Understanding Adobe's Position In Software Industry Compared To Competitors

Understanding Adobe's Position In Software Industry Compared To Competitors

In the ever-evolving and intensely competitive business landscape, conducting a thorough company analysis is of utmost importance for investors and industry followers. In this article, we will carry out an in-depth industry comparison, assessing Adobe (NASDAQ:ADBE) alongside its primary competitors in the Software industry. By meticulously examining key financial metrics, market positioning, and growth prospects, we aim to offer valuable insights to investors and shed light on company's performance within the industry.

在不断发展和竞争激烈的商业环境中,进行彻底的公司分析对投资者和行业追随者至关重要。在本文中,我们将进行深入的行业比较,评估Adobe(纳斯达克: ADBE)与软件行业主要竞争对手的情况。通过精心检查关键财务指标、市场定位和增长前景,我们旨在为投资者提供有价值的见解,并充分了解公司在行业内的表现。

Adobe Background

Adobe背景

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing, and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Adobe 提供内容创作、文档管理和数字营销和广告软件及服务,为创意专业人士和营销人员创建、管理、交付、衡量、优化和参与多种操作系统、设备和媒体的引人入胜的内容。公司有三个板块:数字媒体内容创作、数字营销解决方案的数字体验和出版的传统产品(营业收入不到 5%)。

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Adobe Inc | 40.88 | 14.61 | 10.46 | 11.46% | $2.31 | $4.85 | 10.59% |

| Salesforce Inc | 51.34 | 4.89 | 7.92 | 2.44% | $2.79 | $7.17 | 8.39% |

| SAP SE | 92.53 | 6.08 | 7.56 | 3.53% | $2.71 | $6.21 | 9.38% |

| Intuit Inc | 59.61 | 9.45 | 10.84 | -0.11% | $0.13 | $2.4 | 17.4% |

| Palantir Technologies Inc | 246.59 | 23.18 | 40.17 | 3.43% | $0.11 | $0.55 | 27.15% |

| Synopsys Inc | 53.45 | 10.33 | 12.45 | 5.49% | $0.46 | $1.24 | 12.65% |

| Cadence Design Systems Inc | 74.23 | 16.95 | 17.71 | 5.4% | $0.41 | $1.05 | 18.81% |

| Workday Inc | 41.23 | 7.59 | 8.16 | 1.6% | $0.28 | $1.57 | 16.68% |

| Autodesk Inc | 58.72 | 24.96 | 10.69 | 12.17% | $0.39 | $1.36 | 11.9% |

| Roper Technologies Inc | 39.86 | 3.13 | 8.62 | 2.01% | $0.69 | $1.19 | 2.78% |

| AppLovin Corp | 69.88 | 67.08 | 14.48 | 39.35% | $0.51 | $0.8 | 43.98% |

| Datadog Inc | 262.26 | 17.26 | 18.96 | 1.9% | $0.06 | $0.52 | 26.66% |

| Ansys Inc | 57.20 | 5.06 | 12.20 | 2.37% | $0.2 | $0.52 | 19.64% |

| Tyler Technologies Inc | 110.19 | 7.88 | 12.56 | 2.37% | $0.12 | $0.24 | 9.84% |

| Zoom Video Communications Inc | 27 | 2.73 | 5.16 | 2.6% | $0.23 | $0.88 | 2.09% |

| PTC Inc | 75.52 | 7.37 | 10.05 | 2.32% | $0.13 | $0.41 | -4.37% |

| Manhattan Associates Inc | 75.31 | 58.09 | 16.09 | 24.6% | $0.08 | $0.15 | 11.84% |

| Dynatrace Inc | 103.98 | 7.79 | 10.85 | 1.89% | $0.06 | $0.32 | 19.93% |

| Average | 88.17 | 16.46 | 13.2 | 6.67% | $0.55 | $1.56 | 14.99% |

| 公司 | 市销率P/S | 净资产收益率ROE | 息税前收入EBITDA (以十亿计) | 毛利润 (以十亿计) | 营收增长 | CrowdStrike Holdings Inc (847.84) | 营业收入增长 |

|---|---|---|---|---|---|---|---|

| adobe 公司 | 40.88 | 14.61 | 10.46 | 11.46% | $2.31 | $4.85 | 10.59% |

| Salesforce 公司 | 51.34 | 4.89 | 7.92%,截至2024年3月31日三个月期内。 | 2.44% | $2.79 | 7.17美元 | 8.39% |

| sap se | 92.53 | 6.08 | 7.56 | 3.53% | $2.71 | $6.21 | 9.38% |

| Intuit 公司 | 59.61 | 9.45 | 10.84 | -0.11% | 0.13元 | $2.4 | 17.4% |

| palantir科技公司 | 246.59 | 这些限制性股票单元的中位数结算周期为约3年。 | 40.17 | 3.43% | $0.11 | $0.55 | 27.15% |

| Synopsys 公司 | 53.45 | 10.33 | 12.45 | 5.49% | $0.46 | $1.24 | 12.65% |

| 铿腾电子股份有限公司 | 74.23 | 16.95 | 占比17.71% | 5.4% | $0.41 | $1.05 | 18.81% |

| Workday公司 | 41.23 | 7.59 | 8.16 | 1.6% | $0.28 | $1.57 | 16.68% |

| 欧特克公司 | 58.72 | 24.96 | 10.69 | 12.17% | 0.39美元 | $1.36 | 11.9% |

| 儒博实业股份有限公司 | 39.86 | 3.13 | 8.62 | 2.01% | $0.69 | $1.19 | 2.78% |

| AppLovin公司 | 69.88 | 67.08 | 14.48 | 39.35% | $0.51 | $0.8 | 43.98% |

| datadog | 262.26 | 17.26 | 18.96 | 1.9% | 0.06美元 | 0.52美元 | 26.66% |

| 安泽斯公司 | 57.20 | 5.06 | 12.20 | 2.37% | $0.2 | 0.52美元 | 19.64% |

| Tyler Technologies公司 | 110.19 | 7.88 | 12.56 | 2.37% | $0.12 | 0.24美元 | 9.84% |

