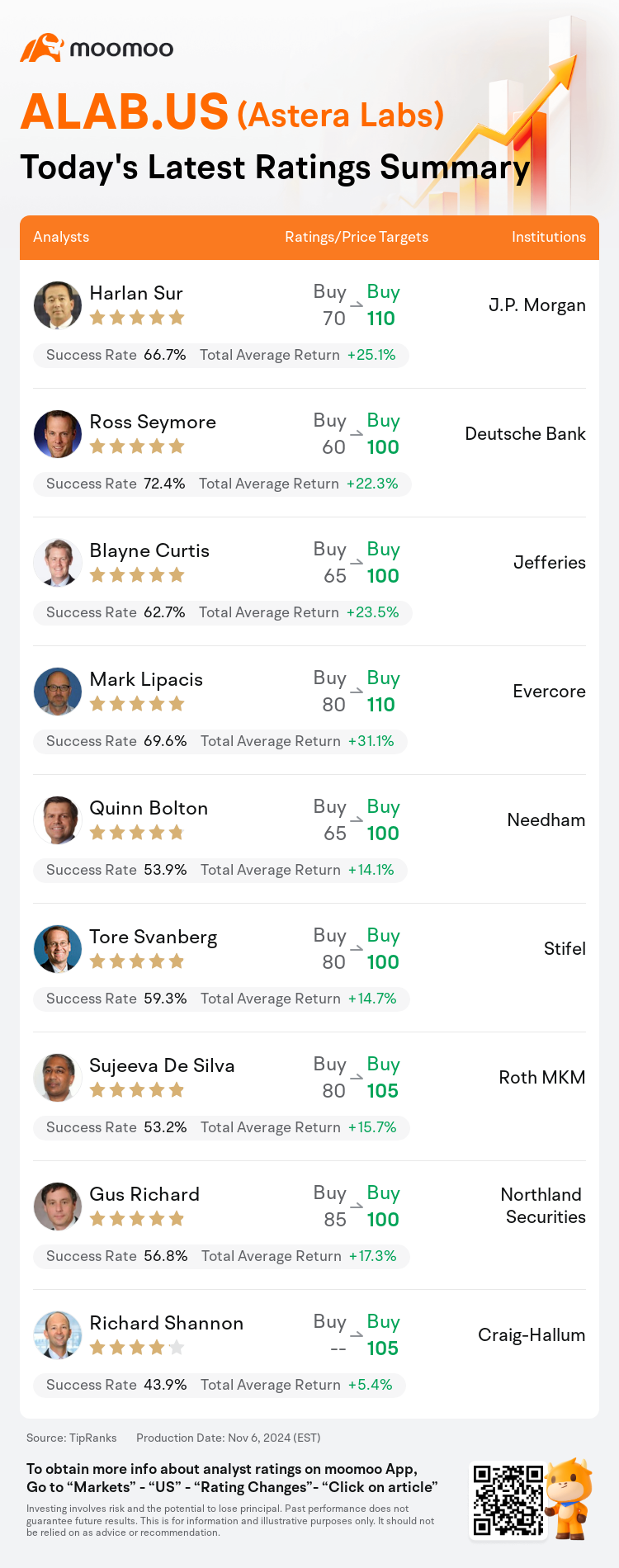

On Nov 06, major Wall Street analysts update their ratings for $Astera Labs (ALAB.US)$, with price targets ranging from $100 to $110.

J.P. Morgan analyst Harlan Sur maintains with a buy rating, and adjusts the target price from $70 to $110.

Deutsche Bank analyst Ross Seymore maintains with a buy rating, and adjusts the target price from $60 to $100.

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $65 to $100.

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $65 to $100.

Evercore analyst Mark Lipacis maintains with a buy rating, and adjusts the target price from $80 to $110.

Needham analyst Quinn Bolton maintains with a buy rating, and adjusts the target price from $65 to $100.

Furthermore, according to the comprehensive report, the opinions of $Astera Labs (ALAB.US)$'s main analysts recently are as follows:

Astera Labs has exhibited a robust increase in revenue this quarter, surpassing the performance in the initial two quarters post-IPO. This uptick is credited to strong sales from GPU platforms, augmented by new ASIC processors and the growth of its second product line. Additionally, there is increasing clarity regarding the anticipated advancements of the third and fourth product lines slated for the latter half of 2025.

Astera Labs has seen another quarter of positive performance attributed to Aries, setting the stage for a promising year ahead, which is expected to be led by Scorpio and Gen 6 developments.

Following 'another impressive beat and raise' in the fourth quarter, analysts continue to recommend buying, as estimates have been increased due to sustained momentum for Aries retimers across both GPU and ASIC programs. The acceleration of 400G deployments for Taurus and the expected ramp-up of Scorpio switch revenues in the second half of 2025, contributing to 10% of overall revenues next year, are also highlighted.

Astera Labs has been recognized for its robust performance in Q3 and an optimistic projection for Q4. The company's revenue trajectory is expected to diversify and maintain high visibility into the year 2025, bolstered by a range of products and increasing content with a diverse customer base.

