Some Analysts Just Cut Their Lavoro Limited (NASDAQ:LVRO) Estimates

Some Analysts Just Cut Their Lavoro Limited (NASDAQ:LVRO) Estimates

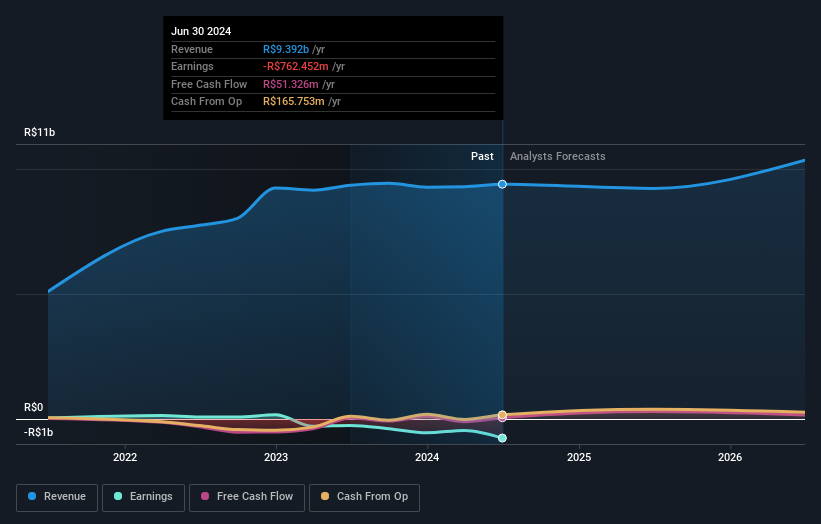

The latest analyst coverage could presage a bad day for Lavoro Limited (NASDAQ:LVRO), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Revenue estimates were cut sharply as the analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

最新的分析师报道可能预示着对Lavoro Limited(纳斯达克:LVRO)而言将是糟糕的一天,分析师们对他们的财务预测进行了全面削减,这可能会让股东们感到有些震惊。 营业收入预测大幅下调,分析师们表示了较弱的展望 - 或许这是一个迹象,投资者也应该调整他们的预期。

Following the latest downgrade, the current consensus, from the twin analysts covering Lavoro, is for revenues of R$9.2b in 2025, which would reflect a noticeable 2.5% reduction in Lavoro's sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of R$12b in 2025. It looks like forecasts have become a fair bit less optimistic on Lavoro, given the sizeable cut to revenue estimates.

在最新的下调之后,涵盖Lavoro的双分析师目前的共识是2025年营收为R$92亿,这将反映出Lavoro过去12个月销售额明显下降了2.5%。 在最新的预测之前,分析师们预测2025年的营收为R$120亿。 看起来对Lavoro的预测变得不那么乐观了,考虑到大幅减少的营收预测。

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that sales are expected to reverse, with a forecast 2.5% annualised revenue decline to the end of 2025. That is a notable change from historical growth of 15% over the last three years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 5.4% annually for the foreseeable future. It's pretty clear that Lavoro's revenues are expected to perform substantially worse than the wider industry.

当然,观察这些预测的另一种方式是将它们与行业自身放在背景中进行比较。 我们要强调,销售预计将出现逆转,预计到2025年底,年均营收将下降2.5%。 这与过去三年中历史增长率为15%形成了明显的对比。 相比之下,我们的数据表明,预计在可预见的未来,同一行业中的其他公司(有分析师覆盖)的营收将以年均5.4%的速度增长。 很明显,预计Lavoro的营收表现将远不及整个行业。

The Bottom Line

最重要的事情是分析师增加了它对下一年每股亏损的估计。令人欣慰的是,营收预测未发生重大变化,业务仍有望比整个行业增长更快。共识价格目标稳定在28.50美元,最新估计不足以对价格目标产生影响。

The most important thing to take away is that analysts cut their revenue estimates for this year. They also expect company revenue to perform worse than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Lavoro going forwards.

最重要的是,分析师们削减了他们对今年的营收预测。 他们还预期公司的营收表现将不如更广泛的市场。 总体而言,鉴于今年预测的急剧下调,我们对Lavoro的未来感到有些谨慎。

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with Lavoro's financials, such as dilutive stock issuance over the past year. For more information, you can click here to discover this and the 1 other concern we've identified.

正如您所看到的,分析师显然并不看好,这可能是有充分理由的。 我们已经发现了Lavoro财务方面的一些潜在问题,比如过去一年的股票稀释发行。 要获取更多信息,您可以点击这里了解我们发现的这个问题和另外一个关注点。

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

当然,看到公司管理层投入大量资金投资股票的情况与分析师是否对其评级下调一样有用。因此,您还可以搜索此处的高内部所有权股票的免费列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

The most important thing to take away is that analysts cut their revenue estimates for this year. They also expect company revenue to perform worse than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Lavoro going forwards.

The most important thing to take away is that analysts cut their revenue estimates for this year. They also expect company revenue to perform worse than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Lavoro going forwards.