On Nov 05, major Wall Street analysts update their ratings for $Charter Communications (CHTR.US)$, with price targets ranging from $315 to $525.

Morgan Stanley analyst Benjamin Swinburne maintains with a hold rating, and adjusts the target price from $360 to $415.

J.P. Morgan analyst Sebastiano Petti maintains with a hold rating, and adjusts the target price from $385 to $400.

BofA Securities analyst Jessica Reif Ehrlich upgrades to a buy rating, and adjusts the target price from $385 to $450.

BofA Securities analyst Jessica Reif Ehrlich upgrades to a buy rating, and adjusts the target price from $385 to $450.

Barclays analyst Kannan Venkateshwar maintains with a sell rating, and adjusts the target price from $300 to $315.

UBS analyst John Hodulik maintains with a hold rating, and adjusts the target price from $325 to $385.

Furthermore, according to the comprehensive report, the opinions of $Charter Communications (CHTR.US)$'s main analysts recently are as follows:

The firm maintains a Neutral stance on Charter shares, citing ongoing competition and projections for decelerating EBITDA growth by 2025. The expectation is for consistent EBITDA growth in the fourth quarter, as positive effects from price hikes and profitable political advertising may be somewhat neutralized by the impact of hurricanes. Looking ahead to 2025, the landscape is anticipated to become more difficult as the influence of political advertising recedes and competitive challenges persist.

The firm anticipates that Charter's customer trends in 2025 will exceed those in 2024, providing a tailwind for the company. The extent of this positive impact will hinge on Charter's capacity to slightly raise its adjusted EBITDA growth, potentially transforming its leverage from a risk to a favorable investment aspect.

Charter's Q3 results exceeded expectations in terms of subscriber metrics and financial performance. The management has indicated that there will be an estimated 100K ACP internet losses in Q4, which they believe will be the final one-off effect stemming from the ACP funding unwind.

Backing out seasonal or one-time benefits reveals a significant improvement in underlying broadband net additions. The expectation is that momentum will accelerate due to the appealing pricing and bundling of the newly introduced 'Life Unlimited' marketing strategy. Additionally, there is a notable moderation in capital expenditure forecasts, and management's indication that BEAD spending will be 'substantially less' than RDOF expenditure considerably mitigates the risk associated with projections for the upcoming years.

The outlook for Charter has improved, with expectations for increased net additions and financials. Additionally, more pessimistic scenarios regarding subscribers and free cash flow are now considered less likely. Despite these improvements, a full structural reevaluation is not supported at this time due to the ongoing unpredictability in broadband trends.

