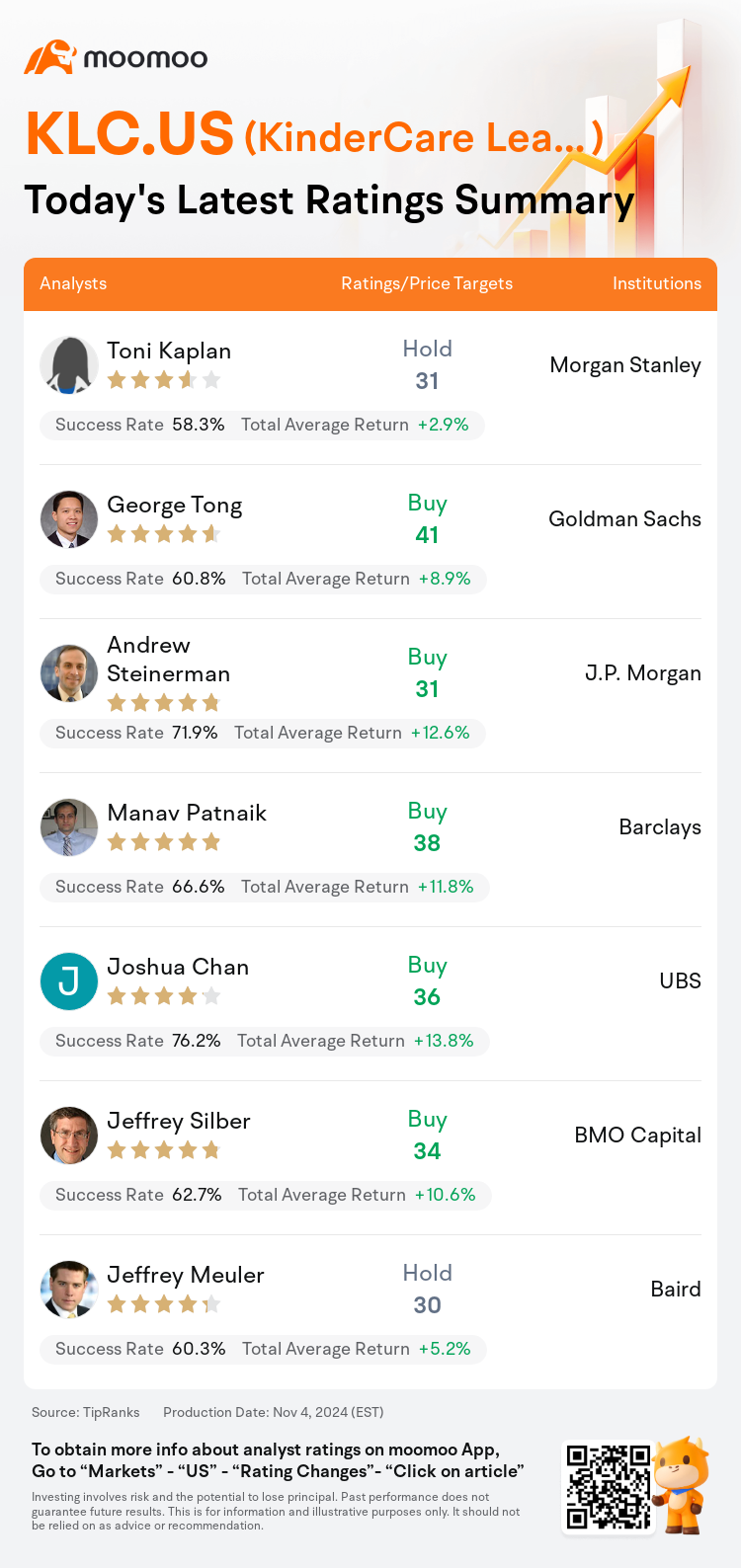

On Nov 04, major Wall Street analysts update their ratings for $KinderCare Learning Companies (KLC.US)$, with price targets ranging from $30 to $41.

Morgan Stanley analyst Toni Kaplan initiates coverage with a hold rating, and sets the target price at $31.

Goldman Sachs analyst George Tong initiates coverage with a buy rating, and sets the target price at $41.

J.P. Morgan analyst Andrew Steinerman initiates coverage with a buy rating, and sets the target price at $31.

