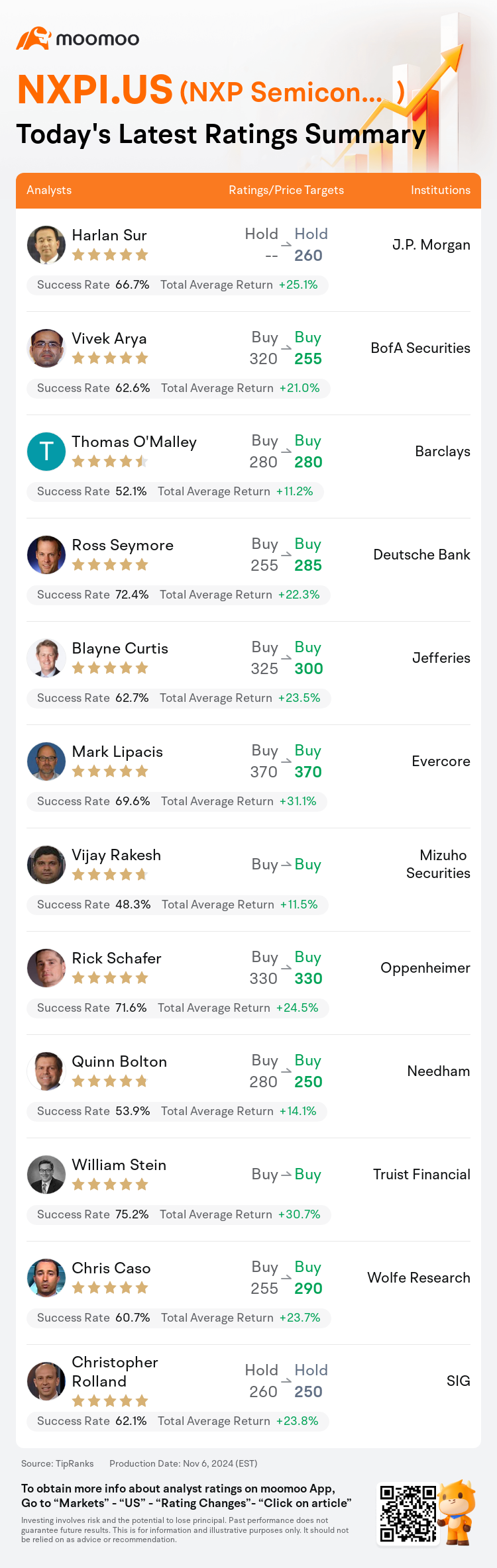

On Nov 06, major Wall Street analysts update their ratings for $NXP Semiconductors (NXPI.US)$, with price targets ranging from $250 to $370.

J.P. Morgan analyst Harlan Sur maintains with a hold rating, and sets the target price at $260.

BofA Securities analyst Vivek Arya maintains with a buy rating, and adjusts the target price from $320 to $255.

Barclays analyst Thomas O'Malley maintains with a buy rating, and maintains the target price at $280.

Barclays analyst Thomas O'Malley maintains with a buy rating, and maintains the target price at $280.

Deutsche Bank analyst Ross Seymore maintains with a buy rating, and adjusts the target price from $255 to $285.

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $325 to $300.

Furthermore, according to the comprehensive report, the opinions of $NXP Semiconductors (NXPI.US)$'s main analysts recently are as follows:

NXP Semiconductors' forecast for the December quarter fell short of initial estimates, with expectations for the March-end quarter to decline by a seasonal high-single digit percentage. This is due to prevailing challenges across automotive, industrial, and IoT end markets. Despite these obstacles, the company continues to navigate through the auto industry's headwinds, leading to a revision of earlier projections subsequent to their recent quarterly financial disclosure.

Management has acknowledged China as the sole strong performer in the automotive sector, while noting a continuously sluggish industrial environment, and anticipates a weaker performance in the upcoming December and March quarters. The sustained softness in the industrial sector is suggested to be more favorable for NXP, given its comparatively minimal exposure among competitors. However, projections indicate that the automotive sector could see a mid-single-digit decline on a quarter-over-quarter basis for the next few quarters, leading to a significantly lower starting point for 2025 than initially anticipated.

NXP Semiconductors' Q3 results were consistent with expectations, but forecasts for Q4 and the early outlook for Q1 are on the weaker side, mirroring the trends observed across many auto/industrial peers outside of China. Despite the challenging economic environment, the company's projected sales growth for 2024 appears to be surpassing that of its competitors. Analysts suggest that the start of Q1 might represent the trough, and they anticipate that the inevitable rebound in auto production could spark a resurgence, particularly in a stock that is not overly saturated with AI speculation.

NXP Semiconductors fulfilled its projections, albeit forecasting a milder future for the second consecutive quarter. The current economic climate has led to cautious forecasts throughout the broad-based semiconductor sector this earnings season. There was an anticipation that NXP's previously cautious stance would offer more protection, which makes the fourth-quarter guidance and the implied first-quarter outlook less satisfactory. Nevertheless, it's believed that the company is addressing these challenges with appropriate and clear actions. The difficulties faced are considered to be systemic rather than specific to NXP, and it's expected that the company's financial results will improve as macro conditions do.

NXP Semiconductors' Q3 results aligned with expectations, yet the Q4 forecast for sales and EPS fell short of the Street consensus by 8% and 14%, respectively. With inventories nearing low points, there is anticipation for a significant recovery for NXP. The revised valuation accounts for a broader contraction in market multiples.

