On Nov 06, major Wall Street analysts update their ratings for $Fidelity National Information Services (FIS.US)$, with price targets ranging from $94 to $103.

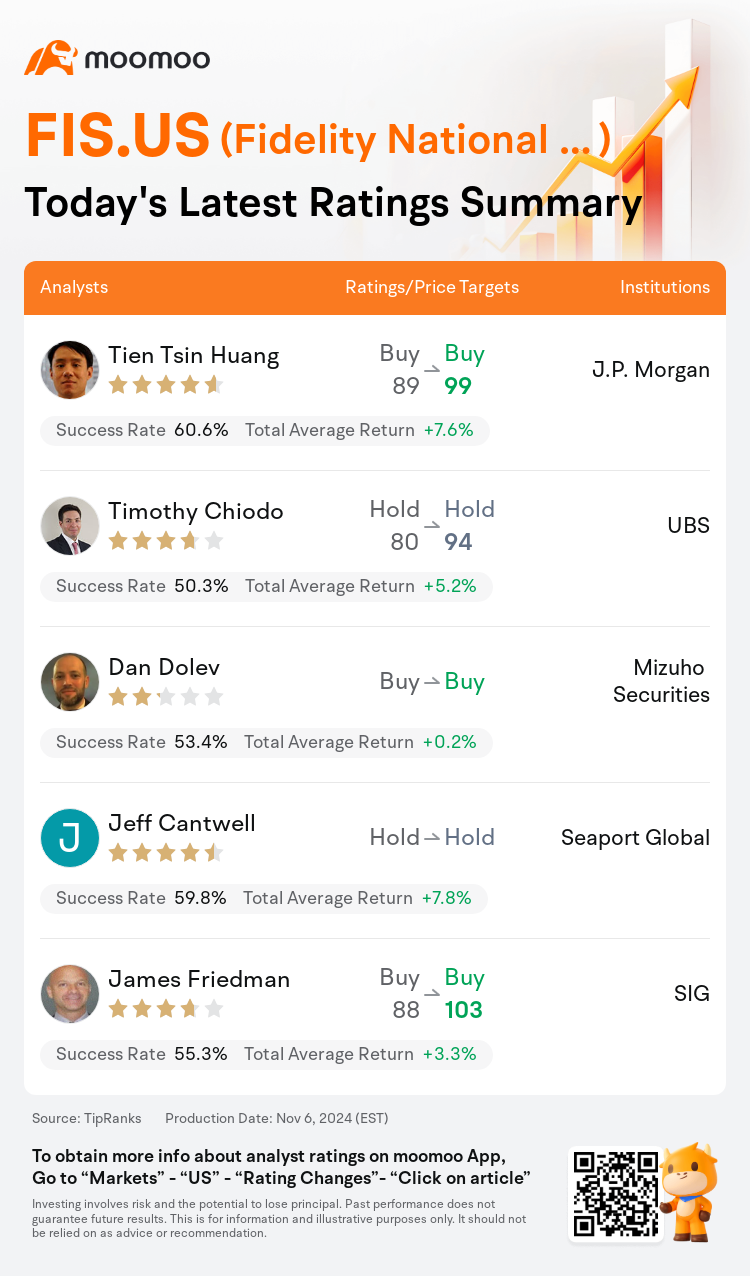

J.P. Morgan analyst Tien Tsin Huang maintains with a buy rating, and adjusts the target price from $89 to $99.

UBS analyst Timothy Chiodo maintains with a hold rating, and adjusts the target price from $80 to $94.

Mizuho Securities analyst Dan Dolev maintains with a buy rating.

Mizuho Securities analyst Dan Dolev maintains with a buy rating.

Seaport Global analyst Jeff Cantwell maintains with a hold rating.

SIG analyst James Friedman maintains with a buy rating, and adjusts the target price from $88 to $103.

Furthermore, according to the comprehensive report, the opinions of $Fidelity National Information Services (FIS.US)$'s main analysts recently are as follows:

Banking and Capital Markets exhibited 'healthy underlying trends' in the third quarter, complemented by earnings outperformance aided by Worldpay. However, there may be future challenges as operating expenses are expected to increase. Valuation is perceived as reasonable, but it is suggested that there may be more advantageous risk/reward opportunities in the Payments sector.

FIS has performed well thus far this year. However, there is a belief that the stock may experience a decline to the lower $80s in the upcoming months, ahead of the 2025 guidance in February, due to investor concerns regarding the future.

The company is enhancing a highly recurring and durable business model, effectively managing investor expectations. Notably, the Banking segment exhibited 6% recurring revenue growth, with the Capital Markets segment also showing approximately 6% growth. Overall growth was bolstered by robust license sales.

FIS has reported another robust quarter, characterized by an acceleration in Banking recurring revenue growth. The outlook for the stock remains positive, with expectations that the portfolio will increasingly shift towards recurring revenue over time.

The company is on track with its execution, evidenced by robust third-quarter results that met expectations; growth was notably seen in Banking recurring revenues, and there was an EPS benefit from temporary gains related to interest and operational expenditure timing in Worldpay.

