Those Who Invested in Texas Capital Bancshares (NASDAQ:TCBI) a Year Ago Are up 35%

Those Who Invested in Texas Capital Bancshares (NASDAQ:TCBI) a Year Ago Are up 35%

It's always best to build a diverse portfolio of shares, since any stock business could lag the broader market. But if you're going to beat the market overall, you need to have individual stocks that outperform. Texas Capital Bancshares, Inc. (NASDAQ:TCBI) has done well over the last year, with the stock price up 35% beating the market return of 31% (not including dividends). Having said that, the longer term returns aren't so impressive, with stock gaining just 22% in three years.

建立多样化的股票组合总是最好的选择,因为任何股票业务都有可能落后于整个市场。但如果你想要在整体上击败市场,你需要拥有表现优异的个别股票。纳斯达克上的texas capital bancshares公司(NASDAQ:TCBI)在过去一年表现不错,股价上涨了35%,超过了市场回报率31%(不包括分红)。话虽如此,长期回报并不那么令人印象深刻,股价仅在三年内增长了22%。

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

现在值得更详细地了解该公司的基本面,因为这将帮助我们判断长期股东回报是否与基础业务的表现相匹配。

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

在他的文章《格雷厄姆和道德斯维尔的超级投资者》中,沃伦·巴菲特描述了股价并不总是理性反映公司价值的方式。检查市场情绪如何随时间变化的一种方式是查看公司股价与每股收益(EPS)之间的互动。

Over the last twelve months, Texas Capital Bancshares actually shrank its EPS by 97%.

过去十二个月,texas capital bancshares实际上将其每股收益下降了97%。

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

这意味着市场可能没有以盈利增长为基础来评价该公司。事实上,当每股收益下降但股价上涨时,通常意味着市场正在考虑其他因素。

Texas Capital Bancshares' revenue actually dropped 35% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

德克萨斯州首都银行股份公司的营业收入实际上比去年下降了35%。因此,仅使用关键业务指标的快照不能让我们清楚地了解市场为何在抬高此股。

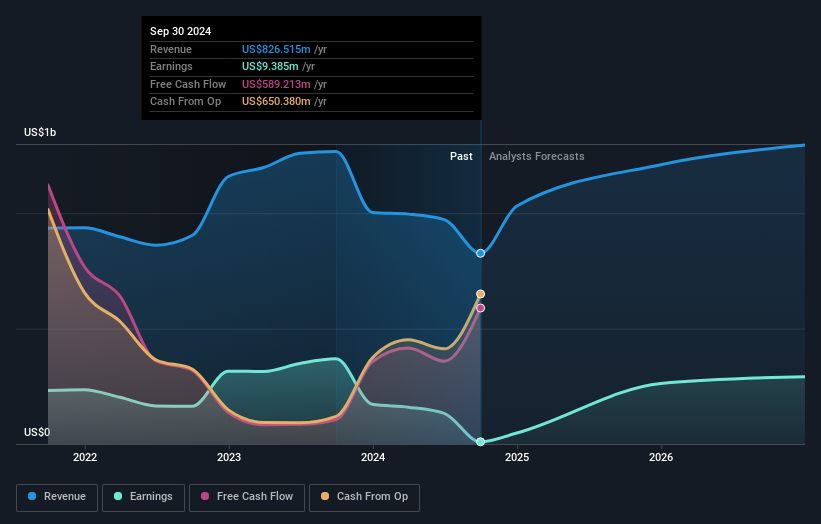

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

您可以看到以下收益和营收的变化情况(通过单击图像了解精确值)。

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Texas Capital Bancshares stock, you should check out this free report showing analyst profit forecasts.

我们认为内部人士在过去一年中大笔购买股份是积极的。即便如此,未来的盈利将更为重要,决定当前股东是否赚钱。如果你正考虑买入或卖出德克萨斯州首都银行股份公司的股票,你应该查看这份免费报告,其中展示了分析师的盈利预测。

A Different Perspective

另一种看法

Texas Capital Bancshares provided a TSR of 35% over the year. That's fairly close to the broader market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 5%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. It's always interesting to track share price performance over the longer term. But to understand Texas Capital Bancshares better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Texas Capital Bancshares , and understanding them should be part of your investment process.

德克萨斯州首都银行股份公司提供了一年中35%的投资回报率。 这与更广泛市场的回报率相当接近。多数人会对收益感到满意,有益的是,该年度回报实际上比过去五年的平均回报率提高了5%。即使股价放缓,管理层的远见可能会带来未来的增长。 跟踪股价表现长期来看总是很有趣。但要更好地了解德克萨斯州首都银行股份公司,我们需要考虑许多其他因素。比如,永远存在的投资风险之神。我们已经确认了德克萨斯州首都银行股份公司的一个警示信号,理解这些信号应该是你的投资过程的一部分。

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

如果您喜欢与管理层共同购买股票,那么您可能会喜欢这个免费的公司列表(提示:大多数公司没有受到关注)。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

请注意,本文所引述的市场回报反映了目前在美国交易所上市的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

Over the last twelve months, Texas Capital Bancshares actually shrank its EPS by 97%.

Over the last twelve months, Texas Capital Bancshares actually shrank its EPS by 97%.