Salesforce Unusual Options Activity For November 04

Salesforce Unusual Options Activity For November 04

Deep-pocketed investors have adopted a bearish approach towards Salesforce (NYSE:CRM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CRM usually suggests something big is about to happen.

深谋远虑的投资者对Salesforce (纽交所:CRM) 采取了看淡的态度,市场参与者不应忽视此举。我们在Benzinga跟踪公开期权记录时揭示了这一重大举动。这些投资者的身份尚未确定,但CRM的如此大规模的行为通常意味着即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 27 extraordinary options activities for Salesforce. This level of activity is out of the ordinary.

我们从观察到的情况中获取了这些信息,当Benzinga的期权扫描器突出显示了27个赛富时的非凡期权活动。这种活跃程度是非同寻常的。

The general mood among these heavyweight investors is divided, with 29% leaning bullish and 59% bearish. Among these notable options, 12 are puts, totaling $1,405,948, and 15 are calls, amounting to $832,944.

这些重量级投资者中,普遍心情分歧,有29%看好和59%看淡。在这些显著的期权中,有12个看跌,总额为$1,405,948,有15个看涨,总额为$832,944。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $240.0 to $360.0 for Salesforce during the past quarter.

分析这些合同中的成交量和未平仓合约,似乎大户们一直在关注赛富时在过去一个季度的价格区间,从$240.0到$360.0。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

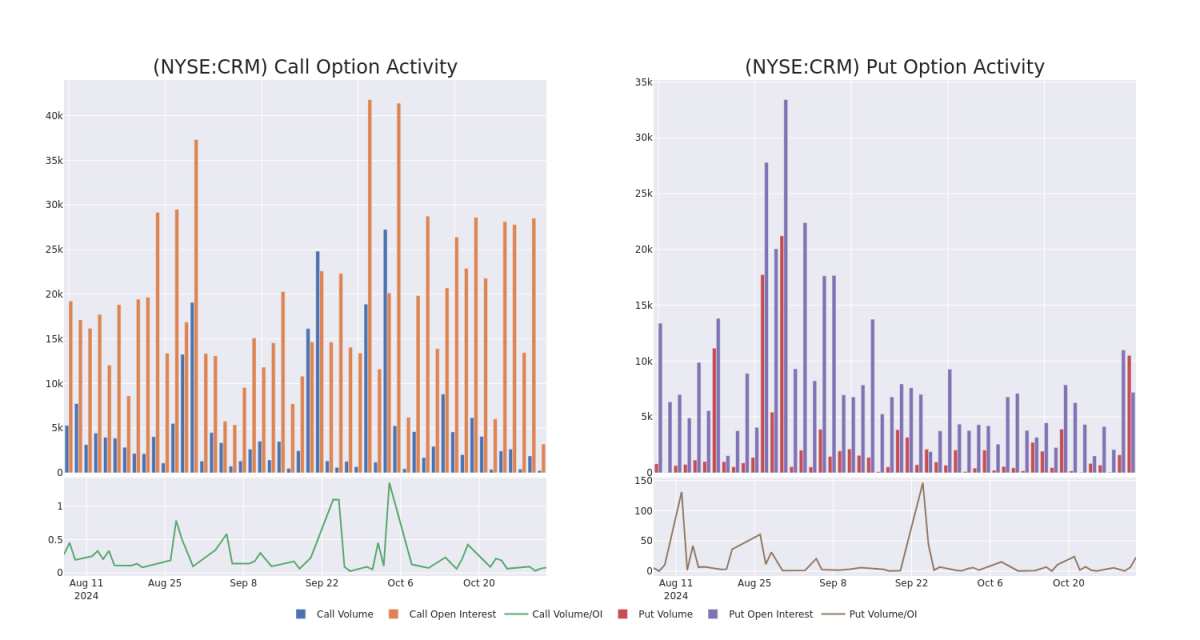

In today's trading context, the average open interest for options of Salesforce stands at 1495.35, with a total volume reaching 2,900.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Salesforce, situated within the strike price corridor from $240.0 to $360.0, throughout the last 30 days.