Here are the latest investment ratings and price targets for $Fidelity National Information Services (FIS.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月6日,多家华尔街大行更新了$繁德信息技术 (FIS.US)$的评级,目标价介于94美元至103美元。

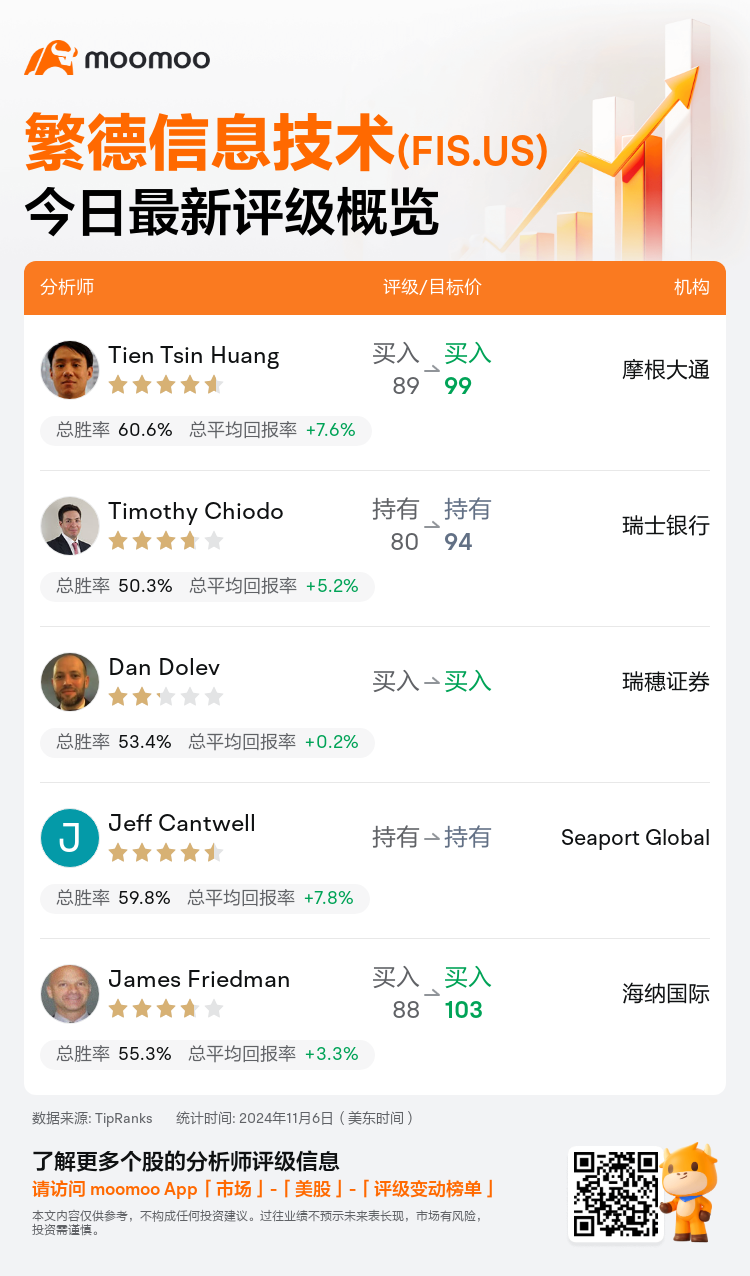

摩根大通分析师Tien Tsin Huang维持买入评级,并将目标价从89美元上调至99美元。

瑞士银行分析师Timothy Chiodo维持持有评级,并将目标价从80美元上调至94美元。

瑞穗证券分析师Dan Dolev维持买入评级。

瑞穗证券分析师Dan Dolev维持买入评级。

Seaport Global分析师Jeff Cantwell维持持有评级。

海纳国际分析师James Friedman维持买入评级,并将目标价从88美元上调至103美元。

此外,综合报道,$繁德信息技术 (FIS.US)$近期主要分析师观点如下:

第三季度银行和资本市场表现出“健康的基本趋势”,受到Worldpay的助力,盈利表现超强。然而,预计营业费用将增加,可能会面临未来挑战。估值被认为是合理的,但建议在支付板块可能有更有利的风险/回报机会。

FIS今年至今表现不错。然而,有人认为股票可能在未来几个月内下跌至80美元以下,预计将于2月进行2025年指引,这是由于投资者对未来的担忧。

公司正在完善高度重复和持久的业务模式,有效管理投资者的期望。值得注意的是,银行板块展示了6%的重复营业收入增长,资本市场板块也显示大约6%的增长。总体增长得到了强劲的许可销售的支持。

FIS报告了又一个强劲的季度,银行重复营业收入增长加快。对该股的前景保持乐观,预计投资组合将随着时间的推移逐渐转向重复营业收入。

该公司的执行进展顺利,第三季度的业绩强劲,符合预期;银行重复收入显著增长,而来自Worldpay利息和运营支出时间的暂时收益也带来了每股收益的好处。

以下为今日5位分析师对$繁德信息技术 (FIS.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

瑞穗证券分析师Dan Dolev维持买入评级。

瑞穗证券分析师Dan Dolev维持买入评级。

Mizuho Securities analyst Dan Dolev maintains with a buy rating.

Mizuho Securities analyst Dan Dolev maintains with a buy rating.