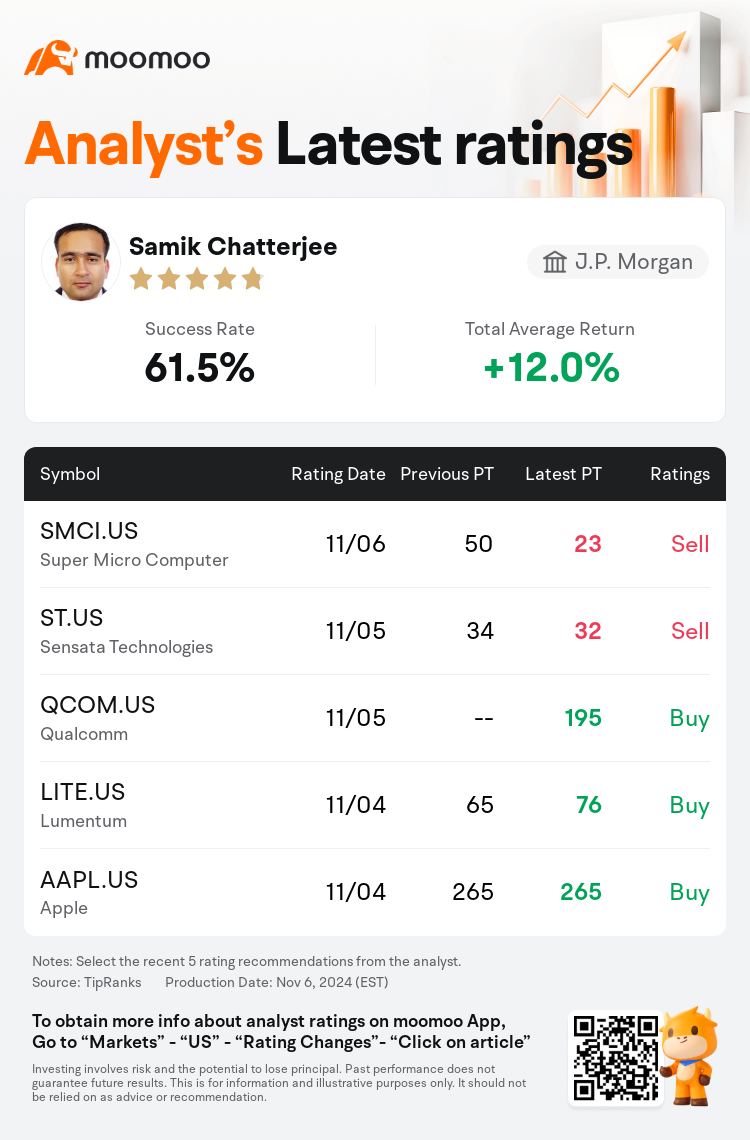

J.P. Morgan analyst Samik Chatterjee downgrades $Super Micro Computer (SMCI.US)$ to a sell rating, and adjusts the target price from $50 to $23.

According to TipRanks data, the analyst has a success rate of 61.5% and a total average return of 12.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Super Micro Computer (SMCI.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Super Micro Computer (SMCI.US)$'s main analysts recently are as follows:

The decrease in the projected value for Supermicro is attributable to heightened estimate risks following the company's delay in annual filings and the resignation of their auditor. The company's preliminary results for Q1 and the outlook for Q2 fell short, primarily due to revenue not meeting expectations. Along with not reaffirming revenue guidance, it seems that Supermicro might be facing some operational difficulties.

Supermicro's recent performance revealed a shortfall in September quarter revenue, and projections for the December quarter suggest a slight sequential downturn. The delay in filing the annual report, due to the search for a new auditor, is anticipated to exert near-term pressure on the stock, along with the increasing possibility of failing to comply with Nasdaq's listing criteria.