J.P. Morgan analyst Andrew Steinerman initiates coverage with a buy rating, and sets the target price at $31.

Barclays analyst Manav Patnaik initiates coverage with a buy rating, and sets the target price at $38.

UBS analyst Joshua Chan initiates coverage with a buy rating, and sets the target price at $36.

Furthermore, according to the comprehensive report, the opinions of $KinderCare Learning Companies (KLC.US)$'s main analysts recently are as follows:

KinderCare Learning, recognized as the largest U.S. provider in the early childhood education industry, is at a pivotal moment where the management team can concentrate on future growth. It is positioned advantageously to attract and retain educators compared to smaller entities.

KinderCare Learning is anticipated to experience annual EBITDA growth of 13%-14% through 2026, influenced by gradual enrollment increases, tuition fees rising faster than wage inflation, and a modest contribution from acquisitions. It is projected that the company's EBITDA margins will enhance, going from 10.6% in 2024 to 12.0% in 2026. This improvement is expected to contribute to a significant upside in the company's shares over the forthcoming year.

As a prominent provider of premium early childcare education, KinderCare is poised to capitalize on the evident childcare requirements in the U.S. The company, with its significant total addressable market of $76B and pricing power, is on a path to profitable growth.

The company is recognized for being the largest day-care center provider in the U.S. and is anticipated to experience mid-single-digit revenue growth. Despite this, the current stock valuation is considered to be reasonable.

KinderCare Learning, recognized as the largest provider of early childhood education services in the U.S., has the capacity to serve more than 210,000 children through its extensive network of 2,500 centers and sites. The company's emphasis on community-based child care centers sets it apart and is anticipated to propel occupancy growth alongside tuition hikes.

Here are the latest investment ratings and price targets for $KinderCare Learning Companies (KLC.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月4日,多家华尔街大行更新了$KinderCare Learning Companies (KLC.US)$的评级,目标价介于30美元至41美元。

摩根士丹利分析师Toni Kaplan首予持有评级,目标价31美元。

高盛集团分析师George Tong首予买入评级,目标价41美元。

摩根大通分析师Andrew Steinerman首予买入评级,目标价31美元。

摩根大通分析师Andrew Steinerman首予买入评级,目标价31美元。

巴克莱银行分析师Manav Patnaik首予买入评级,目标价38美元。

瑞士银行分析师Joshua Chan首予买入评级,目标价36美元。

此外,综合报道,$KinderCare Learning Companies (KLC.US)$近期主要分析师观点如下:

KinderCare Learning被认为是美国早期儿童教育行业中最大的提供商,现在是一个关键时刻,管理团队可以专注于未来的增长。与较小的实体相比,它占据了有利位置,有利于吸引和留住教育工作者。

KinderCare Learning预计到2026年经历13%-14%的年度EBITDA增长,受逐步增加的入学人数、学费涨幅快于工资通胀以及收购的适度贡献影响。预计公司的EBITDA利润率将增加,从2024年的10.6%增至2026年的12.0%。这一改善预计将在未来一年内为公司股价带来显著上涨。

作为一家知名的优质早期儿童教育提供商,KinderCare有望利用美国明显的儿童保育需求。该公司拥有高达760亿美元的巨大潜在市场和定价权力,正在走向盈利增长之路。

该公司被认为是美国最大的托儿中心提供商,并预计将经历适度一位数的营业收入增长。尽管如此,目前的股票估值被认为是合理的。

KinderCare Learning被认为是美国最大的提供早期儿童教育服务的提供商,通过其拥有的2500个中心和场所的庞大网络,有能力为超过21万名儿童提供服务。该公司重视社区为基础的儿童保育中心,这使其与众不同,并预计会推动占用率随着学费上涨而增长。

以下为今日7位分析师对$KinderCare Learning Companies (KLC.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

摩根大通分析师Andrew Steinerman首予买入评级,目标价31美元。

摩根大通分析师Andrew Steinerman首予买入评级,目标价31美元。

J.P. Morgan analyst Andrew Steinerman initiates coverage with a buy rating, and sets the target price at $31.

J.P. Morgan analyst Andrew Steinerman initiates coverage with a buy rating, and sets the target price at $31.