Here's Why We Think Salesforce (NYSE:CRM) Is Well Worth Watching

Here's Why We Think Salesforce (NYSE:CRM) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Salesforce (NYSE:CRM). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Quickly Is Salesforce Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Salesforce's EPS has grown 32% each year, compound, over three years. This has no doubt fuelled the optimism that sees the stock trading on a high multiple of earnings.

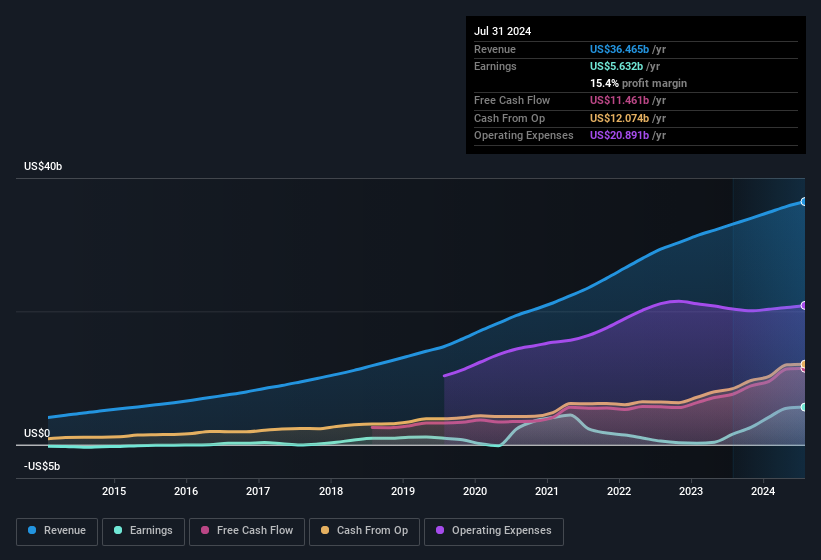

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Salesforce shareholders is that EBIT margins have grown from 13% to 19% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Salesforce shareholders is that EBIT margins have grown from 13% to 19% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Salesforce's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Salesforce Insiders Aligned With All Shareholders?

Since Salesforce has a market capitalisation of US$282b, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$7.6b. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Does Salesforce Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Salesforce's strong EPS growth. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing Salesforce's ROE with industry peers (and the market at large).

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.