| zoom视频通讯公司 | 27 | 2.73 | 5.16 | 2.6% | $0.23 | $0.88 | 2.09% |

| PTC公司 | 75.52 | 7.37 | 10.05 | 2.32% | 0.13元 | $0.41 | -4.37% |

| Manhattan Associates公司 | 75.31 | 58.09 | 16.09 | 24.6% | 0.08美元 | 0.15美元 | 11.84% |

| dynatrace公司 | 103.98 | 7.79 | 10.85 | 1.89% | 0.06美元 | 0.32美元 | 19.93% |

| 平均数 | 88.17 | 16.46 | 13.2 | 6.67% | $0.55 | 1.56美元 | 14.99% |

After thoroughly examining Adobe, the following trends can be inferred:

对adobe进行了彻底的检查,可以得出以下趋势:

The Price to Earnings ratio of 40.88 is 0.46x lower than the industry average, indicating potential undervaluation for the stock.

With a Price to Book ratio of 14.61, significantly falling below the industry average by 0.89x, it suggests undervaluation and the possibility of untapped growth prospects.

The Price to Sales ratio is 10.46, which is 0.79x the industry average. This suggests a possible undervaluation based on sales performance.

The Return on Equity (ROE) of 11.46% is 4.79% above the industry average, highlighting efficient use of equity to generate profits.

The Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $2.31 Billion is 4.2x above the industry average, highlighting stronger profitability and robust cash flow generation.

The gross profit of $4.85 Billion is 3.11x above that of its industry, highlighting stronger profitability and higher earnings from its core operations.

The company's revenue growth of 10.59% is significantly lower compared to the industry average of 14.99%. This indicates a potential fall in the company's sales performance.

市盈率为40.88,比行业平均水平低0.46倍,表明该股有潜在的低估价值。

市净率为14.61,明显低于行业平均水平0.89倍,暗示可能存在低估价值和未开发的增长前景。

市销率为10.46,是行业平均水平的0.79倍。这表明可能存在基于销售业绩的低估价值。

11.46%的净资产收益率(ROE)高出行业平均水平4.79%,突显了有效利用股权创造利润。

23.1亿美元的息税折旧及摊销前利润(EBITDA)是行业平均水平的4.2倍,突显更强的盈利能力和稳健的现金流量产生。

48.5亿美元的毛利润高出行业平均水平3.11倍,突显更强的盈利能力和核心业务收入更高。

公司的营业收入增长10.59%,明显低于行业平均水平的14.99%。这表明公司销售业绩可能出现下滑。

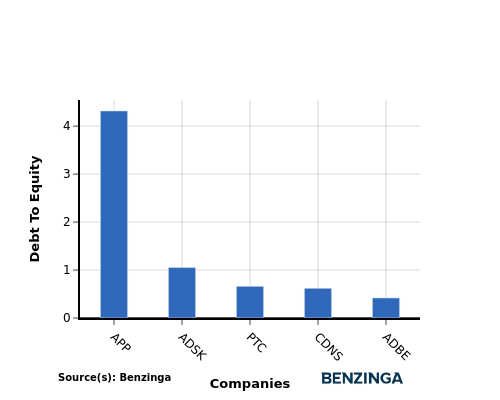

Debt To Equity Ratio

债务权益比率

The debt-to-equity (D/E) ratio is a key indicator of a company's financial health and its reliance on debt financing.

负债股权比率(D/E)是衡量公司财务健康状况及其债务融资依赖程度的关键指标。

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

在行业比较中考虑债务权益比率可以简明地评估公司的财务状况和风险特征,有助于投资者做出明智的决策。

In terms of the Debt-to-Equity ratio, Adobe stands in comparison with its top 4 peers, leading to the following comparisons:

在负债与股权比率方面,Adobe与其前4家同行公司进行了比较,从而得出以下比较:

Adobe has a stronger financial position compared to its top 4 peers, as evidenced by its lower debt-to-equity ratio of 0.42.

This suggests that the company has a more favorable balance between debt and equity, which can be perceived as a positive indicator by investors.

与其前四位同行相比,adobe财务状况更加强劲,其市净率较低,为0.42。

这表明公司在债务和股本之间有一个更有利的平衡,这可能被投资者视为一个积极的指标。

Key Takeaways

要点

For Adobe in the Software industry, the PE, PB, and PS ratios are all low compared to peers, indicating potential undervaluation. On the other hand, Adobe's high ROE, EBITDA, and gross profit suggest strong profitability and operational efficiency. However, the low revenue growth rate may raise concerns about future performance compared to industry peers.

对于软件行业的adobe来说,市盈率、市净率和市销率都较低,表明潜在的低估价。另一方面,adobe的高roe、ebitda和毛利润显示出强劲的盈利能力和运营效率。然而,低营业收入增长率可能会引发对未来绩效与行业同行的担忧。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动化内容引擎生成并由编辑审查。

The Price to Earnings ratio of

The Price to Earnings ratio of