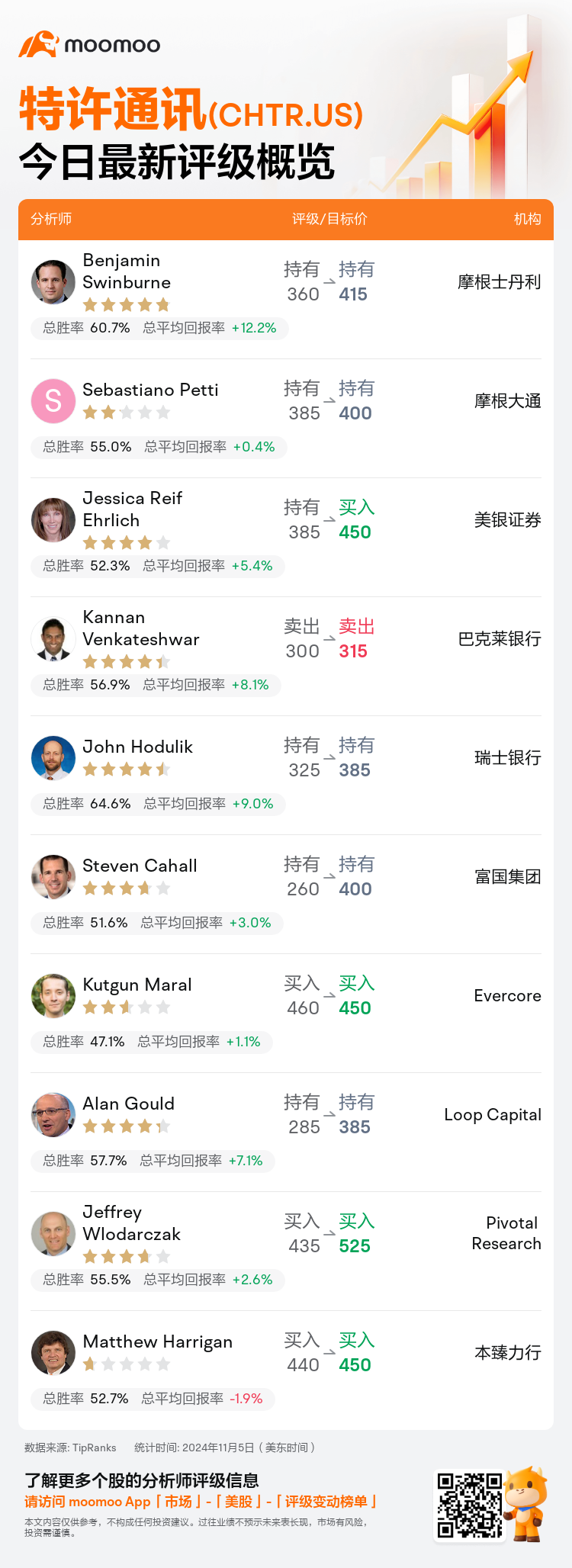

Here are the latest investment ratings and price targets for $Charter Communications (CHTR.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月5日,多家华尔街大行更新了$特许通讯 (CHTR.US)$的评级,目标价介于315美元至525美元。

摩根士丹利分析师Benjamin Swinburne维持持有评级,并将目标价从360美元上调至415美元。

摩根大通分析师Sebastiano Petti维持持有评级,并将目标价从385美元上调至400美元。

美银证券分析师Jessica Reif Ehrlich上调至买入评级,并将目标价从385美元上调至450美元。

美银证券分析师Jessica Reif Ehrlich上调至买入评级,并将目标价从385美元上调至450美元。

巴克莱银行分析师Kannan Venkateshwar维持卖出评级,并将目标价从300美元上调至315美元。

瑞士银行分析师John Hodulik维持持有评级,并将目标价从325美元上调至385美元。

此外,综合报道,$特许通讯 (CHTR.US)$近期主要分析师观点如下:

该公司维持对Charter股票的中立立场,称其面临持续竞争和2025年EBITDA增长放缓的预测。预期第四季度持续EBITDA增长,价格上涨和盈利性政治广告的积极影响可能会被飓风的影响所中和。展望2025年,预计政治广告的影响将减弱,竞争挑战将持续加剧。

该公司预计,2025年Charter的客户趋势将超过2024年,为公司提供了有利支持。这种积极影响的程度取决于Charter略微提高调整后的EBITDA增长能力,可能将其杠杆比率从风险转变为有利的投资方面。

Charter第三季度的结果在订阅用户指标和财务表现方面超出了预期。管理层表示,他们预计第四季度将有大约10万个ACP互联网用户流失,他们认为这将是由ACP资金解套所导致的最后一次一次性影响。

除去季节性或一次性收益,基础宽带净增加量有显著改善。预期动能将加速,这归因于新推出的“无限生活”营销策略的有吸引力的定价和捆绑方式。此外,资本支出预测出现明显调整,管理层表示,BEAD支出将比RDOF支出大大减少,这在很大程度上减轻了对未来几年预测的风险。

Charter的前景已经改善,预计净增加和财务状况将增加。此外,对于订阅用户和自由现金流更悲观的情景现在被认为不太可能。尽管有这些改进,由于宽带趋势持续不可预测,目前不支持进行完全的结构性重新评估。

以下为今日10位分析师对$特许通讯 (CHTR.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师Jessica Reif Ehrlich上调至买入评级,并将目标价从385美元上调至450美元。

美银证券分析师Jessica Reif Ehrlich上调至买入评级,并将目标价从385美元上调至450美元。

BofA Securities analyst Jessica Reif Ehrlich upgrades to a buy rating, and adjusts the target price from $385 to $450.

BofA Securities analyst Jessica Reif Ehrlich upgrades to a buy rating, and adjusts the target price from $385 to $450.