在今天的交易背景下,赛富时期权的平均未平仓合约为1495.35,总成交量达到了2,900.00。附带的图表描述了赛富时高价值交易的看涨和看跌期权成交量和未平仓合约的发展情况,这些交易位于$240.0至$360.0的行权价走廊内,在过去30天内。

Salesforce 30-Day Option Volume & Interest Snapshot

Salesforce 30天期权成交量和持仓量摘要

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | PUT | TRADE | BEARISH | 06/20/25 | $17.8 | $17.5 | $17.7 | $270.00 | $796.5K | 2.3K | 528 |

| CRM | CALL | SWEEP | BULLISH | 01/17/25 | $18.7 | $18.5 | $18.64 | $300.00 | $164.4K | 7.1K | 203 |

| CRM | PUT | TRADE | BULLISH | 12/20/24 | $13.3 | $12.55 | $12.75 | $290.00 | $127.5K | 1.5K | 109 |

| CRM | PUT | SWEEP | NEUTRAL | 12/20/24 | $12.45 | $12.45 | $12.45 | $290.00 | $105.8K | 1.5K | 208 |

| CRM | CALL | SWEEP | NEUTRAL | 01/16/26 | $60.05 | $59.7 | $59.7 | $280.00 | $89.5K | 1.4K | 15 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | 看跌 | 交易 | 看淡 | 06/20/25 | $17.8 | $17.5 | $17.7 | $270.00 | $796.5K | 2.3K | 528 |

| CRM | 看涨 | SWEEP | 看好 | 01/17/25 | $18.7美元 | $18.5 | $18.64 | $ 300.00 | $164.4K | 7.1K | 203 |

| CRM | 看跌 | 交易 | 看好 | 12/20/24 | $13.3 | $12.55 | $12.75 | $290.00 | $127.5K | 1.5K | 109 |

| CRM | 看跌 | SWEEP | 中立 | 12/20/24 | $12.45 | $12.45 | $12.45 | $290.00 | 105.8千美元 | 1.5K | 208 |

| CRM | 看涨 | SWEEP | 中立 | 01/16/26 | $60.05 | 59.7美元 | 59.7美元 | $280.00 | $89.5K | 1.4千 | 15 |

About Salesforce

关于赛富时

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group to deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

赛富时提供企业级云计算解决方案。该公司提供客户关系管理技术,将公司和客户联系在一起。其客户360平台帮助集团提供单一的数据来源,连接客户数据跨系统、应用和设备,帮助公司销售、服务、市场和开展商业。它还为客户支持提供服务云,为数字营销活动提供营销云,作为电子商务引擎的商业云,提供赛富时平台,以允许企业构建应用程序和其他解决方案,例如用于数据集成的MuleSoft。

Present Market Standing of Salesforce

Salesforce目前的市场地位

- Currently trading with a volume of 1,344,015, the CRM's price is up by 1.07%, now at $297.87.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 23 days.

- 目前成交量为1,344,015,赛富时的价格上涨了1.07%,目前报297.87美元。

- RSI读数表明该股目前可能接近超买水平。

- 预期的收益发布还有23天。

Professional Analyst Ratings for Salesforce

赛富时的专业分析师评级

In the last month, 2 experts released ratings on this stock with an average target price of $340.0.

上个月,有2位专家发布了对这只股票的评级,平均目标价为$340.0。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Oppenheimer has revised its rating downward to Outperform, adjusting the price target to $330. * An analyst from Stifel has decided to maintain their Buy rating on Salesforce, which currently sits at a price target of $350.

20年期期权交易员揭示了他的一行图表技巧,显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击这里获取。* Oppenheimer的分析师已将评级调低到强劲买入,并将价格目标调整为$330。* Stifel的分析师决定维持对赛富时的买入评级,目标价为$350。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Salesforce with Benzinga Pro for real-time alerts.

交易期权涉及更大风险,但也有更高利润的潜力。精明的交易员通过持续的教育、战略交易调整、利用各种指标,并保持对市场动态的敏锐感来降低这些风险。通过使用Benzinga Pro及时获得关于Salesforce的最新期权交易,以获取实时提醒。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $240.0 to $360.0 for Salesforce during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $240.0 to $360.0 for Salesforce during the past quarter.