Decoding Visa's Options Activity: What's the Big Picture?

Decoding Visa's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on Visa. Our analysis of options history for Visa (NYSE:V) revealed 21 unusual trades.

金融巨头在Visa上做出了显著的看淡举动。我们对Visa(纽约证券交易所:V)期权历史进行分析后发现了21笔飞凡交易。

Delving into the details, we found 38% of traders were bullish, while 57% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $318,204, and 12 were calls, valued at $602,127.

深入细节,我们发现38%的交易者持有看好态度,而57%展现出看淡倾向。我们发现的所有交易中,有9笔看跌交易,价值318,204美元,有12笔看涨交易,价值602,127美元。

Predicted Price Range

预测价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $250.0 and $335.0 for Visa, spanning the last three months.

在评估交易量和未平仓头寸后,明显看到主要市场搬动者将重点放在Visa的价格区间250.0美元至335.0美元之间,跨越过去三个月。

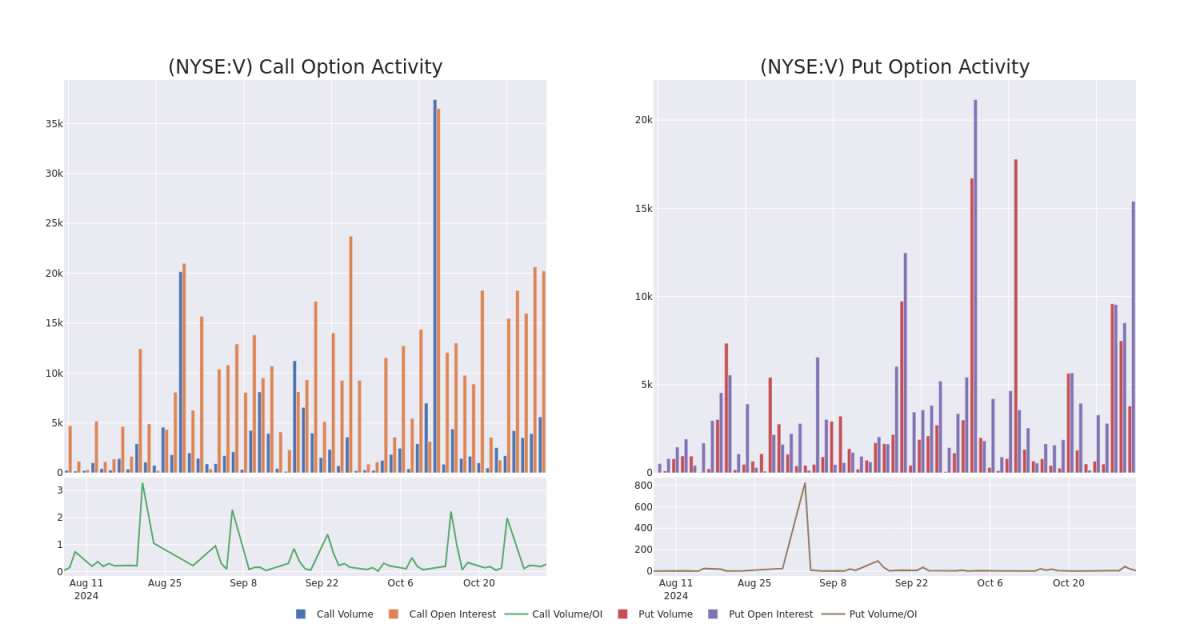

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Visa's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Visa's whale trades within a strike price range from $250.0 to $335.0 in the last 30 days.