Here are the latest investment ratings and price targets for $NXP Semiconductors (NXPI.US)$ from 12 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

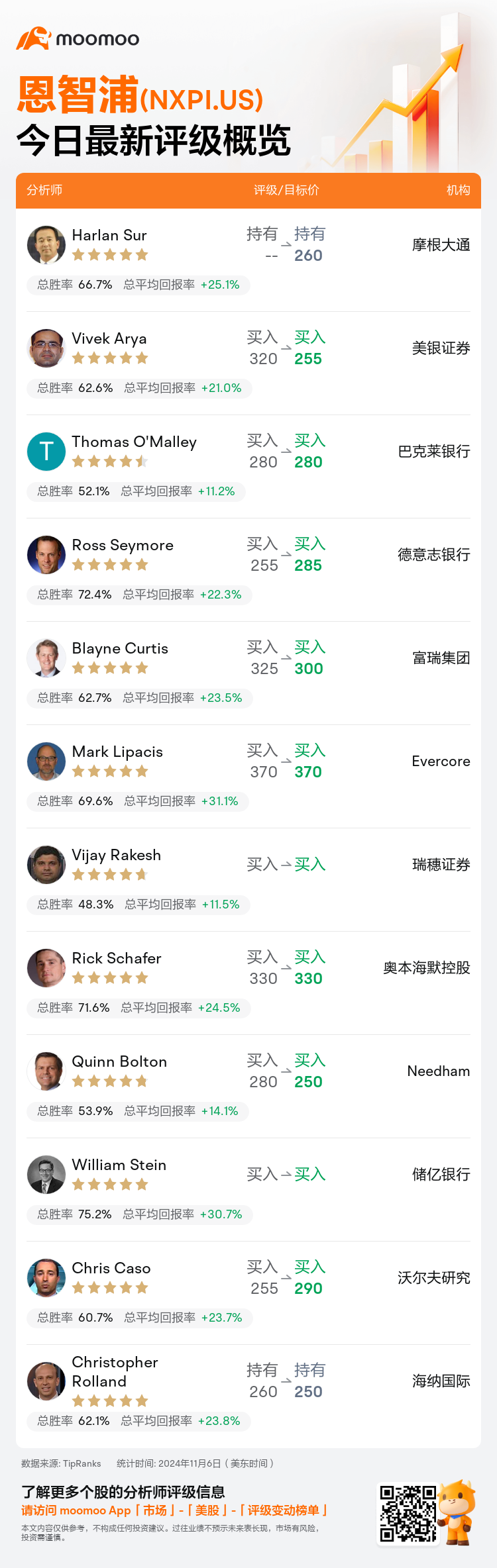

美东时间11月6日,多家华尔街大行更新了$恩智浦 (NXPI.US)$的评级,目标价介于250美元至370美元。

摩根大通分析师Harlan Sur维持持有评级,目标价260美元。

美银证券分析师Vivek Arya维持买入评级,并将目标价从320美元下调至255美元。

巴克莱银行分析师Thomas O'Malley维持买入评级,维持目标价280美元。

巴克莱银行分析师Thomas O'Malley维持买入评级,维持目标价280美元。

德意志银行分析师Ross Seymore维持买入评级,并将目标价从255美元上调至285美元。

富瑞集团分析师Blayne Curtis维持买入评级,并将目标价从325美元下调至300美元。

此外,综合报道,$恩智浦 (NXPI.US)$近期主要分析师观点如下:

恩智浦半导体对12月季度的预测低于最初预期,预计第一季度的下降幅度将会高达个位数。这是由于汽车,工业和物联网终端市场普遍面临的挑战。尽管面临这些障碍,该公司仍在应对汽车行业的逆风,导致近期季度财务披露后修订了早期预测。

管理层已经承认中国是汽车行业中唯一表现强劲的地区,同时指出工业环境持续萎靡不振,预计未来12月和3月季度的表现将较弱。工业行业持续疲软的情况被认为对恩智浦更有利,因为它在竞争对手中的暴露相对较小。然而,预测显示汽车行业在未来几个季度可能会出现环比单位数下降,导致2025年的起点显著低于最初预期。

恩智浦半导体第三季度的业绩符合预期,但第四季度和第一季度初期的展望较为疲弱,与中国以外许多汽车/工业同行观察到的趋势相一致。尽管面临挑战性的经济环境,公司对2024年的预期销售增长似乎超过了竞争对手。分析师认为第一季度的开始可能代表低谷,并预计汽车生产的不可避免的复苏可能会引发一场复苏,特别是在一家没有过多人工智能投机的股票中。

恩智浦半导体实现了其预测,尽管连续第二个季度预测未来会减弱。当前的经济环境导致本次财报季节整个广泛半导体行业的谨慎预测。预期恩智浦此前谨慎的立场将提供更多保护,这使得第四季度的指引和暗示的第一季度展望显得不够令人满意。尽管如此,人们认为该公司正在以适当和明确的行动应对这些挑战。面临的困难被认为是系统性的,而非特定于恩智浦,预计随着宏观条件的改喡,该公司的财务业绩将会改善。

恩智浦半导体第三季度的业绩符合预期,但第四季度的销售和每股收益预测均低于街头共识8%和14%。随着库存接近低点,预计恩智浦将出现明显复苏。修订后的估值考虑了市场倍数的更广泛收缩。

以下为今日12位分析师对$恩智浦 (NXPI.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Thomas O'Malley维持买入评级,维持目标价280美元。

巴克莱银行分析师Thomas O'Malley维持买入评级,维持目标价280美元。

Barclays analyst Thomas O'Malley maintains with a buy rating, and maintains the target price at $280.

Barclays analyst Thomas O'Malley maintains with a buy rating, and maintains the target price at $280.