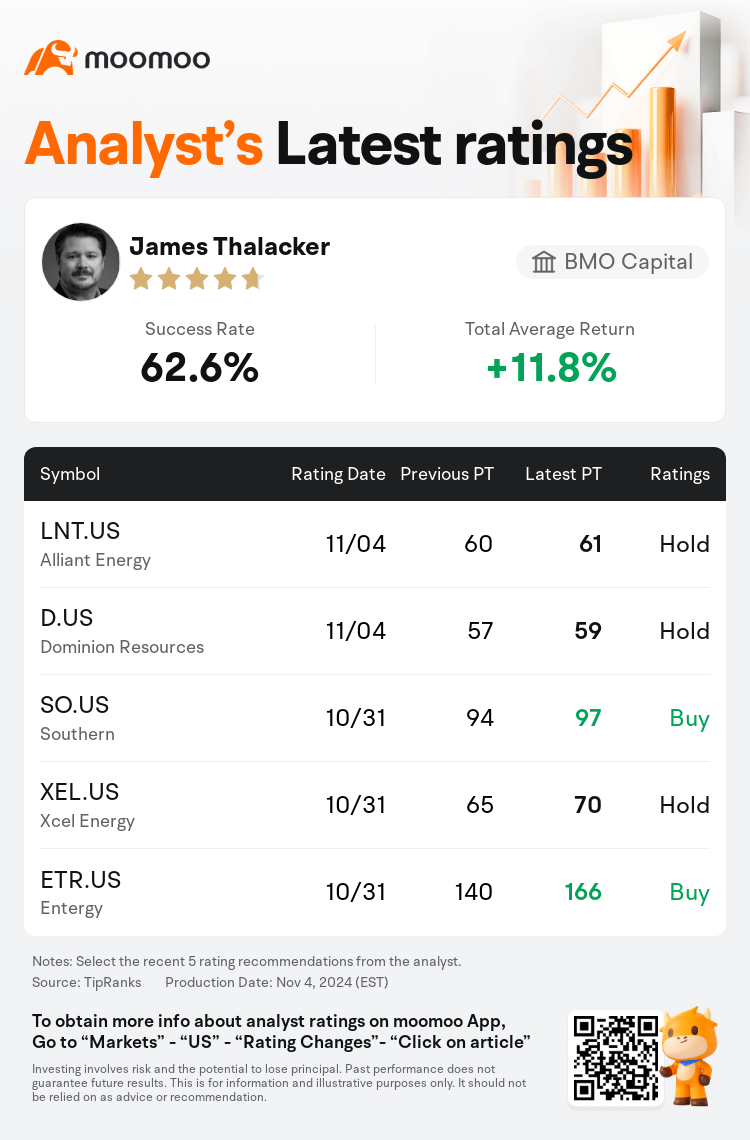

BMO Capital analyst James Thalacker maintains $Alliant Energy (LNT.US)$ with a hold rating, and adjusts the target price from $60 to $61.

According to TipRanks data, the analyst has a success rate of 62.6% and a total average return of 11.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Alliant Energy (LNT.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Alliant Energy (LNT.US)$'s main analysts recently are as follows:

Alliant Energy experienced a mixed quarter with a Q3 earnings beat but a less than favorable outlook for FY25. The reduction in the 2024 outlook took investors by surprise, a sentiment primarily driven by the combined effects of weather-related challenges and non-recurring factors, which are expected to normalize by 2025. Additionally, Alliant's management predictions are on the cautious side, allowing for the possibility of future positive revisions.

A revision in the 2024 EPS forecast and the choice to base the 5%-7% EPS CAGR on the lower mid-point slightly overshadowed what was an otherwise substantial capex update. Analysts suggest investors focus beyond the short-term disturbances.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

BMO资本市场分析师James Thalacker维持$美国联合能源 (LNT.US)$持有评级,并将目标价从60美元上调至61美元。

根据TipRanks数据显示,该分析师近一年总胜率为62.6%,总平均回报率为11.8%。

此外,综合报道,$美国联合能源 (LNT.US)$近期主要分析师观点如下:

此外,综合报道,$美国联合能源 (LNT.US)$近期主要分析师观点如下:

Alliant Energy经历了喜忧参半的季度,第三季度的收益超过预期,但25财年的前景并不乐观。2024年展望的下调令投资者大吃一惊,这种情绪主要是由与天气相关的挑战和非经常性因素的综合影响所驱动的,预计到2025年这些因素将恢复正常。此外,Alliant的管理层预测持谨慎态度,这使得未来有可能进行积极修正。

对2024年每股收益预测的修订以及选择将5%-7%的每股收益复合年增长率建立在较低的中点基础上,略微掩盖了原本可观的资本支出更新。分析师认为,投资者关注的不仅仅是短期动荡。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$美国联合能源 (LNT.US)$近期主要分析师观点如下:

此外,综合报道,$美国联合能源 (LNT.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of