观察成交量和未平仓头寸对于期权交易而言是一个强大的举措。这些数据可以帮助您跟踪Visa特定行权价的期权流动性和利益。在以下内容中,我们可以观察Visa所有的大宗交易中涵盖行权价范围从250.0美元至335.0美元的所有看涨和看跌交易分别的成交量和未平仓头寸的演变,在过去的30天内。

Visa 30-Day Option Volume & Interest Snapshot

Visa 30天期权成交量和未平仓合约快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| V | CALL | SWEEP | BEARISH | 01/17/25 | $12.5 | $12.4 | $12.4 | $290.00 | $120.2K | 3.6K | 29 |

| V | CALL | TRADE | BEARISH | 01/17/25 | $45.3 | $44.9 | $44.9 | $250.00 | $112.2K | 3.9K | 50 |

| V | CALL | SWEEP | BEARISH | 01/17/25 | $45.75 | $45.3 | $45.3 | $250.00 | $81.5K | 3.9K | 18 |

| V | PUT | SWEEP | BEARISH | 09/19/25 | $8.45 | $8.4 | $8.43 | $260.00 | $72.5K | 248 | 127 |

| V | PUT | SWEEP | BULLISH | 01/16/26 | $47.5 | $47.15 | $47.15 | $335.00 | $47.1K | 0 | 10 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| V | 看涨 | SWEEP | 看淡 | 01/17/25 | $12.5 | $12.4 | $12.4 | $290.00 | $120.2K | 3.6千 | 29 |

| V | 看涨 | 交易 | 看淡 | 01/17/25 | $45.3 | $44.9 | $44.9 | $250.00 | $112.2K | 3.9K | 50 |

| V | 看涨 | SWEEP | 看淡 | 01/17/25 | $45.75 | $45.3 | $45.3 | $250.00 | $81.5K | 3.9K | 18 |

| V | 看跌 | SWEEP | 看淡 | 09/19/25 | 8.45美元 | $8.4 | $8.43 | $260.00 | $72.5K | 248 | 127 |

| V | 看跌 | SWEEP | 看好 | 01/16/26 | $47.5 | $47.15 | $47.15 | 335.00美元 | $47.1K | 0 | 10 |

About Visa

关于Visa

Visa is the largest payment processor in the world. In fiscal 2023, it processed almost $15 trillion in total volume. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second.

Visa是世界上最大的支付处理器。在2023财年,它的总成交量接近15万亿美元。Visa在200多个国家和地区开展业务,并可以处理来自160多种货币的交易。其系统每秒可处理超过65000笔交易。

After a thorough review of the options trading surrounding Visa, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对Visa周边的期权交易进行全面审查之后,我们将深入研究该公司。包括对其当前市场地位和表现的评估。

Present Market Standing of Visa

Visa目前的市场地位

- With a trading volume of 1,186,919, the price of V is up by 0.45%, reaching $292.06.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 80 days from now.

- 交易量为1,186,919,V的价格上涨0.45%,达到292.06美元。

- 当前RSI值表明股票可能已经超买。

- 下次收益报告将在80天后发布。

What Analysts Are Saying About Visa

关于Visa的分析师观点

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $326.2.

过去30天内,共有5位专业分析师对这支股票进行了评估,设定了平均目标价格为$326.2。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Visa, targeting a price of $322. * Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Visa, targeting a price of $326. * An analyst from Citigroup has decided to maintain their Buy rating on Visa, which currently sits at a price target of $326. * Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Visa, targeting a price of $322. * An analyst from Macquarie has decided to maintain their Outperform rating on Visa, which currently sits at a price target of $335.

20年期权交易专家揭示了他的一行图表技术,显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击这里获取更多信息。* 保持立场,派杰投资的分析师继续维持对Visa的超配评级,目标价格为$322。* 保持立场,摩根士丹利的分析师继续维持对Visa的超配评级,目标价格为$326。* 花旗集团的分析师决定维持对Visa的买入评级,目标价格为$326。* 保持立场,RBC资本的分析师继续维持对Visa的跑赢评级,目标价格为$322。* 麦格理的分析师决定维持对Visa的跑赢评级,目标价格为$335。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Visa options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在的回报。明智的交易者通过不断地学习、调整他们的策略、监控多个因子,并密切关注市场变化来管理这些风险。通过Benzinga Pro实时提醒,了解最新的维萨期权交易。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Visa's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Visa's whale trades within a strike price range from $250.0 to $335.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Visa's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Visa's whale trades within a strike price range from $250.0 to $335.0 in the last 30 days.