Solid Earnings Reflect State Grid YingdaLtd's (SHSE:600517) Strength As A Business

Solid Earnings Reflect State Grid YingdaLtd's (SHSE:600517) Strength As A Business

State Grid Yingda Co.,Ltd.'s (SHSE:600517) strong earnings report was rewarded with a positive stock price move. We have done some analysis, and we found several positive factors beyond the profit numbers.

国网英大公司(SHSE:600517)的强劲盈利报告得到了股价上涨的回报。我们进行了一些分析,发现除了利润数字之外还有几个积极因素。

Zooming In On State Grid YingdaLtd's Earnings

聚焦国网英大公司的盈利能力

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

在高端金融领域,用于衡量公司将实际利润转化为自由现金流(FCF)的关键比率是应记比率(来自现金流)。要获取应计比率,我们首先要从某一期间的利润中减去FCF,然后将该数字除以该期间的平均营运资产。这个比率告诉我们公司实际利润有多少不是由自由现金流支持的。

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

这意味着负的应计比率是一件好事,因为它表明公司带来的自由现金流比其利润所显示的更多。虽然拥有正的应计比率并不是问题,表明一定程度的非现金利润,但高应计比率可能是一件坏事,因为这表明纸面利润不能得到现金流支持。这是因为一些学术研究表明,高应计比率往往导致较低的利润或利润增长率。

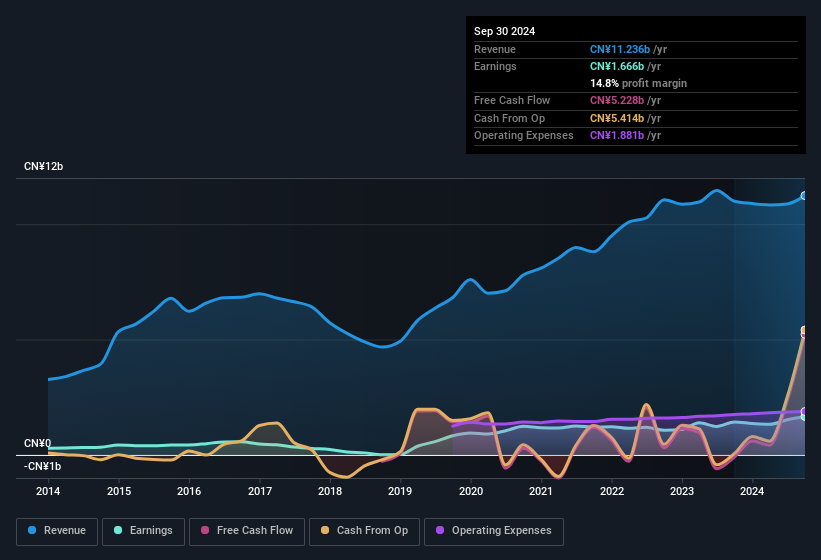

For the year to September 2024, State Grid YingdaLtd had an accrual ratio of -0.38. That indicates that its free cash flow quite significantly exceeded its statutory profit. In fact, it had free cash flow of CN¥5.2b in the last year, which was a lot more than its statutory profit of CN¥1.67b. Given that State Grid YingdaLtd had negative free cash flow in the prior corresponding period, the trailing twelve month resul of CN¥5.2b would seem to be a step in the right direction. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

截至2024年9月的一年时间里,国网英大公司的应计比率为-0.38。这表明其自由现金流明显高于其法定利润。事实上,上一年的自由现金流为5200000000人民币,远远超过了1670000000人民币的法定利润。考虑到国网英大公司在上一对应期间出现负的自由现金流,13000000000人民币的近12个月结果似乎是朝着正确方向迈出的一步。话虽如此,事情还有更多值得关注的地方。应计比率反映了飞凡项目对法定利润的影响,至少在一定程度上。

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of State Grid YingdaLtd.

注意:我们始终建议投资者检查资产负债表实力。点击这里查看我们对国网英大公司资产负债表分析。

The Impact Of Unusual Items On Profit

除了稀释之外,还应该注意的是,万集科技在过去12个月中因不寻常项目获得了价值人民币3.5万元的利润。虽然我们希望看到利润增加,但当这些不寻常项目对利润做出重大贡献时,我们会更加谨慎。我们对全球大部分上市公司的数据进行了分析,发现不寻常项目往往是一次性的。这正如我们所期望的那样,因为这些提升被描述为"不寻常"。相对于其利润而言,万集科技在2021年12月前的不寻常项目贡献大。因此,我们可以推断出,这些不寻常项目正在使其财务利润显著增强。

Surprisingly, given State Grid YingdaLtd's accrual ratio implied strong cash conversion, its paper profit was actually boosted by CN¥233m in unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

国网英大的计提比率意味着其现金转化能力强,而其纸面利润实际上受到飞凡项目的23300万元人民币的提振。虽然盈利增加总是令人高兴的,但来自飞凡项目的巨额贡献有时会减弱我们的热情。当我们分析全球大多数上市公司时,我们发现重大飞凡项目往往不会重复出现。毕竟,这正是会计术语的含义。假设这些飞凡项目今年不再出现,我们预计明年盈利会较弱(在没有业务增长的情况下)。

Our Take On State Grid YingdaLtd's Profit Performance

我们对国网英大的利润表现的看法

In conclusion, State Grid YingdaLtd's accrual ratio suggests its statutory earnings are of good quality, but on the other hand the profits were boosted by unusual items. Considering all the aforementioned, we'd venture that State Grid YingdaLtd's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. If you'd like to know more about State Grid YingdaLtd as a business, it's important to be aware of any risks it's facing. Every company has risks, and we've spotted 1 warning sign for State Grid YingdaLtd you should know about.

总的来说,国网英大的计提比率表明其法定收益质量良好,但另一方面利润受飞凡项目提振。考虑到所有上述因素,我们认为国网英大的利润结果在一定程度上相当好地反映了其真实盈利能力,尽管有点保守。如果您想了解更多关于国网英大作为一个业务的信息,重要的是要意识到它所面临的任何风险。每家公司都存在风险,我们已经发现了国网英大的1个警告信号,您应该知道。

Our examination of State Grid YingdaLtd has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

我们对国网英大的审查主要集中在一些因素上,这些因素可能使其盈利看起来比实际更好。但如果您能把注意力集中在细节上,总是会有更多发现。例如,许多人认为高股本回报是有利的商业经济的指标,而其他人则喜欢‘跟随资金’并寻找内部人员正在买入的股票。因此,您可能希望查看这份提供高股本回报公司的免费集合,或这份具有高内部所有权的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

For the year to September 2024, State Grid YingdaLtd had an accrual ratio of -0.38. That indicates that its free cash flow quite significantly exceeded its statutory profit. In fact, it had free cash flow of CN¥5.2b in the last year, which was a lot more than its statutory profit of CN¥1.67b. Given that State Grid YingdaLtd had negative free cash flow in the prior corresponding period, the trailing twelve month resul of CN¥5.2b would seem to be a step in the right direction. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

For the year to September 2024, State Grid YingdaLtd had an accrual ratio of -0.38. That indicates that its free cash flow quite significantly exceeded its statutory profit. In fact, it had free cash flow of CN¥5.2b in the last year, which was a lot more than its statutory profit of CN¥1.67b. Given that State Grid YingdaLtd had negative free cash flow in the prior corresponding period, the trailing twelve month resul of CN¥5.2b would seem to be a step in the right direction. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.