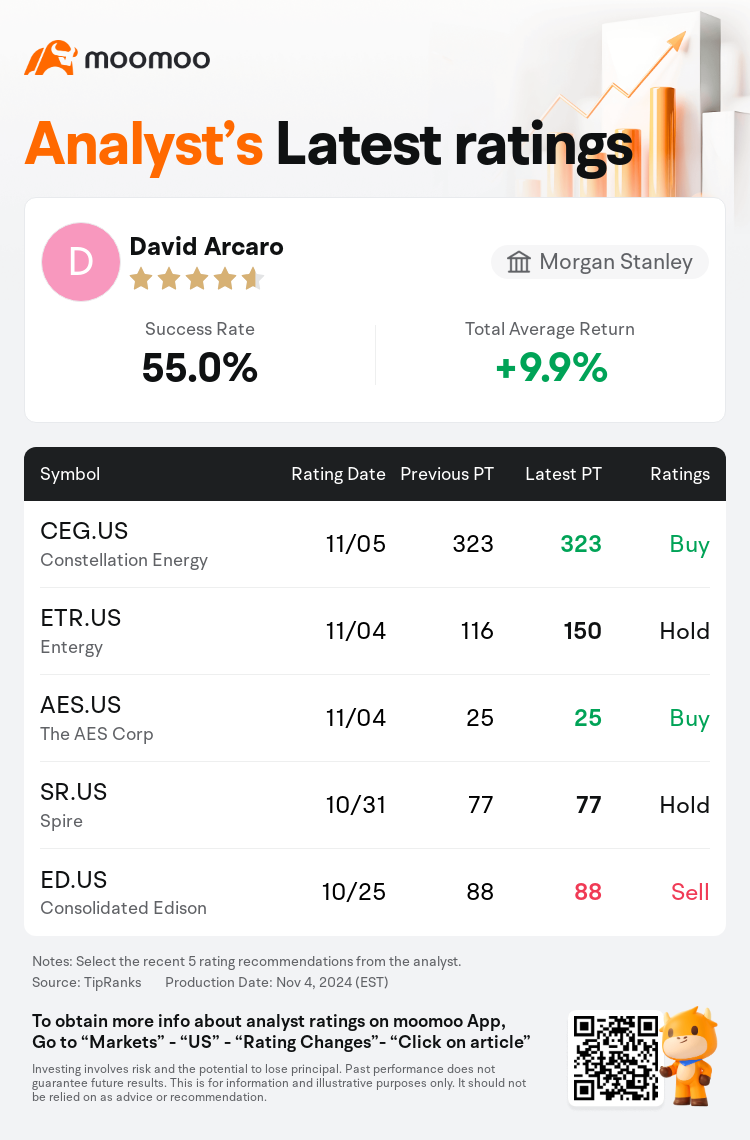

Morgan Stanley analyst David Arcaro upgrades $Entergy (ETR.US)$ to a hold rating, and adjusts the target price from $116 to $150.

According to TipRanks data, the analyst has a success rate of 55.0% and a total average return of 9.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Entergy (ETR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Entergy (ETR.US)$'s main analysts recently are as follows:

Entergy has revised its strategic business plan, revealing an increased forecast for capital expenditures, sales growth, EPS guidance, and an enhanced EPS growth rate. Additionally, the company has announced a service agreement with a significant Louisiana customer, necessitating the construction of three new combined cycle units. They are also exploring the development of nuclear units. While the updated strategy is acknowledged for its potential to create value, it also introduces execution risks, which are noted alongside the current valuation.

The company is now perceived to have a more favorable growth and risk outlook, with industrial sales contributing to an earnings increase that surpasses its peers at a rate of 8%-9%. Additionally, regulatory concerns in Louisiana have reached a resolution that was more positive than anticipated. Despite the ongoing structural challenges posed by hurricane risk, the current valuation of the shares presents a more equitable balance of risk and reward.

Following a robust quarter, the company has explored the potential to incorporate carbon capture and nuclear technology into its fleet, aiming to cater to the significant load growth in its service area.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

摩根士丹利分析师David Arcaro上调$安特吉 (ETR.US)$至持有评级,并将目标价从116美元上调至150美元。

根据TipRanks数据显示,该分析师近一年总胜率为55.0%,总平均回报率为9.9%。

此外,综合报道,$安特吉 (ETR.US)$近期主要分析师观点如下:

此外,综合报道,$安特吉 (ETR.US)$近期主要分析师观点如下:

Entergy修改了其战略业务计划,透露了对资本支出、销售增长、每股收益指导以及每股收益增长率的提高的预测。此外,该公司还宣布与路易斯安那州的一家重要客户签订服务协议,因此需要建造三个新的联合循环装置。他们还在探索发展核装置。尽管更新后的策略因其创造价值的潜力而获得认可,但它也引入了执行风险,这些风险与当前估值一起显示。

现在,人们认为该公司的增长和风险前景更为乐观,工业销售推动的收益增长超过了同行,增长率为8%-9%。此外,路易斯安那州的监管问题已经达成了一项比预期更为积极的解决方案。尽管飓风风险带来了持续的结构性挑战,但目前的股票估值在风险和回报之间提供了更加公平的平衡。

在经历了强劲的季度之后,该公司探索了将碳捕集和核技术纳入其机队的可能性,旨在满足其服务领域的显著负荷增长。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$安特吉 (ETR.US)$近期主要分析师观点如下:

此外,综合报道,$安特吉 (ETR.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of