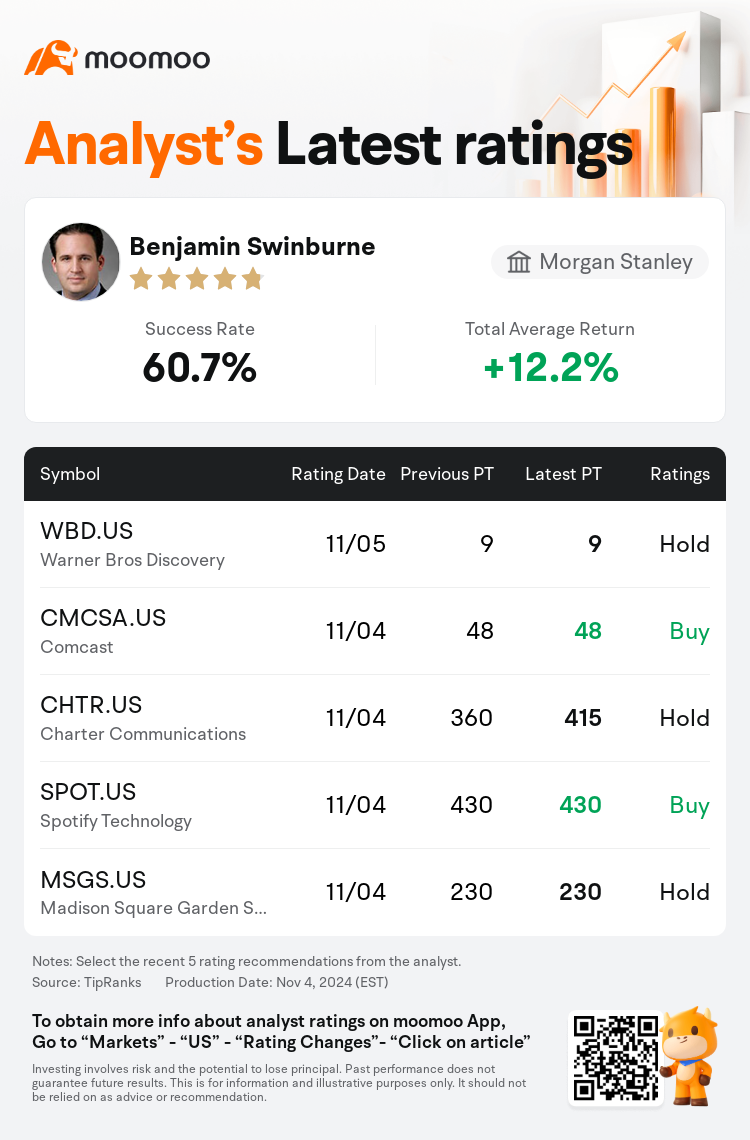

Morgan Stanley analyst Benjamin Swinburne maintains $Comcast (CMCSA.US)$ with a buy rating, and maintains the target price at $48.

According to TipRanks data, the analyst has a success rate of 60.7% and a total average return of 12.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Comcast (CMCSA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Comcast (CMCSA.US)$'s main analysts recently are as follows:

The firm considers Comcast's Q3 report to be 'encouraging,' but believes that a spinoff of the networks would not have a significant impact.

The third quarter results for Comcast did not materially alter the investment thesis, but highlighted several positives. Among the key updates was the company's contemplation of divesting certain assets from NBCUniversal's cable networks division. Although the potential scope of this divestiture may be more limited than some investors might wish, it represents a notable strategic pivot for a company that has historically emphasized the synergies between its divisions. This development suggests a willingness from management to reconsider the future of mature assets that confront secular headwinds, while still prioritizing investment in its primary areas of growth.

The firm commented on Comcast's favorable 3Q24 outcomes, noting improvements despite increased Broadband losses, attributing the success to a combination of better-than-expected ACP non-pay reserve results, revenue from the Olympics, and the company's announcement of potential plans to investigate the separation of its cable networks.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

摩根士丹利分析师Benjamin Swinburne维持$康卡斯特 (CMCSA.US)$买入评级,维持目标价48美元。

根据TipRanks数据显示,该分析师近一年总胜率为60.7%,总平均回报率为12.2%。

此外,综合报道,$康卡斯特 (CMCSA.US)$近期主要分析师观点如下:

此外,综合报道,$康卡斯特 (CMCSA.US)$近期主要分析师观点如下:

该公司认为康卡斯特的第三季度报告 “令人鼓舞”,但认为分拆这些网络不会产生重大影响。

康卡斯特第三季度的业绩并没有实质性地改变投资论点,但凸显了几个积极方面。关键更新之一是该公司正在考虑从NBCUniversal的有线电视网络部门剥离某些资产。尽管此次剥离的潜在范围可能比某些投资者预期的要有限,但对于一家历来强调各部门协同效应的公司来说,这是一个值得注意的战略支点。这一事态发展表明,管理层愿意重新考虑面临长期不利因素的成熟资产的未来,同时仍然优先投资于其主要增长领域。

该公司对康卡斯特在24年第三季度取得的良好业绩发表了评论,指出尽管宽带损失有所增加,但仍有所改善,这归因于ACP非薪准备金业绩好于预期、奥运会收入以及该公司宣布可能计划调查有线电视网络分离情况。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$康卡斯特 (CMCSA.US)$近期主要分析师观点如下:

此外,综合报道,$康卡斯特 (CMCSA.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of