Following Supermicro's announcement of the resignation of its auditor, the company's stock value has nearly halved. Concerns regarding the rationale behind the auditor's decision, the company's capability to submit its annual report, and a purported investigation by the Department of Justice are expected to overshadow the significance of the company's quarterly financial results and forecasts.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

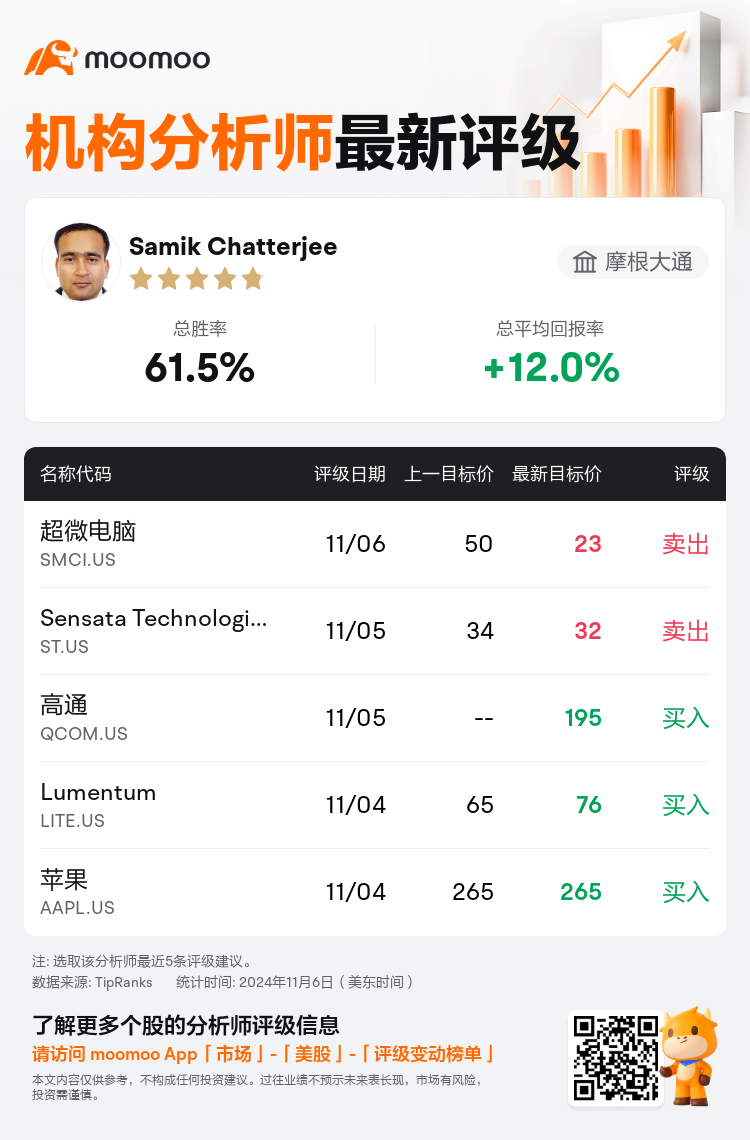

摩根大通分析师Samik Chatterjee下调$超微电脑 (SMCI.US)$至卖出评级,并将目标价从50美元下调至23美元。

根据TipRanks数据显示,该分析师近一年总胜率为61.5%,总平均回报率为12.0%。

此外,综合报道,$超微电脑 (SMCI.US)$近期主要分析师观点如下:

此外,综合报道,$超微电脑 (SMCI.US)$近期主要分析师观点如下:

Supermicro预计价值的下降归因于该公司推迟提交年度申报以及审计师辞职后的估算风险增加。该公司第一季度的初步业绩和第二季度的前景不佳,这主要是由于收入未达到预期。除了没有重申收入指导外,Supermicro似乎还可能面临一些运营困难。

Supermicro最近的表现显示,9月份的季度收入出现短缺,对12月季度的预测表明将出现轻微的连续衰退。由于寻找新的审计师而推迟提交年度报告,预计将在短期内给该股带来压力,同时不遵守纳斯达克上市标准的可能性也越来越大。

在Supermicro宣布其审计师辞职之后,该公司的股票价值几乎下降了一半。对审计师决定背后的理由、该公司提交年度报告的能力以及司法部所谓的调查的担忧预计将掩盖该公司季度财务业绩和预测的重要性。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$超微电脑 (SMCI.US)$近期主要分析师观点如下:

此外,综合报道,$超微电脑 (SMCI.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of