Here are the latest investment ratings and price targets for $Astera Labs (ALAB.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

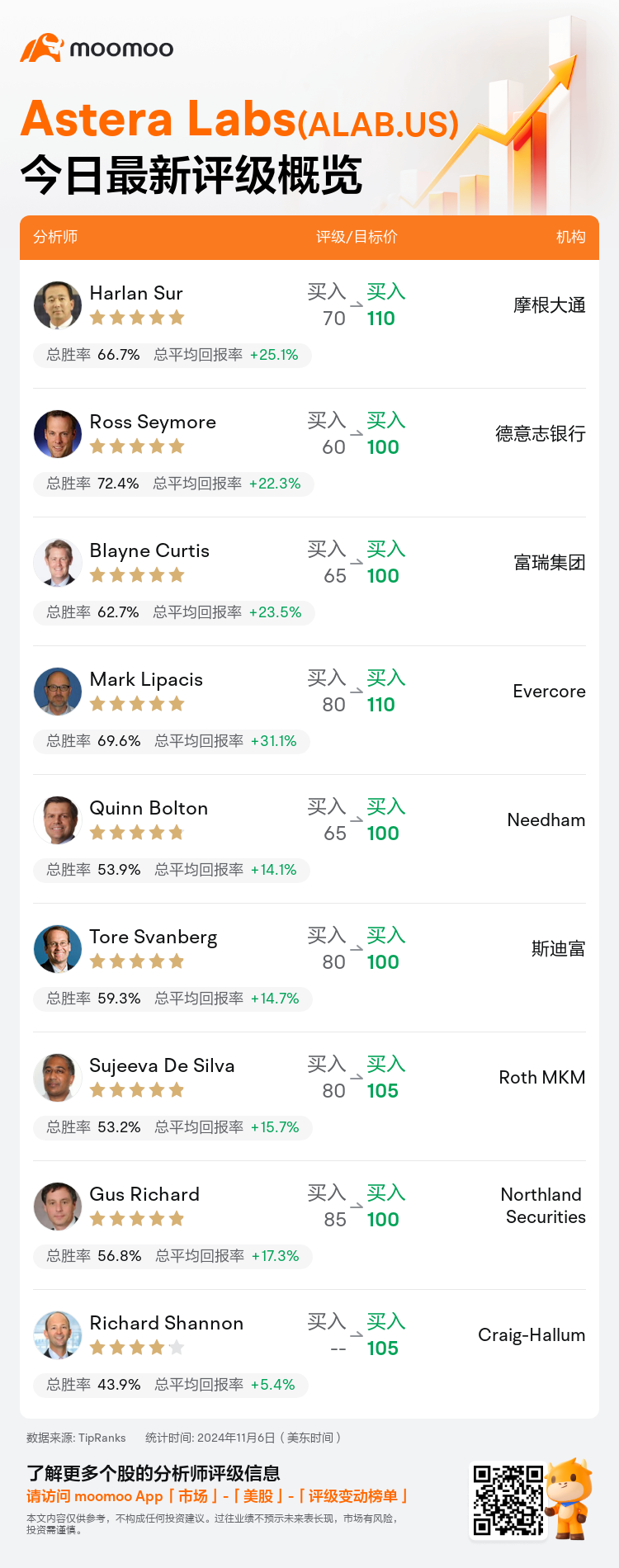

美东时间11月6日,多家华尔街大行更新了$Astera Labs (ALAB.US)$的评级,目标价介于100美元至110美元。

摩根大通分析师Harlan Sur维持买入评级,并将目标价从70美元上调至110美元。

德意志银行分析师Ross Seymore维持买入评级,并将目标价从60美元上调至100美元。

富瑞集团分析师Blayne Curtis维持买入评级,并将目标价从65美元上调至100美元。

富瑞集团分析师Blayne Curtis维持买入评级,并将目标价从65美元上调至100美元。

Evercore分析师Mark Lipacis维持买入评级,并将目标价从80美元上调至110美元。

Needham分析师Quinn Bolton维持买入评级,并将目标价从65美元上调至100美元。

此外,综合报道,$Astera Labs (ALAB.US)$近期主要分析师观点如下:

Astera Labs在本季度营业收入实现强劲增长,超过上市后初两个季度的表现。这一增长归功于gpu芯片平台的强劲销售,受到新ASIC处理器和第二产品线增长的推动。此外,对于2025年下半年预期中的第三和第四产品线的预期进展也更加清晰。

Astera Labs又度过了一个积极的季度,这要归功于Aries的表现,为一个有前途的明年打下了基础,预计将由Scorpio和Gen 6发展领导。

在第四季度再次取得'另一个令人印象深刻的业绩和提高'后,分析师继续推荐购买,因为由于Aries retimers在GPU和ASIC项目中的持续势头,估计已经增加。还强调了Taurus的400G部署加速和预计在2025年下半年扩大的Scorpio交换机营收,将为明年总营收的10%做出贡献。

Astera Labs在Q3已经被认可为业绩强劲,对Q4持乐观态度。公司的营收轨迹预计将多样化,并保持对2025年的高度可见性,这得益于一系列产品和与多样化客户群体的业务增长。

以下为今日9位分析师对$Astera Labs (ALAB.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富瑞集团分析师Blayne Curtis维持买入评级,并将目标价从65美元上调至100美元。

富瑞集团分析师Blayne Curtis维持买入评级,并将目标价从65美元上调至100美元。

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $65 to $100.

Jefferies analyst Blayne Curtis maintains with a buy rating, and adjusts the target price from $65 to $100.